European shares on Friday hit their highest level in nearly two months as investors flocked to technology stocks after positive US earnings overnight, while news of slowing revenue growth from Vodafone Group PLC weighed on telecoms.

The pan-European STOXX 600 rose 0.6 percent to post its fourth straight weekly gain, up 0.2 percent.

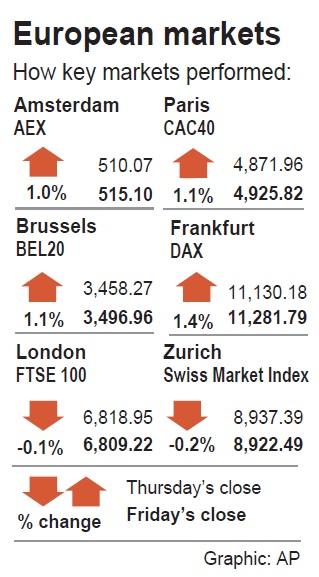

Frankfurt’s DAX was the top performer, while Britain’s exporter-heavy FTSE 100 underperformed as a stronger sterling weighed.

Exuberance for tech stocks continued even after Intel Corp delivered a profit and sales warning after the closing bell, blaming a slowdown in China and sluggish demand for its data center and modem chips.

The sector hit its highest level since Nov. 11 last year.

Investors instead drew comfort from better-than-expected earnings from other US chipmakers earlier in the session: Xilinx Inc, Lam Research Corp and Texas Instruments Inc.

The sector has been hit hard by fears about stagnating smartphone demand and a cooling Chinese economy after sales warnings from Apple, Samsung and Taiwan Semiconductor Manufacturing Co (台積電) earlier this month.

This week, though, investors have pounced every morsel of good news — chipmaker STMicro’s gloomy near-term guidance was ignored on Thursday in favor of its outlook for a strong second half.

“So much of the bad is priced in,” Accendo Markets analyst Mike van Dulken said.

The market was also bracing for key events next week.

The US Federal Reserve’s meeting on Wednesday would be closely watched for signs that the US central bank will delay its steady rate-hike cycle, while Washington and Beijing are to hold the next round of talks aimed at ending their festering trade spat.

The negotiations come as a March 1 deadline to resolve the dispute looms.

However, the chances of a truce are low, with both sides divided over major issues like China’s protection of its intellectual property.

“We’ve got a month until the deadline and it’s probably going to go down to the wire. The markets will be up and down until then on the soundbites from both sides,” Van Dulken said.

On Friday, a key German business morale indicator fell for the fifth straight month this month, while the European Central Bank’s (ECB) survey of professional forecasters pointed to sharply lower growth and inflation.

ECB President Mario Draghi on Thursday said that a dip in the 19-member eurozone’s economy could be deeper and longer than thought even a few weeks ago.

Automakers and parts suppliers, which are sensitive to trade frictions and the health of the Chinese economy, were the strongest performers, hitting Dec. 3 highs.

Mining and oil stocks also gained.

Telecoms were one of only two sectors in the red after disappointing results from Vodafone and Nordic telecom group Telia AB.

Vodafone was down 2.3 percent, hitting its lowest in nearly nine years after the world’s second-largest mobile operator said revenue growth slowed in the third quarter of last year due to ongoing price competition in Spain and Italy and a slowdown in South Africa.

The stock was knocked hard on Thursday after its South African unit issued disappointing results.

Telia was down 3.5 percent, at the bottom of the STOXX 600 after its weaker-than-expected results.

SEEKING CLARITY: Washington should not adopt measures that create uncertainties for ‘existing semiconductor investments,’ TSMC said referring to its US$165 billion in the US Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) told the US that any future tariffs on Taiwanese semiconductors could reduce demand for chips and derail its pledge to increase its investment in Arizona. “New import restrictions could jeopardize current US leadership in the competitive technology industry and create uncertainties for many committed semiconductor capital projects in the US, including TSMC Arizona’s significant investment plan in Phoenix,” the chipmaker wrote in a letter to the US Department of Commerce. TSMC issued the warning in response to a solicitation for comments by the department on a possible tariff on semiconductor imports by US President Donald Trump’s

The government has launched a three-pronged strategy to attract local and international talent, aiming to position Taiwan as a new global hub following Nvidia Corp’s announcement that it has chosen Taipei as the site of its Taiwan headquarters. Nvidia cofounder and CEO Jensen Huang (黃仁勳) on Monday last week announced during his keynote speech at the Computex trade show in Taipei that the Nvidia Constellation, the company’s planned Taiwan headquarters, would be located in the Beitou-Shilin Technology Park (北投士林科技園區) in Taipei. Huang’s decision to establish a base in Taiwan is “primarily due to Taiwan’s talent pool and its strength in the semiconductor

Industrial production expanded 22.31 percent annually last month to 107.51, as increases in demand for high-performance computing (HPC) and artificial intelligence (AI) applications drove demand for locally-made chips and components. The manufacturing production index climbed 23.68 percent year-on-year to 108.37, marking the 14th consecutive month of increase, the Ministry of Economic Affairs said. In the first four months of this year, industrial and manufacturing production indices expanded 14.31 percent and 15.22 percent year-on-year, ministry data showed. The growth momentum is to extend into this month, with the manufacturing production index expected to rise between 11 percent and 15.1 percent annually, Department of Statistics

An earnings report from semiconductor giant and artificial intelligence (AI) bellwether Nvidia Corp takes center stage for Wall Street this week, as stocks hit a speed bump of worries over US federal deficits driving up Treasury yields. US equities pulled back last week after a torrid rally, as investors turned their attention to tax and spending legislation poised to swell the US government’s US$36 trillion in debt. Long-dated US Treasury yields rose amid the fiscal worries, with the 30-year yield topping 5 percent and hitting its highest level since late 2023. Stocks were dealt another blow on Friday when US President Donald