Eslite Spectrum Corp (誠品生活), which runs the Eslite bookstore chain, on Saturday said that it will either choose its branch in Taipei’s Xinyi District (信義) or Nanxi (南西) as its 24-hour outlet following the closure of the Dunnan (敦南) store.

Eslite on April 10 launched an online poll asking people to vote for their preference for the company’s new 24-hour bookstore after the Dunnan store closes when its lease expires at the end of next month.

Among five candidates, the Xinyi store, on Songgao Road, garnered the most support, ahead of the Nanxi store, which is on Nanjing W Road, the company said.

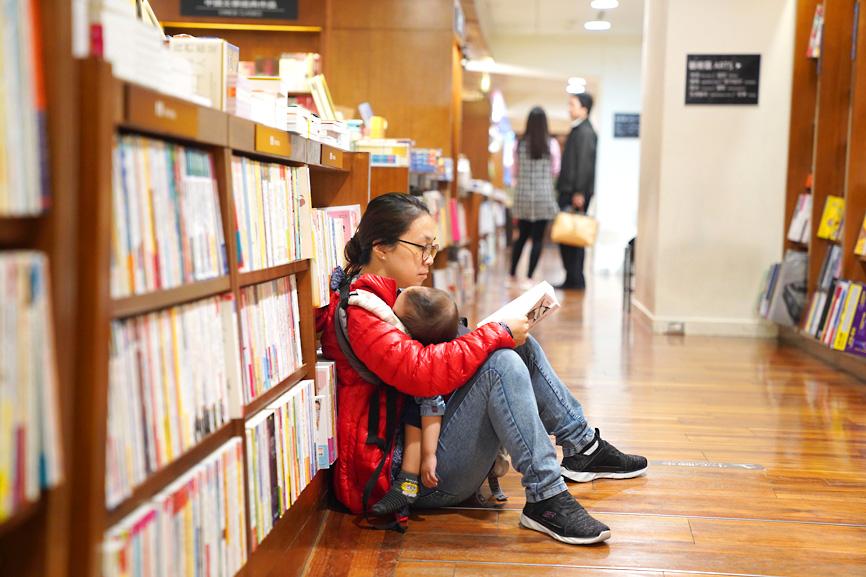

Photo: CNA

Those who support the Xinyi store touted its favorable location inside the busy commercial district and its proximity to mass transit systems, while those who favored the Nanxi store said they could grab a cup of coffee while reading.

Sarutahiko Coffee, a popular Japanese brand, has opened a branch inside the Nanxi store.

Eslite, which is expected to announce its decision on Thursday, has said that while the Nanxi store ranks second in the poll, it might be a more viable location to become its 24-hour outlet when all conditions are considered.

FEW IN THE WORLD

The Dunnan store opened in 1989 and started to provide round-the-clock service in 1999, becoming one of the few bookstores in the world to remain open 24 hours.

The building housing the bookstore is to be rebuilt under an urban renewal project launched by Cathay Financial Holding Co (國泰金控).

The store, covering two above-ground floors and three below in the 12-story Dunnan Financial Building on Dunhua S Road, has been a big draw for foreign visitors and has become a nighttime tourist attraction.

The company also said the deadline for the sale of 100,000 books from the store’s stock has been extended to Friday next week.

TAITUNG CLOSURE

Meanwhile, Eslite has said it would close its Taitung store at the end of this month after closing its Anping (安平) outlet in Tainan last month.

The company would have 42 stores in Taiwan once the Dunnan store closes.

Eslite has stores in Taikoo, Causeway Bay and Tsim Sha Tsui in Hong Kong, and Suzhou and Shenzhen in China, as well as an outlet in Tokyo, which opened in September last year.

The US dollar was trading at NT$29.7 at 10am today on the Taipei Foreign Exchange, as the New Taiwan dollar gained NT$1.364 from the previous close last week. The NT dollar continued to rise today, after surging 3.07 percent on Friday. After opening at NT$30.91, the NT dollar gained more than NT$1 in just 15 minutes, briefly passing the NT$30 mark. Before the US Department of the Treasury's semi-annual currency report came out, expectations that the NT dollar would keep rising were already building. The NT dollar on Friday closed at NT$31.064, up by NT$0.953 — a 3.07 percent single-day gain. Today,

‘SHORT TERM’: The local currency would likely remain strong in the near term, driven by anticipated US trade pressure, capital inflows and expectations of a US Fed rate cut The US dollar is expected to fall below NT$30 in the near term, as traders anticipate increased pressure from Washington for Taiwan to allow the New Taiwan dollar to appreciate, Cathay United Bank (國泰世華銀行) chief economist Lin Chi-chao (林啟超) said. Following a sharp drop in the greenback against the NT dollar on Friday, Lin told the Central News Agency that the local currency is likely to remain strong in the short term, driven in part by market psychology surrounding anticipated US policy pressure. On Friday, the US dollar fell NT$0.953, or 3.07 percent, closing at NT$31.064 — its lowest level since Jan.

The New Taiwan dollar and Taiwanese stocks surged on signs that trade tensions between the world’s top two economies might start easing and as US tech earnings boosted the outlook of the nation’s semiconductor exports. The NT dollar strengthened as much as 3.8 percent versus the US dollar to 30.815, the biggest intraday gain since January 2011, closing at NT$31.064. The benchmark TAIEX jumped 2.73 percent to outperform the region’s equity gauges. Outlook for global trade improved after China said it is assessing possible trade talks with the US, providing a boost for the nation’s currency and shares. As the NT dollar

The Financial Supervisory Commission (FSC) yesterday met with some of the nation’s largest insurance companies as a skyrocketing New Taiwan dollar piles pressure on their hundreds of billions of dollars in US bond investments. The commission has asked some life insurance firms, among the biggest Asian holders of US debt, to discuss how the rapidly strengthening NT dollar has impacted their operations, people familiar with the matter said. The meeting took place as the NT dollar jumped as much as 5 percent yesterday, its biggest intraday gain in more than three decades. The local currency surged as exporters rushed to