Mizuho Financial Group Inc will pursue a digital route if it decides to follow its Japanese competitors into retail banking in Asia’s fast-growing emerging markets, chief executive officer Tatsufumi Sakai said.

Japan’s third-largest banking group is more likely to either buy an online lender or build one from scratch itself, rather than acquire banks with physical branches, Sakai said in an interview.

“We don’t intend to enter legacy consumer business at this point,” he said. “We’re more interested in a digital business model.”

Photo: Bloomberg

Japan’s biggest banks have made Asia their focus as persistently low interest rates and a sluggish economy hurt prospects at home.

Mizuho’s approach would mark a sharp contrast with Mitsubishi UFJ Financial Group Inc and Sumitomo Mitsui Financial Group Inc, which have spent billions of dollars acquiring traditional commercial lenders in Southeast Asia in recent years.

While Mizuho does not have any specific plans to get into retail banking in emerging Asia right now, the region has huge growth potential and a young population that is embracing digital technology for banking, Sakai said.

“The need for financial services will no doubt increase,” he said.

With the weakest capital ratio among the three Japanese banks, Mizuho has less room to make acquisitions of the scale that its rivals have achieved. At home, it is reducing its retail branch network and bolstering digital channels, according to a five-year business plan released last month.

Sakai, 59, also spoke of ambitions to expand transaction banking for corporate clients in Asia.

Handling more money transfers and cash flows for companies would allow the bank to boost its overseas deposits, providing a relatively cheap source of foreign-currency funding.

Mizuho and its rivals have been aggressively expanding overseas lending, which generates bigger margins than domestic loans.

“It’s important to secure as much as client deposit money as a stable funding source” to continue expanding lending abroad, Sakai said.

While there has been ample liquidity in the past three years, “we expect the funding environment will become tighter,” he said.

Sakai ruled out the idea of acquiring a US bank to expand Mizuho’s dollar deposits, given the costs of buying and integrating a local lender, along with regulatory issues.

Taiwan’s rapidly aging population is fueling a sharp increase in homes occupied solely by elderly people, a trend that is reshaping the nation’s housing market and social fabric, real-estate brokers said yesterday. About 850,000 residences were occupied by elderly people in the first quarter, including 655,000 that housed only one resident, the Ministry of the Interior said. The figures have nearly doubled from a decade earlier, Great Home Realty Co (大家房屋) said, as people aged 65 and older now make up 20.8 percent of the population. “The so-called silver tsunami represents more than just a demographic shift — it could fundamentally redefine the

The US government on Wednesday sanctioned more than two dozen companies in China, Turkey and the United Arab Emirates, including offshoots of a US chip firm, accusing the businesses of providing illicit support to Iran’s military or proxies. The US Department of Commerce included two subsidiaries of US-based chip distributor Arrow Electronics Inc (艾睿電子) on its so-called entity list published on the federal register for facilitating purchases by Iran’s proxies of US tech. Arrow spokesman John Hourigan said that the subsidiaries have been operating in full compliance with US export control regulations and his company is discussing with the US Bureau of

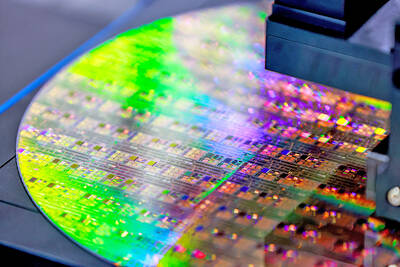

Businesses across the global semiconductor supply chain are bracing themselves for disruptions from an escalating trade war, after China imposed curbs on rare earth mineral exports and the US responded with additional tariffs and restrictions on software sales to the Asian nation. China’s restrictions, the most targeted move yet to limit supplies of rare earth materials, represent the first major attempt by Beijing to exercise long-arm jurisdiction over foreign companies to target the semiconductor industry, threatening to stall the chips powering the artificial intelligence (AI) boom. They prompted US President Donald Trump on Friday to announce that he would impose an additional

China Airlines Ltd (CAL, 中華航空) said it expects peak season effects in the fourth quarter to continue to boost demand for passenger flights and cargo services, after reporting its second-highest-ever September sales on Monday. The carrier said it posted NT$15.88 billion (US$517 million) in consolidated sales last month, trailing only September last year’s NT$16.01 billion. Last month, CAL generated NT$8.77 billion from its passenger flights and NT$5.37 billion from cargo services, it said. In the first nine months of this year, the carrier posted NT$154.93 billion in cumulative sales, up 2.62 percent from a year earlier, marking the second-highest level for the January-September