Chunghwa Telecom Co (中華電信) yesterday became the nation’s first telecom to debut its 5G services, offering tiered tariffs that include a threshold of NT$599 and flat rates, as it aims to switch half of its subscribers to the 5G network within three years.

Subscribers would have unlimited data transmission for monthly fees starting at NT$1,399 — the same flat rate as when the company launched its 4G service in 2014 — and they can subscribe to the highest-rate plan for NT$2,699 per month for faster data transmission speeds and larger bandwidth, the company said.

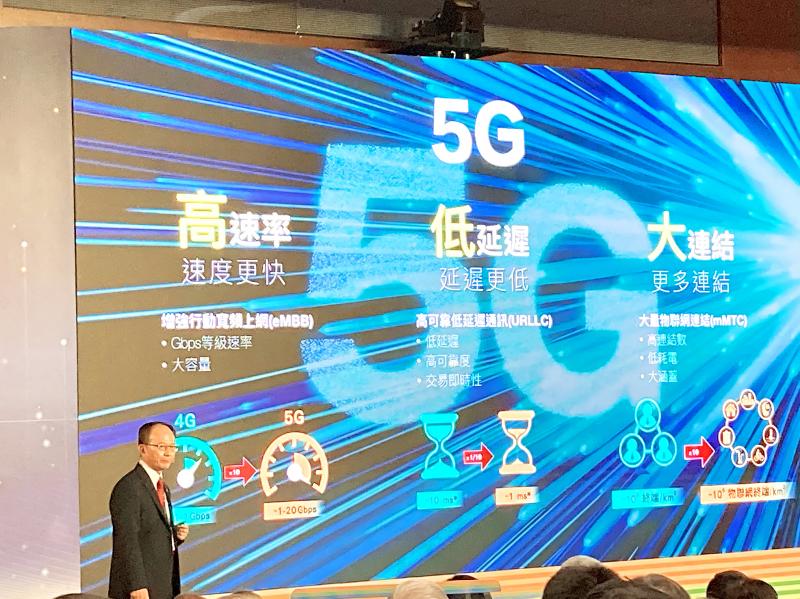

Data transmission speeds would be within the range of 500 megabytes per second to 1.5 gigabytes per second, the company said.

Photo: CNA

Hotspot sharing volume would be limited to 50 gigabytes, it said.

“To some extent, a flat rate is a requirement in Taiwan’s market. However, the tariffs are very, very low, compared with those offered in South Korea or Japan,” Chunghwa Telecom chairman Sheih Chi-mau (謝繼茂) told reporters on the sidelines of the launch event.

South Korea’s KT Corp charges fees equivalent to at least NT$2,040 per month and SK Telecom Co offers a monthly rate of NT$2,400 for unlimited data transmission, according to information provided by Chunghwa Telecom.

Photo: Lisa Wang, Taipei Times

The company expects half of its 10.5 million mobile subscribers to switch to the 5G network within three years, Sheih said.

The company expects to reach 1 million 5G subscribers in the first year of commercial launch, he said.

However, the company said 5G would not be a panacea for a persistent decline in telecom revenue.

Photo: Lisa Wang, Taipei Times

“It will be good enough to see a flat 5G telecom revenue,” Sheih said, responding to a reporter’s question about whether 5G would provide an opportunity for the company to reverse a revenue downtrend.

Chunghwa Telecom plans to double the number of its 5G base stations to 4,000 by the end of this year, compared with 2,000 now, he said.

The number would climb to more than 10,000 by 2022, he added.

The company plans to invest NT$27 billion (US$910.32 million) on its network infrastructure.

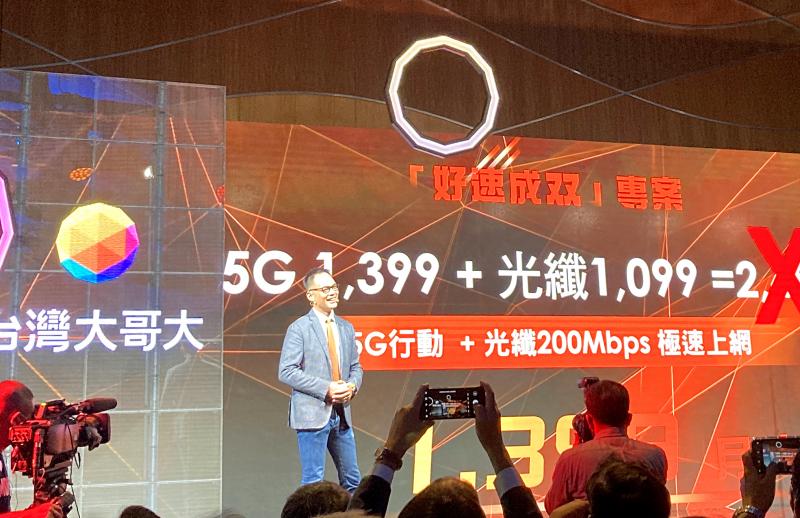

Separately yesterday, Taiwan Mobile Co (台灣大哥大) said that it would launch 5G services today.

It also aims to boost the 5G penetration rate among its subscribers to 50 percent within three years, company president Jamie Lin (林之晨) told reporters at a news conference in Taipei.

During the period, Taiwan Mobile is targeting expanding its 5G network by deploying more than 10,000 base stations to cover 90 percent of the nation’s population, Lin said.

With new 5G services on offer, such as instant playback for sports and virtual reality video streaming, the company expects non-telecom services to contribute NT$100 billion to its revenue over the period.

Taiwan Mobile also plans to offer tailor-made 5G rate plans for mobile game players later this year, Lin said.

Taiwan Mobile’s rate plans are similar to those of Chunghwa Telecom, with additional free high-speed broadband connection.

Far EasTone Telecommunications Co (遠傳電信) is to launch its 5G services on Friday.

South Korea’s equity benchmark yesterday crossed a new milestone just a month after surpassing the once-unthinkable 5,000 mark as surging global memory demand powers the country’s biggest chipmakers. The KOSPI advanced as much as 2.6 percent to a record 6,123, with Samsung Electronics Co and SK Hynix Inc each gaining more than 2 percent. With the benchmark now up 45 percent this year, South Korea’s stock market capitalization has also moved past France’s, following last month’s overtaking of Germany’s. Long overlooked by foreign funds, despite being undervalued, South Korean stocks have now emerged as clear winners in the global market. The so-called “artificial intelligence

‘SEISMIC SHIFT’: The researcher forecast there would be about 1.1 billion mobile shipments this year, down from 1.26 billion the prior year and erasing years of gains The global smartphone market is expected to contract 12.9 percent this year due to the unprecedented memorychip shortage, marking “a crisis like no other,” researcher International Data Corp (IDC) said. The new forecast, a dramatic revision down from earlier estimates, gives the latest accounting of the ongoing memory crunch that is affecting every corner of the electronics industry. The demand for advanced memory to power artificial intelligence (AI) tasks has drained global supply until well into next year and jeopardizes the business model of many smartphone makers. IDC forecast about 1.1 billion mobile shipments this year, down from 1.26 billion the prior

People stand in a Pokemon store in Tokyo on Thursday. One of the world highest-grossing franchises is celebrated its 30th anniversary yesterday.

Chinese artificial intelligence (AI) start-up DeepSeek’s (深度求索) latest AI model, set to be released as soon as next week, was trained on Nvidia Corp’s most advanced AI chip, the Blackwell, a senior official of US President Donald Trump’s administration said on Monday, in what could represent a violation of US export controls. The US believes DeepSeek will remove the technical indicators that might reveal its use of American AI chips, the official said, adding that the Blackwells are likely clustered at its data center in Inner Mongolia, an autonomous region of China. The person declined to say how the US government received