The S&P 500 ended higher on Friday as investors weighed the prospect of more fiscal stimulus against fears of further business disruptions due to a record rise in COVID-19 cases in the US.

Netflix Inc tumbled 6.5 percent after the video streaming service forecast slower-than-expected subscriber growth during the third quarter, pulling the communication services sector down 0.4 percent.

The S&P 500 utilities, real-estate and healthcare indices were the session’s strongest gainers.

However, a 1.5 percent drop in Goldman Sachs Group Inc helped keep the Dow Jones Industrial Average in negative territory.

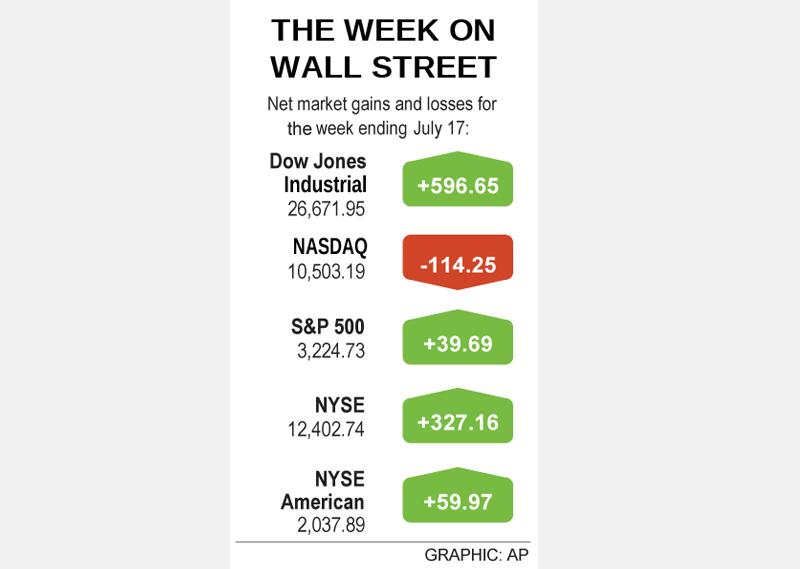

For the week, the S&P 500 and the Dow rose 1.25 percent and 2.29 percent respectively, after optimism over an eventual novel coronavirus vaccine and hopes of a post-pandemic economic recovery helped investors look past a continuous surge in COVID-19 cases.

Cases on Friday rose by at least 70,674, after climbing by a record 77,499 on Thursday.

The NASDAQ ended 1.08 percent lower for the week as investors sold shares of high-flying companies including Microsoft Corp and Amazon.com Inc and moved into cyclical sectors.

Next week, the second-quarter earnings season shifts into high gear with reports expected from corporate heavyweights including Microsoft, Tesla Inc, Intel Corp and Verizon Communications Inc.

With this year largely written off as a disaster for US corporations because of the virus, investors are looking for information from companies about the potential size and timing of an eventual recovery.

“The question is what 2021 and 2022 look like, and what can folks glean from the commentary, especially when companies have withdrawn their guidance and made it difficult to get a sense of what their prospects look like,” said Tom Hainlin, a national investment strategist at US Bank Wealth Management.

The Cboe Volatility Index, known as Wall Street’s “fear gauge,” ended at 25.68, its lowest closing level since June 5.

The Dow Jones Industrial Average fell 0.23 percent to end at 26,671.95 points, while the S&P 500 gained 0.28 percent to 3,224.73. The NASDAQ Composite climbed 0.28 percent to 10,503.19.

Unprecedented stimulus measures and improving economic data have helped the S&P 500 rise to within about 5 percent of its February record high.

Investors are also hoping for more fiscal support, as a program that offers additional unemployment benefits is set to expire on July 31. The US Congress is to return to Washington on Monday to debate another coronavirus aid bill.

“Both Republicans and Democrats have a strong incentive to agree upon further pre-election stimulus. It’s not a matter of ‘if’ a stimulus passes, it’s just what the size and content of that package looks like,” UBS Private Wealth Management senior vice president Andrea Bevis said.

BlackRock Inc, the world’s largest asset manager, rose 3.7 percent after reporting a jump in quarterly profit as investors poured money into its fixed-income funds and cash management services.

Volume on US exchanges was 9.5 billion shares, compared with the 11.6 billion average for the full session over the past 20 trading days.

Advancing issues outnumbered declining ones on the NYSE by a 1.43-to-1 ratio; on the NASDAQ, a 1.50-to-1 ratio favored advancers.

The S&P 500 posted 39 new 52-week highs and no new lows; the NASDAQ Composite recorded 89 new highs and 11 new lows.

GROWING OWINGS: While Luxembourg and China swapped the top three spots, the US continued to be the largest exposure for Taiwan for the 41st consecutive quarter The US remained the largest debtor nation to Taiwan’s banking sector for the 41st consecutive quarter at the end of September, after local banks’ exposure to the US market rose more than 2 percent from three months earlier, the central bank said. Exposure to the US increased to US$198.896 billion, up US$4.026 billion, or 2.07 percent, from US$194.87 billion in the previous quarter, data released by the central bank showed on Friday. Of the increase, about US$1.4 billion came from banks’ investments in securitized products and interbank loans in the US, while another US$2.6 billion stemmed from trust assets, including mutual funds,

AI TALENT: No financial details were released about the deal, in which top Groq executives, including its CEO, would join Nvidia to help advance the technology Nvidia Corp has agreed to a licensing deal with artificial intelligence (AI) start-up Groq, furthering its investments in companies connected to the AI boom and gaining the right to add a new type of technology to its products. The world’s largest publicly traded company has paid for the right to use Groq’s technology and is to integrate its chip design into future products. Some of the start-up’s executives are leaving to join Nvidia to help with that effort, the companies said. Groq would continue as an independent company with a new chief executive, it said on Wednesday in a post on its Web

Even as the US is embarked on a bitter rivalry with China over the deployment of artificial intelligence (AI), Chinese technology is quietly making inroads into the US market. Despite considerable geopolitical tensions, Chinese open-source AI models are winning over a growing number of programmers and companies in the US. These are different from the closed generative AI models that have become household names — ChatGPT-maker OpenAI or Google’s Gemini — whose inner workings are fiercely protected. In contrast, “open” models offered by many Chinese rivals, from Alibaba (阿里巴巴) to DeepSeek (深度求索), allow programmers to customize parts of the software to suit their

JOINT EFFORTS: MediaTek would partner with Denso to develop custom chips to support the car-part specialist company’s driver-assist systems in an expanding market MediaTek Inc (聯發科), the world’s largest mobile phone chip designer, yesterday said it is working closely with Japan’s Denso Corp to build a custom automotive system-on-chip (SoC) solution tailored for advanced driver-assistance systems and cockpit systems, adding another customer to its new application-specific IC (ASIC) business. This effort merges Denso’s automotive-grade safety expertise and deep vehicle integration with MediaTek’s technologies cultivated through the development of Media- Tek’s Dimensity AX, leveraging efficient, high-performance SoCs and artificial intelligence (AI) capabilities to offer a scalable, production-ready platform for next-generation driver assistance, the company said in a statement yesterday. “Through this collaboration, we are bringing two