With the US dollar expected to weaken in the next 12 months due to near-zero interest rates, investors should consider purchasing US corporate bonds, Standard Chartered Bank Taiwan Ltd (渣打台灣銀行) said on Thursday.

The bank said that the US Federal Reserve since last month has been buying bonds issued by US companies to curb default rates.

The US dollar is forecast to be weaker against the pound, the euro and the yen, as well as the Canadian dollar, the Swedish krona and the Swiss franc, as the greenback lacks high investment returns after the Fed in March slashed the benchmark interest rate to near zero, Standard Chartered said.

“The Fed last month said that there would be no rate hikes until the end of 2022 at the earliest, therefore it is unlikely that the US dollar would become stronger in the next 12 months,” Standard Chartered Bank Taiwan investment strategy head Allen Liu (劉家豪) said.

With the pandemic situation slowing worldwide and countries easing lockdown restrictions, the global economy is likely to recover in the second half of this year, which would lessen the market demand for the US dollar as a hedging tool, director of wealth management Terry Chen (陳太齡) said.

Despite a downbeat outlook for the US dollar, the bank prefers US dollar-denominated investment-grade corporate bonds issued by US companies, given that the Fed started buying corporates bonds as part of a US$250 billion program to back up US companies, Liu said.

“Their yields could remain above 2 to 3 percent and are still better than deposits. More importantly, with support from the Fed, investors do not need to worry about defaults,” Liu said.

Investors looking for higher returns could consider high-yield bonds issued in mature markets, as they have an average yield of 6.5 percent, he said.

Overall, bonds would be safer than stocks in the next six months, he added.

Technology and medical stocks are also attractive, as they have gained more business opportunities amid the pandemic, Liu said.

“There might be some speculation in buying stocks of companies that claim to have made progress toward COVID-19 drugs or vaccines, as no one can know whether the firms would be able to reach the finish line,” Liu said.

“It is better to diversify risk when investing in biotech companies,” he said.

Meanwhile, UBS Group AG is overweight on Singaporean and Indian equities, which have not fully erased their losses for the year, as they are attractive by valuation, said Hartmut Issel, Singapore-based head of APAC equities at UBS Global Wealth Management.

As the governments are launching stimulus packages to bring their economies back on track, “it is a matter of time” before the stock markets rebound, Issel said.

The yen is predicted to strengthen against the US dollar and South Korea’s stock market is expected to remain resilient, he said.

Despite worries about a second wave of COVID-19 in the second half of the year, countries are unlikely to impose lockdown measures again that hurt their economies, he said.

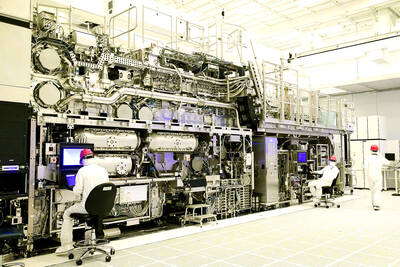

ASML Holding NV’s new advanced chip machines have a daunting price tag, said Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), one of the Dutch company’s biggest clients. “The cost is very high,” TSMC senior vice president Kevin Zhang (張曉強) said at a technology symposium in Amsterdam on Tuesday, referring to ASML’s latest system known as high-NA extreme ultraviolet (EUV). “I like the high-NA EUV’s capability, but I don’t like the sticker price,” Zhang said. ASML’s new chip machine can imprint semiconductors with lines that are just 8 nanometers thick — 1.7 times smaller than the previous generation. The machines cost 350 million euros (US$378 million)

Apple Inc has closed in on an agreement with OpenAI to use the start-up’s technology on the iPhone, part of a broader push to bring artificial intelligence (AI) features to its devices, people familiar with the matter said. The two sides have been finalizing terms for a pact to use ChatGPT features in Apple’s iOS 18, the next iPhone operating system, said the people, who asked not to be identified because the situation is private. Apple also has held talks with Alphabet Inc’s Google about licensing its Gemini chatbot. Those discussions have not led to an agreement, but are ongoing. An OpenAI

EXPLOSION: A driver who was transporting waste material from the site was hit by a blunt object after an uncontrolled pressure release and thrown 6m from the truck Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) said yesterday there was no damage to its facilities after an incident at its Arizona factory construction site where a waste disposal truck driver was transported to hospital. Firefighters responded to an explosion on Wednesday afternoon at the TSMC plant in Phoenix, the Arizona Republic reported, citing the local fire department. Cesar Anguiano-Guitron, 41, was transporting waste material from the project site and stopped to inspect the tank when he was made aware of a potential problem, a police report seen by Bloomberg News showed. Following an “uncontrolled pressure release,” he was hit by a blunt

‘FULL SUPPORT’: Kumamoto Governor Takashi Kimura said he hopes more companies would settle in the prefecture to create an area similar to Taiwan’s Hsinchu Science Park The newly elected governor of Japan’s Kumamoto Prefecture said he is ready to ensure wide-ranging support to woo Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) to build its third Japanese chip factory there. Concerns of groundwater shortages when TSMC’s two plants begin operations in the prefecture’s Kikuyo have spurred discussions about the possibility of tapping unused dam water, Kumamoto Governor Takashi Kimura said in an interview on Saturday. While Kimura said talks about a third plant have yet to occur, Bloomberg had reported TSMC is already considering its third Japanese fab — also in Kumamoto — which would make more advanced chips. “We are