European shares on Friday rose, but settled slightly below session highs after lawmakers rejected British Prime Minister Theresa May’s deal to exit the EU for the third time, increasing the possibility of a “no deal” or prolonged Brexit.

The pan-European STOXX 600 on Friday closed up 2.24 points, or 0.6 percent, at 379.08, having earlier hit session highs on encouraging signals from US-China trade talks. That was a 0.8 percent rise from a close of 376.03 on March 22.

The benchmark clocked its best quarter in four years, although gains this month were lower than in the previous two months as a bruising trade war, which contributed to a slowdown in global growth, and the chaos around Brexit hit sentiment.

All subsectors within the pan-regional benchmark ended the quarter higher, led by the retail sector’s 20 percent surge over the past three months.

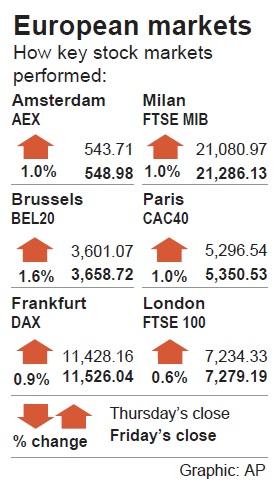

France’s CAC 40 on Friday outperformed with a gain of 53.99 points, or 1 percent, to 5,350.53, jumping 1.5 percent from a close of 5,269.92 on March 22.

Germany’s trade-sensitive DAX on Friday rose 97.88 points, or 0.9 percent, to 11,526.04, a gain of 1.4 percent from 11,364.17 a week earlier.

Britain’s exporter-heavy FTSE 100 was on Friday up 44.86 points, or 0.6 percent, at 7,279.19, rising 1 percent from a close of 7,207.59 on March 22.

Stocks in Dublin — a barometer for Brexit sentiment — closed 1.5 percent higher, posting their best day in almost two months.

Britain now has until April 12 to convince the other 27 EU capitals that it has an alternative path out of the impasse or see itself cast out of the bloc with no deal on post-Brexit ties with its largest trading ally.

Swedish-based apparel retailer Hennes & Mauritz AB was among the top gainers on the STOXX 600, up 9.5 percent after reporting a smaller-than-expected drop in quarterly pretax profit.

The European labor market is robust and personal income gains are boosting retail sales, ING Groep NV economist Bert Colijn said.

The retail sector logged its best quarter since the second quarter of 2003, and while banks posted the second smallest sectoral gain, they broke a five-quarter losing run.

Stocks also got a boost from reports that US Secretary of the Treasury Steven Mnuchin had a productive working dinner in Beijing as US-China trade talks ended.

Any move toward a deal would be positive for European markets, Colijn said, as the slowdown in China and the US has had an impact on exports from Europe.

Additional reporting by staff writer

SEEKING CLARITY: Washington should not adopt measures that create uncertainties for ‘existing semiconductor investments,’ TSMC said referring to its US$165 billion in the US Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) told the US that any future tariffs on Taiwanese semiconductors could reduce demand for chips and derail its pledge to increase its investment in Arizona. “New import restrictions could jeopardize current US leadership in the competitive technology industry and create uncertainties for many committed semiconductor capital projects in the US, including TSMC Arizona’s significant investment plan in Phoenix,” the chipmaker wrote in a letter to the US Department of Commerce. TSMC issued the warning in response to a solicitation for comments by the department on a possible tariff on semiconductor imports by US President Donald Trump’s

The government has launched a three-pronged strategy to attract local and international talent, aiming to position Taiwan as a new global hub following Nvidia Corp’s announcement that it has chosen Taipei as the site of its Taiwan headquarters. Nvidia cofounder and CEO Jensen Huang (黃仁勳) on Monday last week announced during his keynote speech at the Computex trade show in Taipei that the Nvidia Constellation, the company’s planned Taiwan headquarters, would be located in the Beitou-Shilin Technology Park (北投士林科技園區) in Taipei. Huang’s decision to establish a base in Taiwan is “primarily due to Taiwan’s talent pool and its strength in the semiconductor

Industrial production expanded 22.31 percent annually last month to 107.51, as increases in demand for high-performance computing (HPC) and artificial intelligence (AI) applications drove demand for locally-made chips and components. The manufacturing production index climbed 23.68 percent year-on-year to 108.37, marking the 14th consecutive month of increase, the Ministry of Economic Affairs said. In the first four months of this year, industrial and manufacturing production indices expanded 14.31 percent and 15.22 percent year-on-year, ministry data showed. The growth momentum is to extend into this month, with the manufacturing production index expected to rise between 11 percent and 15.1 percent annually, Department of Statistics

An earnings report from semiconductor giant and artificial intelligence (AI) bellwether Nvidia Corp takes center stage for Wall Street this week, as stocks hit a speed bump of worries over US federal deficits driving up Treasury yields. US equities pulled back last week after a torrid rally, as investors turned their attention to tax and spending legislation poised to swell the US government’s US$36 trillion in debt. Long-dated US Treasury yields rose amid the fiscal worries, with the 30-year yield topping 5 percent and hitting its highest level since late 2023. Stocks were dealt another blow on Friday when US President Donald