HSBC Bank Taiwan Ltd (匯豐台灣商銀) is committed to enhancing corporate social responsibility by cutting carbon emissions, boosting sustainable financing and conducting projects that result in positive social impacts such as wild bird protection, the bank said in an interview in Taipei on Friday.

The bank aims to reduce its carbon emissions as its parent company, HSBC Holdings PLC, earlier this month said it targets to reduce emissions in its daily operations and supply chains to net zero by 2030, as well as net zero emissions of its portfolio of customers by 2050, it said.

HSBC Taiwan has adopted measures to make its branches and offices eco-friendly and cut their power consumption, such as installing automatic sensors that turn off lights when there is enough daylight and after business hours, HSBC Taiwan corporate sustainability head Ruth Lee (李清如) said.

Photo: Kao Shih-ching, Taipei Times

The measures helped the lender reduce its annual carbon emissions per employee to 1.8 tonnes last year, ahead of the parent company’s goal to reduce annual emissions per employee to 2 tonnes by the end of this year from 3.5 tonnes in 2011, Lee said.

HSBC Taiwan is considering to use more renewable energy sources to further improve its carbon footprint, although it still needs to talk to the landlords of its offices and persuade them to purchase green energy, Lee said.

Another option is buying renewable energy certificates, she said.

HSBC Taiwan would continue granting loans to local renewable energy developers such as wind or solar power developers, as well as providing financing to companies in other sectors to help them reduce carbon emissions, the bank’s chief risk officer Angus Tsang (曾德誼) said.

“While risk assessment for sustainable financing takes a similar approach as that for regular corporate loans, we provide our clients who apply for sustainable financing special financial incentives such as lower interest rates if they meet their target emission improvement,” Tsang said.

HSBC Holdings said it aims to provide US$750 billion to US$1 trillion by 2030 to customers to help them become more sustainable.

Meanwhile, the bank would continue supporting the protection of wild birds, and the conservation of wetlands and biological habitat in Taipei’s Guandu Nature Park (關渡自然公園), not only through funding, but also through its staff’s volunteer efforts, Lee said, adding that employees have thus far clocked 31,050 volunteer hours at the park.

The bank also conducts other projects such as boosting financial education in rural areas, Lee said.

It allows staff to take two days paid leave per year for volunteering, she said, adding that only 22 percent of employees last year took the leave, as most of them preferred participating in the company’s volunteer activities on weekends or during their regular leave.

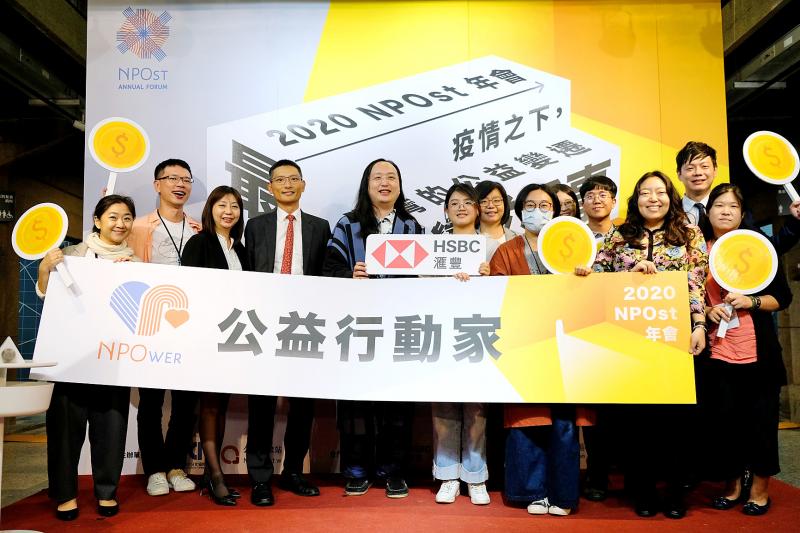

HSBC Taiwan works with NPOst, a charity-focused platform launched by the Association of Digital Culture, Taiwan, a non-profit organization, and would provide financial support for social actors to help those affected by the COVID-19 pandemic, the bank said.

To many, Tatu City on the outskirts of Nairobi looks like a success. The first city entirely built by a private company to be operational in east Africa, with about 25,000 people living and working there, it accounts for about two-thirds of all foreign investment in Kenya. Its low-tax status has attracted more than 100 businesses including Heineken, coffee brand Dormans, and the biggest call-center and cold-chain transport firms in the region. However, to some local politicians, Tatu City has looked more like a target for extortion. A parade of governors have demanded land worth millions of dollars in exchange

Hong Kong authorities ramped up sales of the local dollar as the greenback’s slide threatened the foreign-exchange peg. The Hong Kong Monetary Authority (HKMA) sold a record HK$60.5 billion (US$7.8 billion) of the city’s currency, according to an alert sent on its Bloomberg page yesterday in Asia, after it tested the upper end of its trading band. That added to the HK$56.1 billion of sales versus the greenback since Friday. The rapid intervention signals efforts from the city’s authorities to limit the local currency’s moves within its HK$7.75 to HK$7.85 per US dollar trading band. Heavy sales of the local dollar by

Taiwan Semiconductor Manufacturing Co’s (TSMC, 台積電) revenue jumped 48 percent last month, underscoring how electronics firms scrambled to acquire essential components before global tariffs took effect. The main chipmaker for Apple Inc and Nvidia Corp reported monthly sales of NT$349.6 billion (US$11.6 billion). That compares with the average analysts’ estimate for a 38 percent rise in second-quarter revenue. US President Donald Trump’s trade war is prompting economists to retool GDP forecasts worldwide, casting doubt over the outlook for everything from iPhone demand to computing and datacenter construction. However, TSMC — a barometer for global tech spending given its central role in the

An Indonesian animated movie is smashing regional box office records and could be set for wider success as it prepares to open beyond the Southeast Asian archipelago’s silver screens. Jumbo — a film based on the adventures of main character, Don, a large orphaned Indonesian boy facing bullying at school — last month became the highest-grossing Southeast Asian animated film, raking in more than US$8 million. Released at the end of March to coincide with the Eid holidays after the Islamic fasting month of Ramadan, the movie has hit 8 million ticket sales, the third-highest in Indonesian cinema history, Film