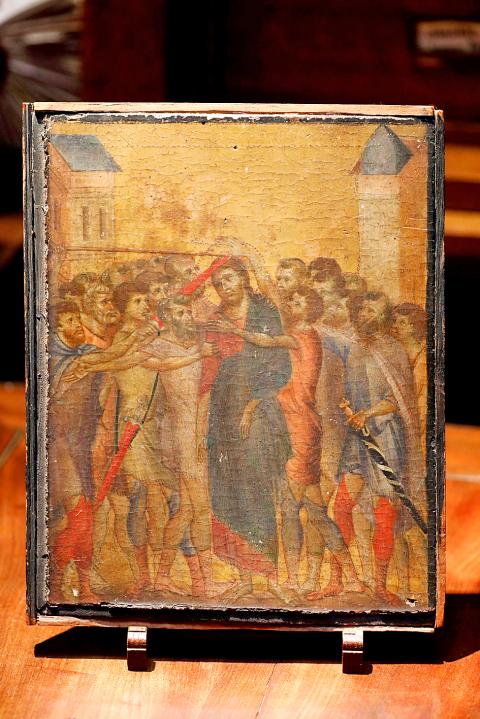

A rare masterpiece by Italian early Renaissance master Cimabue that was discovered in a French kitchen sold for 24 million euros (US$26.6 million) on Sunday, about five times the initial estimate.

The Acteon auction house did not identify the winning bidder for the painting, Christ Mocked, at the sale in Senlis, outside Paris.

The selling price, which included costs, smashed the initial estimate of between 4 million and 6 million euros. Bidding began at 3 million euros, with only three of the eight bidders present at the auction.

Photo: Reuters

It is the first time in decades that a painting by Cimabue, a pioneering primitive painter who lived from 1272-1302 and is also known as Cenni di Pepo, has gone under the hammer.

Acteon said the figure was the highest ever reached for a medieval painting and the eighth-highest ever reached for a medieval or old master painting.

The highest figure ever reached for a painting was the US$450 million paid for the Salvator Mundi attributed to Leonardo da Vinci and sold at auction in 2017.

Experts last month announced the sensational discovery of the painting by Cimabue, which was owned by a woman in the northern French town of Compiegne. She had it hanging between her kitchen and her sitting room.

She believed it was merely an old religious icon when she took it to the auctioneers to be valued.

The tiny unsigned work, measuring just 26cm by 20cm, was found to be in excellent condition, although covered in grime from having been displayed right above a cooking hotplate.

Art experts at Turquin in Paris used infrared reflectology to confirm that the piece is part of a larger diptych from 1280, when Cimabue painted eight scenes of the passion and crucifixion of Christ. Each of the two panels in the diptych had four scenes.

Separately, a rare 1950s Patek Philippe timepiece is coming up for sale in a Christie’s auction in Hong Kong that risks taking place against the backdrop of the political demonstrations that have hit sales of new watches.

The 18-carat pink gold Patek Philippe has a rare translucent blue enamel dial and is known by the name of the 177-year-old Milan-based shop where it was sold, Gobbi.

The estimate is US$7 million to US$14 million, which Christie’s said is the highest for any wristwatch offered in an auction.

The sale is scheduled for Nov. 27, and it continues a trend in which auctioneers increasingly offer prestigious lots in Asia, to tap demand by collectors in China, the world’s largest market for Swiss watches.

Christie’s yesterday showed the timepiece along with other lots to journalists in Hong Kong to drum up interest.

Additional reporting by Bloomberg

SEEKING CLARITY: Washington should not adopt measures that create uncertainties for ‘existing semiconductor investments,’ TSMC said referring to its US$165 billion in the US Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) told the US that any future tariffs on Taiwanese semiconductors could reduce demand for chips and derail its pledge to increase its investment in Arizona. “New import restrictions could jeopardize current US leadership in the competitive technology industry and create uncertainties for many committed semiconductor capital projects in the US, including TSMC Arizona’s significant investment plan in Phoenix,” the chipmaker wrote in a letter to the US Department of Commerce. TSMC issued the warning in response to a solicitation for comments by the department on a possible tariff on semiconductor imports by US President Donald Trump’s

The government has launched a three-pronged strategy to attract local and international talent, aiming to position Taiwan as a new global hub following Nvidia Corp’s announcement that it has chosen Taipei as the site of its Taiwan headquarters. Nvidia cofounder and CEO Jensen Huang (黃仁勳) on Monday last week announced during his keynote speech at the Computex trade show in Taipei that the Nvidia Constellation, the company’s planned Taiwan headquarters, would be located in the Beitou-Shilin Technology Park (北投士林科技園區) in Taipei. Huang’s decision to establish a base in Taiwan is “primarily due to Taiwan’s talent pool and its strength in the semiconductor

Industrial production expanded 22.31 percent annually last month to 107.51, as increases in demand for high-performance computing (HPC) and artificial intelligence (AI) applications drove demand for locally-made chips and components. The manufacturing production index climbed 23.68 percent year-on-year to 108.37, marking the 14th consecutive month of increase, the Ministry of Economic Affairs said. In the first four months of this year, industrial and manufacturing production indices expanded 14.31 percent and 15.22 percent year-on-year, ministry data showed. The growth momentum is to extend into this month, with the manufacturing production index expected to rise between 11 percent and 15.1 percent annually, Department of Statistics

An earnings report from semiconductor giant and artificial intelligence (AI) bellwether Nvidia Corp takes center stage for Wall Street this week, as stocks hit a speed bump of worries over US federal deficits driving up Treasury yields. US equities pulled back last week after a torrid rally, as investors turned their attention to tax and spending legislation poised to swell the US government’s US$36 trillion in debt. Long-dated US Treasury yields rose amid the fiscal worries, with the 30-year yield topping 5 percent and hitting its highest level since late 2023. Stocks were dealt another blow on Friday when US President Donald