The S&P 500 ended higher on Friday as investors weighed the prospect of more fiscal stimulus against fears of further business disruptions due to a record rise in COVID-19 cases in the US.

Netflix Inc tumbled 6.5 percent after the video streaming service forecast slower-than-expected subscriber growth during the third quarter, pulling the communication services sector down 0.4 percent.

The S&P 500 utilities, real-estate and healthcare indices were the session’s strongest gainers.

However, a 1.5 percent drop in Goldman Sachs Group Inc helped keep the Dow Jones Industrial Average in negative territory.

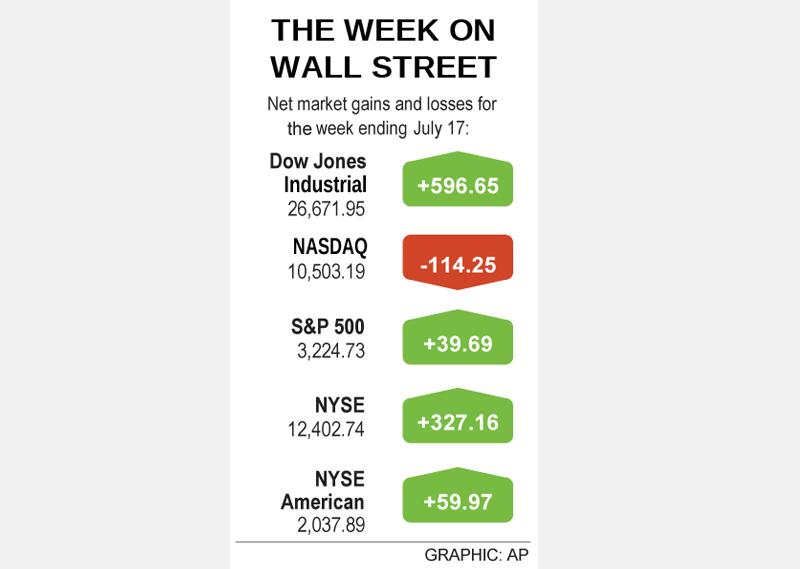

For the week, the S&P 500 and the Dow rose 1.25 percent and 2.29 percent respectively, after optimism over an eventual novel coronavirus vaccine and hopes of a post-pandemic economic recovery helped investors look past a continuous surge in COVID-19 cases.

Cases on Friday rose by at least 70,674, after climbing by a record 77,499 on Thursday.

The NASDAQ ended 1.08 percent lower for the week as investors sold shares of high-flying companies including Microsoft Corp and Amazon.com Inc and moved into cyclical sectors.

Next week, the second-quarter earnings season shifts into high gear with reports expected from corporate heavyweights including Microsoft, Tesla Inc, Intel Corp and Verizon Communications Inc.

With this year largely written off as a disaster for US corporations because of the virus, investors are looking for information from companies about the potential size and timing of an eventual recovery.

“The question is what 2021 and 2022 look like, and what can folks glean from the commentary, especially when companies have withdrawn their guidance and made it difficult to get a sense of what their prospects look like,” said Tom Hainlin, a national investment strategist at US Bank Wealth Management.

The Cboe Volatility Index, known as Wall Street’s “fear gauge,” ended at 25.68, its lowest closing level since June 5.

The Dow Jones Industrial Average fell 0.23 percent to end at 26,671.95 points, while the S&P 500 gained 0.28 percent to 3,224.73. The NASDAQ Composite climbed 0.28 percent to 10,503.19.

Unprecedented stimulus measures and improving economic data have helped the S&P 500 rise to within about 5 percent of its February record high.

Investors are also hoping for more fiscal support, as a program that offers additional unemployment benefits is set to expire on July 31. The US Congress is to return to Washington on Monday to debate another coronavirus aid bill.

“Both Republicans and Democrats have a strong incentive to agree upon further pre-election stimulus. It’s not a matter of ‘if’ a stimulus passes, it’s just what the size and content of that package looks like,” UBS Private Wealth Management senior vice president Andrea Bevis said.

BlackRock Inc, the world’s largest asset manager, rose 3.7 percent after reporting a jump in quarterly profit as investors poured money into its fixed-income funds and cash management services.

Volume on US exchanges was 9.5 billion shares, compared with the 11.6 billion average for the full session over the past 20 trading days.

Advancing issues outnumbered declining ones on the NYSE by a 1.43-to-1 ratio; on the NASDAQ, a 1.50-to-1 ratio favored advancers.

The S&P 500 posted 39 new 52-week highs and no new lows; the NASDAQ Composite recorded 89 new highs and 11 new lows.

HORMUZ ISSUE: The US president said he expected crude prices to drop at the end of the war, which he called a ‘minor excursion’ that could continue ‘for a little while’ The United Arab Emirates (UAE) and Kuwait started reducing oil production, as the near-closure of the crucial Strait of Hormuz ripples through energy markets and affects global supply. Abu Dhabi National Oil Co (ADNOC) is “managing offshore production levels to address storage requirements,” the company said in a statement, without giving details. Kuwait Petroleum Corp said it was lowering production at its oil fields and refineries after “Iranian threats against safe passage of ships through the Strait of Hormuz.” The war in the Middle East has all but closed Hormuz, the narrow waterway linking the Persian Gulf to the open seas,

RATIONING: The proposal would give the Trump administration ample leverage to negotiate investments in the US as it decides how many chips to give each country US officials are debating a new regulatory framework for exporting artificial intelligence (AI) chips and are considering requiring foreign nations to invest in US AI data centers or security guarantees as a condition for granting exports of 200,000 chips or more, according to a document seen by Reuters. The rules are not yet final and could change. They would be the first attempt to regulate the flow of AI chips to US allies and partners since US President Donald Trump’s administration said it rescinded its predecessor’s so-called AI diffusion rules. Those rules sought to keep a significant amount of AI

Apple Inc increased iPhone production in India by about 53 percent last year and now makes a quarter of its marquee devices there, reflecting the US company’s efforts to avoid tariffs on China. The company assembled about 55 million iPhones in India last year, up from 36 million a year earlier, people familiar with the matter said, asking not to be named because the numbers aren’t public. Apple makes about 220 million to 230 million iPhones a year globally, with India’s share of the total increasing rapidly. Apple has accelerated its expansion in the world’s most populous country in recent years, bolstered

HEADWINDS: The company said it expects its computer business, as well as consumer electronics and communications segments to see revenue declines due to seasonality Pegatron Corp (和碩) yesterday said it aims to grow its artificial intelligence (AI) server revenue more than 10-fold this year from last year, driven by orders from neocloud solutions clients and large cloud service providers. The electronics manufacturing service provider said AI server revenue growth would be driven primarily by the Nvidia Corp GB300 server platform. Server shipments are expected to increase each quarter this year, with the second half likely to outperform the first half, it said. The AI server market is expected to broaden this year as more inference applications emerge, which would drive demand for system-on-chip, application-specific integrated circuits