Wall Street closed higher and the NASDAQ reached an all-time closing high on Thursday as investors headed into a long holiday weekend buoyed by a record surge in payrolls, which provided assurance that the US economic recovery was well under way.

All three major US stock averages advanced, with the benchmark S&P 500 posting its fourth straight daily gain.

Massive stimulus and hopes for a speedy economic rebound have returned the S&P 500 and the NASDAQ to 7.6 percent and 12.6 percent below their record highs reached in February.

According to the US Department of Labor, the US economy last month added 4.8 million jobs — 1.8 million more than analysts expected and setting a second consecutive record.

Massive rehiring sent the unemployment rate down to 11.1 percent.

“There was a lot to like in economic data for the week, and there’s still talk that there will be more stimulus from Washington after they get back from the fourth of July break,” said Paul Nolte, portfolio manager at Kingsview Asset Management in Chicago.

However, even with May and last month’s consecutive record payroll gains, the labor market has still recovered only a fraction of the 22 million jobs lost in the March-to-April plunge.

The recovery of the US economy, now in its sixth month of recession, could stall as new cases of COVID-19 hit record levels and several states hit hardest by the resurgence halted or reversed plans to reopen their economies.

Florida on Thursday reported a record-shattering 10,000 new cases, worse than any European country at the peak of their outbreaks.

“With the spikes [in new COVID-19 cases] we’ve seen the larger states — Texas, California and Florida — those states have taken steps to turn back their re-opening plans, and that will slow the overall growth and consumer spending in those regions,” Nolte added.

In the coming weeks, market participants are predicted to train their focus on second-quarter reporting season.

In aggregate, analysts now expect S&P earnings to have dropped by 43.1 percent as companies grapple with plunging demand and disrupted supply chains.

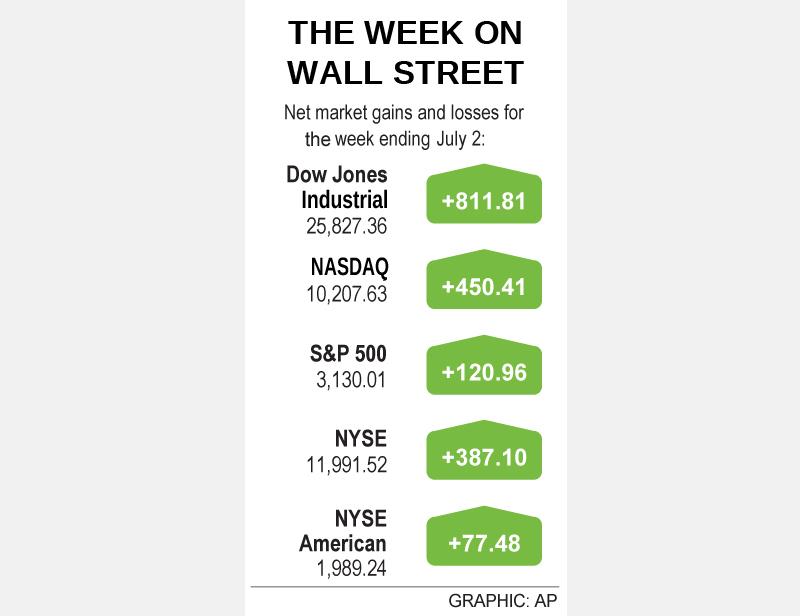

The Dow Jones Industrial Average rose 92.39 points, or 0.36 percent, to 25,827.36, the S&P 500 gained 14.15 points, or 0.45 percent, to 3,130.01 and the NASDAQ Composite added 53 points, or 0.52 percent, to 10,207.63.

Compared with Friday last week, the Dow ended up 0.87 percent, the S&P 500 gained 2.92 percent and the NASDAQ 6.45 increased percent.

Of the 11 major sectors in the S&P 500, all but real estate and communications services closed higher, with materials enjoying the largest percentage gain.

Microsoft Corp provided the biggest boost to the S&P 500, and last month retained its top spot as the most globally invested stock, data from trading platform eToro showed.

Tesla Inc jumped 8 percent after the electric automaker’s second-quarter vehicle deliveries beat Wall Street estimates.

Advancing issues outnumbered declining ones on the NYSE by a 1.90-to-1 ratio; on the NASDAQ, a 1.28-to-1 ratio favored advancers.

The S&P 500 posted 36 new 52-week highs and no new lows; the NASDAQ Composite recorded 123 new highs and 10 new lows.

Volume on US exchanges was 10.03 billion shares, compared with the 13.24 billion average over the past 20 trading days.

South Korea’s equity benchmark yesterday crossed a new milestone just a month after surpassing the once-unthinkable 5,000 mark as surging global memory demand powers the country’s biggest chipmakers. The KOSPI advanced as much as 2.6 percent to a record 6,123, with Samsung Electronics Co and SK Hynix Inc each gaining more than 2 percent. With the benchmark now up 45 percent this year, South Korea’s stock market capitalization has also moved past France’s, following last month’s overtaking of Germany’s. Long overlooked by foreign funds, despite being undervalued, South Korean stocks have now emerged as clear winners in the global market. The so-called “artificial intelligence

‘SEISMIC SHIFT’: The researcher forecast there would be about 1.1 billion mobile shipments this year, down from 1.26 billion the prior year and erasing years of gains The global smartphone market is expected to contract 12.9 percent this year due to the unprecedented memorychip shortage, marking “a crisis like no other,” researcher International Data Corp (IDC) said. The new forecast, a dramatic revision down from earlier estimates, gives the latest accounting of the ongoing memory crunch that is affecting every corner of the electronics industry. The demand for advanced memory to power artificial intelligence (AI) tasks has drained global supply until well into next year and jeopardizes the business model of many smartphone makers. IDC forecast about 1.1 billion mobile shipments this year, down from 1.26 billion the prior

People stand in a Pokemon store in Tokyo on Thursday. One of the world highest-grossing franchises is celebrated its 30th anniversary yesterday.

NEW IDENTITY: Known for its software, India has expanded into hardware, with its semiconductor industry growing from US$38bn in 2023 to US$45bn to US$50bn India on Saturday inaugurated its first semiconductor assembly and test facility, a milestone in the government’s push to reduce dependence on foreign chipmakers and stake a claim in a sector dominated by China. Indian Prime Minister Narendra Modi opened US firm Micron Technology Inc’s semiconductor assembly, test and packaging unit in his home state of Gujarat, hailing the “dawn of a new era” for India’s technology ambitions. “When young Indians look back in the future, they will see this decade as the turning point in our tech future,” Modi told the event, which was broadcast on his YouTube channel. The plant would convert