South Korea is to add a new artificial intelligence (AI) chip to its arsenal of semiconductors as the nation seeks a bigger slice of the global technology market and an upgrade of its industrial capabilities.

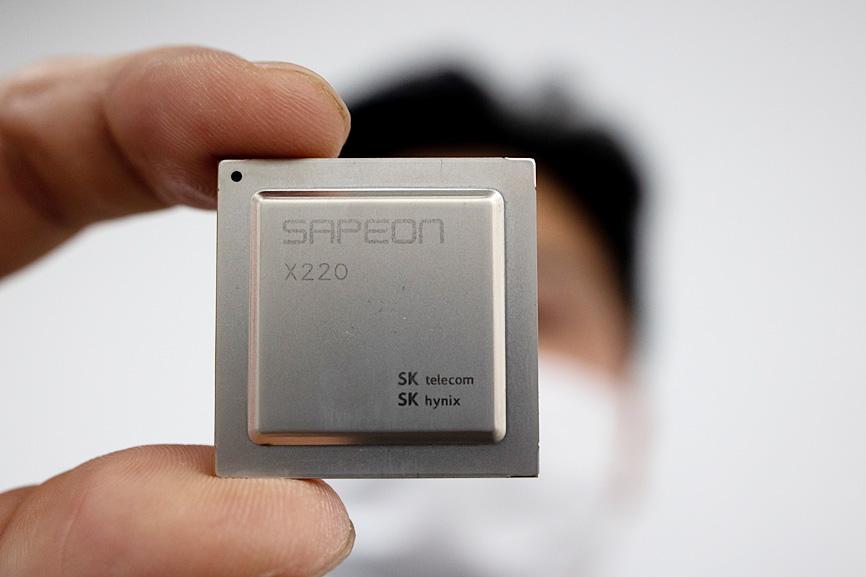

The Sapeon X220, unveiled yesterday by the country’s largest carrier SK Telecom Co, is designed to speed up servers that cater to a growing number of mobile devices — from drones to self-driving vehicles — that perform better with AI.

It is the latest product of the nation’s decade-long push to broaden its dominance beyond memory chips, where Samsung Electronics Co and SK Hynix Inc control about two-thirds of the global market.

Photo: Bloomberg

Seoul sees data-processing chips as a major engine for economic growth, along with 5G wireless networks.

The government has provided more than 600 billion won (US$542. million) in support to develop the chips and plans to invest another 1 trillion won over the next decade, viewing them as crucial in automating factories and improving the competitiveness of the country’s exports.

“As we teamed up with the government, we said: ‘Let’s make AI available and affordable for all of our companies,’” SK Telecom vice president Lee Jong-min said. “South Korea has the demand, the full stack of tech needed to meet the demand, and the ability to take it to the next level.”

Semiconductors account for about one-fifth of South Korea’s exports, most of them memory chips.

The country is now turning to application-specific integrated circuits (ASICs), such as the X220, which is tailored for AI operations.

It follows a similar US$1 billion investment plan announced by the US government earlier this year, which also emphasized AI and public-private collaboration.

As the first country in the world to roll out commercial 5G last year, South Korea believes that it can also lead in adopting and optimizing AI, aided by the nation’s compact size, wide broadband coverage and smartphone penetration.

However, competition is heating up in the AI semiconductor sector, with the likes of Amazon.com Inc and Google holding company Alphabet Inc investing in their own bespoke server silicon.

As more devices than ever come online, companies are betting that they can unlock value and insights from the resulting trove of data through machine learning and analysis at scale.

Like SK Telecom, US competitors offer cloud services to other companies, and the investment in designing the chips makes sense when factoring in the cost of electricity and the chips’ ability to handle greater volumes of data more efficiently.

SK Telecom’s chip, at the size of a postage stamp, is the first South Korean ASIC for data centers to be commercialized, the company said.

It represents the latest push by the Seoul-based carrier to expand beyond its traditional mobile and broadband businesses, and keep up in an era of AI-driven innovation.

The global AI chip market is led by Nvidia Corp, a graphics-card giant whose market value has eclipsed that of Intel Corp.

Even smartphone processors from the likes of Apple Inc and Huawei Technologies Co (華為) now come with dedicated cores for handling AI tasks, and the need for more ASICs is forecast to rise as AI gains more ground in global technology.

Sweeping policy changes under US Secretary of Health and Human Services Robert F. Kennedy Jr are having a chilling effect on vaccine makers as anti-vaccine rhetoric has turned into concrete changes in inoculation schedules and recommendations, investors and executives said. The administration of US President Donald Trump has in the past year upended vaccine recommendations, with the country last month ending its longstanding guidance that all children receive inoculations against flu, hepatitis A and other diseases. The unprecedented changes have led to diminished vaccine usage, hurt the investment case for some biotechs, and created a drag that would likely dent revenues and

Macronix International Co (旺宏), the world’s biggest NOR flash memory supplier, yesterday said it would spend NT$22 billion (US$699.1 million) on capacity expansion this year to increase its production of mid-to-low-density memory chips as the world’s major memorychip suppliers are phasing out the market. The company said its planned capital expenditures are about 11 times higher than the NT$1.8 billion it spent on new facilities and equipment last year. A majority of this year’s outlay would be allocated to step up capacity of multi-level cell (MLC) NAND flash memory chips, which are used in embedded multimedia cards (eMMC), a managed

CULPRITS: Factors that affected the slip included falling global crude oil prices, wait-and-see consumer attitudes due to US tariffs and a different Lunar New Year holiday schedule Taiwan’s retail sales ended a nine-year growth streak last year, slipping 0.2 percent from a year earlier as uncertainty over US tariff policies affected demand for durable goods, data released on Friday by the Ministry of Economic Affairs showed. Last year’s retail sales totaled NT$4.84 trillion (US$153.27 billion), down about NT$9.5 billion, or 0.2 percent, from 2024. Despite the decline, the figure was still the second-highest annual sales total on record. Ministry statistics department deputy head Chen Yu-fang (陳玉芳) said sales of cars, motorcycles and related products, which accounted for 17.4 percent of total retail rales last year, fell NT$68.1 billion, or

In the wake of strong global demand for AI applications, Taiwan’s export-oriented economy accelerated with the composite index of economic indicators flashing the first “red” light in December for one year, indicating the economy is in booming mode, the National Development Council (NDC) said yesterday. Moreover, the index of leading indicators, which gauges the potential state of the economy over the next six months, also moved higher in December amid growing optimism over the outlook, the NDC said. In December, the index of economic indicators rose one point from a month earlier to 38, at the lower end of the “red” light.