The NASDAQ Composite closed lower on Friday, although well above its session low as selling eased late in the day after investors dumped heavyweight technology stocks due to concerns about high valuations and a patchy economic recovery.

The major indices regained some ground in late afternoon, although trading was still volatile.

At its lowest point of the day the tech-heavy NASDAQ fell as much as 9.9 percent from its record high reached on Wednesday and the S&P 500 dipped briefly below its pre-crisis record, reached in February, although it too closed well off session lows.

Mega-cap companies, such as Apple Inc Microsoft Inc, Amazon.com Inc and Facebook Inc, also pared losses, although of that group only Apple managed a very tiny gain for the day.

“You had a significant selloff on Thursday, some follow-through in the morning and then we stabilized. The selling was pretty fierce,” said Michael Antonelli, market strategist at Robert W. Baird & Co in Milwaukee.

“Corrections like this have been quick and severe lately. We don’t know if its over,” he said. “The fact we stabilized today could be a good sign.”

While Thursday’s selloff already reflected investor fears that valuations for the NASDAQ high-fliers had overheated, the worries were exacerbated on Friday by the Financial Times (FT) and others reporting that options trading by Japan’s Softbank Group Corp had inflated these stocks.

“We’ve started to see signs of weakness in the last few days, notably yesterday. Then you get a headline like the FT story. That really adds fuel to the fire on the downside,” said Jeffrey Kleintop, chief global investment strategist at Charles Schwab Corp in Boston.

The NASDAQ had powered the stock market’s stellar recovery from the pandemic-led crash, climbing as much as 82 percent from March lows.

The benchmark S&P 500 and the Dow Jones Industrial Average had surged about 60 percent from their troughs.

Earlier on Friday, the US Department of Labor’s closely watched employment report showed that the unemployment rate last month improved to 8.4 percent from 10.2 percent in July, better than analysts had anticipated. However, non-farm payrolls increased less than expected.

Kleintop said that the jobs news did little to help the progress of stalled talks for a fresh COVID-19 stimulus package among sharply divided lawmakers in Washington.

“It wasn’t wonderful enough to get the market excited enough that we don’t need any more stimulus. On the other hand it wasn’t weak enough to bring the two sides in Washington together to extend that stimulus package,” he said.

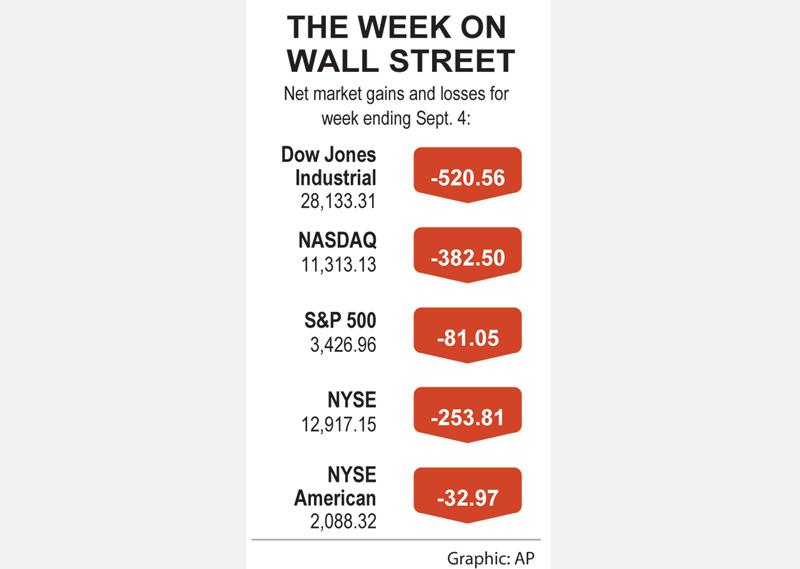

The Dow Jones Industrial Average on Friday fell 159.42 points, or 0.56 percent, to close at 28,133.31, the S&P 500 lost 28.1 points, or 0.81 percent, to 3,426.96 and the NASDAQ Composite dropped 144.97 points, or 1.27 percent, to 11,313.13.

The communication services, consumer discretionary and technology indexes posted the day’s steepest percentage declines among the 11 major S&P sectors.

Only three S&P sectors ended the day higher, including financials, which was powered by a 2.2 percent gain in its bank sub-sector index.

Also, the S&P 1500 airlines sub-index rose 1.85 percent for the day.

For the week, the S&P 500 fell 2.31 percent after five consecutive weeks of gains. The Dow dropped 1.82 percent and the NASDAQ lost 3.27 percent, and clocked its biggest two-day drop since March 17 between Thursday and Friday.

Some fund managers have warned that the declines could be a preview of a rocky two months ahead of the Nov. 3 US presidential election, as institutional investors return from summer vacations and also refocus on potential economic pitfalls.

Wall Street’s fear gauge, after hitting a more than 11-week high in late morning trading, ended the day lower.

Broadcom Inc gained 3 percent after the Apple supplier forecast fourth-quarter revenue above analysts’ estimates.

Declining issues outnumbered advancing ones on the New York Stock Exchange by a 1.53-to-1 ratio; on NASDAQ, a 1.63-to-1 ratio favored decliners.

The S&P 500 posted no new 52-week highs and 1 new low; the NASDAQ Composite recorded 21 new highs and 88 new lows.

On US exchanges 11.31 billion shares changed hands, compared with the 9.29 billion average for the past 20 sessions.

South Korea’s equity benchmark yesterday crossed a new milestone just a month after surpassing the once-unthinkable 5,000 mark as surging global memory demand powers the country’s biggest chipmakers. The KOSPI advanced as much as 2.6 percent to a record 6,123, with Samsung Electronics Co and SK Hynix Inc each gaining more than 2 percent. With the benchmark now up 45 percent this year, South Korea’s stock market capitalization has also moved past France’s, following last month’s overtaking of Germany’s. Long overlooked by foreign funds, despite being undervalued, South Korean stocks have now emerged as clear winners in the global market. The so-called “artificial intelligence

‘SEISMIC SHIFT’: The researcher forecast there would be about 1.1 billion mobile shipments this year, down from 1.26 billion the prior year and erasing years of gains The global smartphone market is expected to contract 12.9 percent this year due to the unprecedented memorychip shortage, marking “a crisis like no other,” researcher International Data Corp (IDC) said. The new forecast, a dramatic revision down from earlier estimates, gives the latest accounting of the ongoing memory crunch that is affecting every corner of the electronics industry. The demand for advanced memory to power artificial intelligence (AI) tasks has drained global supply until well into next year and jeopardizes the business model of many smartphone makers. IDC forecast about 1.1 billion mobile shipments this year, down from 1.26 billion the prior

People stand in a Pokemon store in Tokyo on Thursday. One of the world highest-grossing franchises is celebrated its 30th anniversary yesterday.

Chinese artificial intelligence (AI) start-up DeepSeek’s (深度求索) latest AI model, set to be released as soon as next week, was trained on Nvidia Corp’s most advanced AI chip, the Blackwell, a senior official of US President Donald Trump’s administration said on Monday, in what could represent a violation of US export controls. The US believes DeepSeek will remove the technical indicators that might reveal its use of American AI chips, the official said, adding that the Blackwells are likely clustered at its data center in Inner Mongolia, an autonomous region of China. The person declined to say how the US government received