Pinterest Inc, the online visual discovery platform with an estimated 250 million users, filed for a public share offering on Friday, the latest of the big venture-backed start-ups to hit Wall Street.

The San Francisco-based bulletin board that connects people with interests including food, fashion, travel and lifestyle said it would trade under the symbol PINS on the New York Stock Exchange.

“Pinterest is where more than 250 million people around the world go to get inspiration for their lives,” the company said in its filing with the US Securities and Exchange Commission, which is expected to seek a valuation of about US$12 billion.

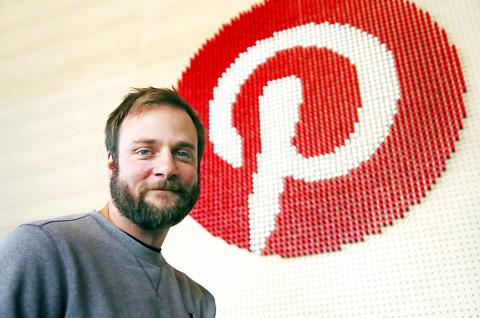

Photo: AP

“They come to discover ideas for just about anything you can imagine: daily activities like cooking dinner or deciding what to wear, major commitments like remodeling a house or training for a marathon, ongoing passions like fly fishing or fashion and milestone events like planning a wedding or a dream vacation,” it said.

Documents for the initial public offering (IPO) showed Pinterest lost US$63 million last year on revenue of US$755.9 million. That compared with a loss of US$130 million on US$473 million in 2017 revenue.

Launched in 2010, Pinterest brings in money from its role in online shopping and from advertising.

It becomes the latest of the richly valued tech start-ups worth more than US$1 billion, sometimes called “unicorns,” to hit Wall Street. Ride-hailing giant Lyft Inc is expected to begin trading next week and rival Uber Technologies Inc is likely to announce terms of its IPO soon.

Details of the Pinterest offering were absent, with a temporary placeholder sum of US$100 million to be raised, an amount likely to rise substantially.

Like several other start-ups, Pinterest will use a dual-class share structure that enables the founders, including chief executive officer Ben Silbermann, to retain control.

Research firm eMarketer expects Pinterest’s global ad revenue to hit US$1 billion this year, making up just 0.3 percent of the total digital ad spend.

Pinterest said in the filing that “substantially all” of its revenue comes from ads.

Risk factors cited by Pinterest included competitors mimicking its products well enough to lure away users.

The company also warned potential investors that while a Comscore study indicated that its US audience is 43 percent of Internet users, including about 80 percent of adult women with children, it will need to penetrate other demographics such as men and international users for growth.

Laws regarding data privacy or removing content could also hamper the online bulletin board, the filing said.

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), the world’s biggest contract chipmaker, booked its first-ever profit from its Arizona subsidiary in the first half of this year, four years after operations began, a company financial statement showed. Wholly owned by TSMC, the Arizona unit contributed NT$4.52 billion (US$150.1 million) in net profit, compared with a loss of NT$4.34 billion a year earlier, the statement showed. The company attributed the turnaround to strong market demand and high factory utilization. The Arizona unit counts Apple Inc, Nvidia Corp and Advanced Micro Devices Inc among its major customers. The firm’s first fab in Arizona began high-volume production

VOTE OF CONFIDENCE: The Japanese company is adding Intel to an investment portfolio that includes artificial intelligence linchpins Nvidia Corp and TSMC Softbank Group Corp agreed to buy US$2 billion of Intel Corp stock, a surprise deal to shore up a struggling US name while boosting its own chip ambitions. The Japanese company, which is adding Intel to an investment portfolio that includes artificial intelligence (AI) linchpins Nvidia Corp and Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), is to pay US$23 a share — a small discount to Intel’s last close. Shares of the US chipmaker, which would issue new stock to Softbank, surged more than 5 percent in after-hours trading. Softbank’s stock fell as much as 5.4 percent on Tuesday in Tokyo, its

COLLABORATION: Softbank would supply manufacturing gear to the factory, and a joint venture would make AI data center equipment, Young Liu said Hon Hai Precision Industry Co (鴻海精密) would operate a US factory owned by Softbank Group Corp, setting up what is in the running to be the first manufacturing site in the Japanese company’s US$500 billion Stargate venture with OpenAI and Oracle Corp. Softbank is acquiring Hon Hai’s electric-vehicle plant in Ohio, but the Taiwanese company would continue to run the complex after turning it into an artificial intelligence (AI) server production plant, Hon Hai chairman Young Liu (劉揚偉) said yesterday. Softbank would supply manufacturing gear to the factory, and a joint venture between the two companies would make AI data

The Taiwan Automation Intelligence and Robot Show, which is to be held from Wednesday to Saturday at the Taipei Nangang Exhibition Center, would showcase the latest in artificial intelligence (AI)-driven robotics and automation technologies, the organizer said yesterday. The event would highlight applications in smart manufacturing, as well as information and communications technology, the Taiwan Automation Intelligence and Robotics Association said. More than 1,000 companies are to display innovations in semiconductors, electromechanics, industrial automation and intelligent manufacturing, it said in a news release. Visitors can explore automated guided vehicles, 3D machine vision systems and AI-powered applications at the show, along