Softbank Group Corp plans to keep a stake in the chip designer Arm Ltd, even if it sells a partial interest to Nvidia Corp, the Nikkei reported.

The companies are negotiating terms, the newspaper reported, citing sources.

Softbank might take a stake in Nvidia after it buys Arm, the report said.

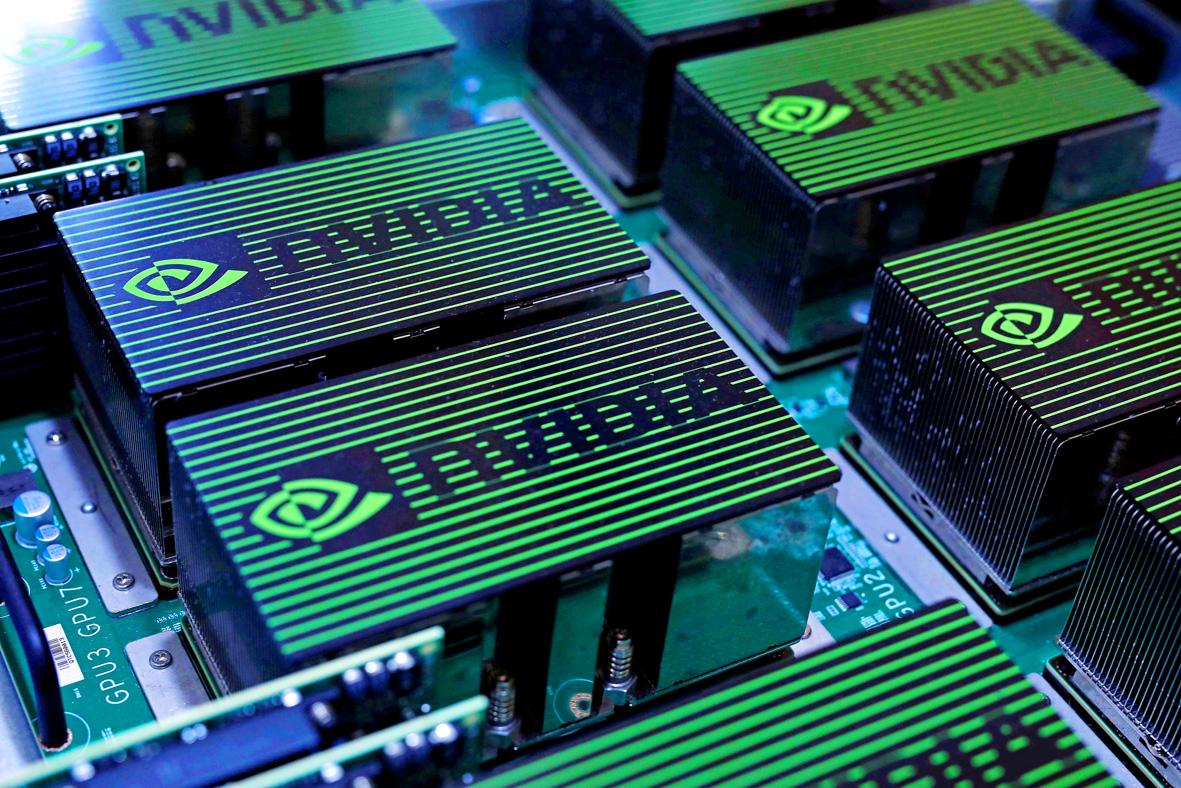

Photo: Reuters

Nvidia and Arm might also merge through a share swap, and Softbank would become a major shareholder in the combined company, it said.

The two parties aim to reach a deal in the next few weeks, the sources said, asking not to be identified because the information is private.

Nvidia is the only suitor in concrete discussions with Softbank, the sources said.

A deal for Arm could be the largest ever in the semiconductor industry, which has been consolidating in the past few years as companies seek to diversify and add scale.

However, any deal with Nvidia, which is a customer of Arm, would likely trigger regulatory scrutiny, as well as a wave of opposition from other users.

Cambridge, England-based Arm’s technology underpins chips that are crucial to most modern electronics, including those that dominate the smartphone market, an area in which Nvidia has failed to gain a foothold.

Customers including Apple Inc, Qualcomm Inc, Advanced Micro Devices Inc (AMD) and Intel Corp could demand assurances that a new owner would continue providing equal access to Arm’s instruction set.

Such concerns resulted in Softbank, a neutral company, buying Arm the last time it was for sale. It bought Arm for US$32 billion four years ago.

No final decisions have been made, and the negotiations could drag on longer or fall apart, the sources said.

Representatives for Nvidia, Softbank and Arm declined to comment.

“With Nvidia’s low-cost fabless model enabling it to focus on R&D, engineering and programming, the fit with Arm would be perfect,” Mirabaud Securities Ltd analyst Neil Campling said.

Nvidia is the largest maker of graphics processing units (GPU) and it is spreading the use of the gaming component into new areas such as artificial intelligence processing in data centers and self-driving vehicles.

Marrying its own capabilities with central processing units (CPU) designed by Arm could enable it to take on Intel and AMD in a more comprehensive way, Rosenblatt Securities Inc analyst Hans Mosesmann said.

He said that Nvidia would have to pay an estimated US$55 billion for Arm.

“You need control of both CPU and GPU roadmaps and this, of course, includes data centers,” he wrote in a note on Friday. “Strategically, Nvidia needs a scalable CPU that can be integrated into its GPU roadmap, as is the case with AMD and Intel.”

SEMICONDUCTORS: The German laser and plasma generator company will expand its local services as its specialized offerings support Taiwan’s semiconductor industries Trumpf SE + Co KG, a global leader in supplying laser technology and plasma generators used in chip production, is expanding its investments in Taiwan in an effort to deeply integrate into the global semiconductor supply chain in the pursuit of growth. The company, headquartered in Ditzingen, Germany, has invested significantly in a newly inaugurated regional technical center for plasma generators in Taoyuan, its latest expansion in Taiwan after being engaged in various industries for more than 25 years. The center, the first of its kind Trumpf built outside Germany, aims to serve customers from Taiwan, Japan, Southeast Asia and South Korea,

POWERING UP: PSUs for AI servers made up about 50% of Delta’s total server PSU revenue during the first three quarters of last year, the company said Power supply and electronic components maker Delta Electronics Inc (台達電) reported record-high revenue of NT$161.61 billion (US$5.11 billion) for last quarter and said it remains positive about this quarter. Last quarter’s figure was up 7.6 percent from the previous quarter and 41.51 percent higher than a year earlier, and largely in line with Yuanta Securities Investment Consulting Co’s (元大投顧) forecast of NT$160 billion. Delta’s annual revenue last year rose 31.76 percent year-on-year to NT$554.89 billion, also a record high for the company. Its strong performance reflected continued demand for high-performance power solutions and advanced liquid-cooling products used in artificial intelligence (AI) data centers,

Gasoline and diesel prices at domestic fuel stations are to fall NT$0.2 per liter this week, down for a second consecutive week, CPC Corp, Taiwan (台灣中油) and Formosa Petrochemical Corp (台塑石化) announced yesterday. Effective today, gasoline prices at CPC and Formosa stations are to drop to NT$26.4, NT$27.9 and NT$29.9 per liter for 92, 95 and 98-octane unleaded gasoline respectively, the companies said in separate statements. The price of premium diesel is to fall to NT$24.8 per liter at CPC stations and NT$24.6 at Formosa pumps, they said. The price adjustments came even as international crude oil prices rose last week, as traders

SIZE MATTERS: TSMC started phasing out 8-inch wafer production last year, while Samsung is more aggressively retiring 8-inch capacity, TrendForce said Chipmakers are expected to raise prices of 8-inch wafers by up to 20 percent this year on concern over supply constraints as major contract chipmakers Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) and Samsung Electronics Co gradually retire less advanced wafer capacity, TrendForce Corp (集邦科技) said yesterday. It is the first significant across-the-board price hike since a global semiconductor correction in 2023, the Taipei-based market researcher said in a report. Global 8-inch wafer capacity slid 0.3 percent year-on-year last year, although 8-inch wafer prices still hovered at relatively stable levels throughout the year, TrendForce said. The downward trend is expected to continue this year,