Plans by Italy’s new populist government to loosen the budgetary belt a few notches roiled markets in Europe.

With the spending plans putting the Italian government on a collission course with the European Commission, Milan took the brunt of the blow in equity markets, dropping by more than 4.6 percent at one point on Friday. s

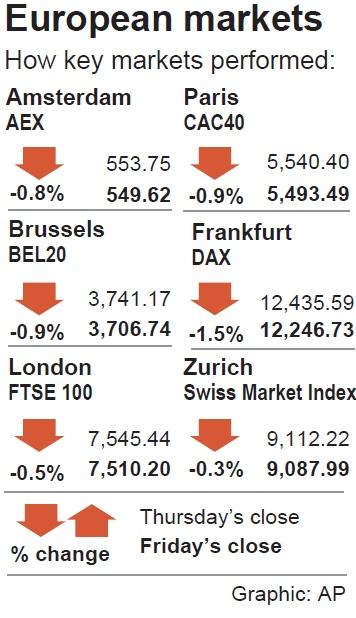

The Euro zone STOXX 50 index on Friday lost 1.4 percent to hit 3,399.2, a drop of 0.9 percent for the week, while the STOXX 600 was down 0.8 percent, sitting at 383.18 at the close, a 0.3 percent decline for the week

Thursday’s budget deal that calls for a 2.4 percent deficit for the next three years came after warnings from the EU to rein in spending, and vastly exceeds the 0.8 percent deficit foreseen by the previous, centre-left government.

“The Italian budget continued to cast a shadow over the markets on Friday, setting up a rocky end to a rocky month,” said Connor Campbell, financial analyst at Spreadex trading group.

“Investors are distancing themselves from Italian bonds and stocks, and risk-off sentiment is spreading across Europe,” said David Madden, a market analyst at CMC Markets in the UK.

“The severe sell-off in European financial stocks is reminiscent of the eurozone debt crisis,” he added.

The trading of shares in some Italian banks was briefly suspended amid heavy price falls, with Banco BPM leading the way down with a drop of 9.4 percent.

The top two Italian banks, UniCredit and Intesa Sanpaolo, lost 6.7 and 8.3 percent respectively.

Insulated from concerns over Italy and the euro zone, the top UK index ended the month with a 1 percent gain, but was down 1.6 percent on the quarter after three months of turmoil in Brexit negotiations.

The FTSE 100 on Friday fell 0.5 percent to 7,510.2, a 0.3 percent increase for the week.

Meta Platforms Inc offered US$100 million bonuses to OpenAI employees in an unsuccessful bid to poach the ChatGPT maker’s talent and strengthen its own generative artificial intelligence (AI) teams, OpenAI CEO Sam Altman has said. Facebook’s parent company — a competitor of OpenAI — also offered “giant” annual salaries exceeding US$100 million to OpenAI staffers, Altman said in an interview on the Uncapped with Jack Altman podcast released on Tuesday. “It is crazy,” Sam Altman told his brother Jack in the interview. “I’m really happy that at least so far none of our best people have decided to take them

BYPASSING CHINA TARIFFS: In the first five months of this year, Foxconn sent US$4.4bn of iPhones to the US from India, compared with US$3.7bn in the whole of last year Nearly all the iPhones exported by Foxconn Technology Group (富士康科技集團) from India went to the US between March and last month, customs data showed, far above last year’s average of 50 percent and a clear sign of Apple Inc’s efforts to bypass high US tariffs imposed on China. The numbers, being reported by Reuters for the first time, show that Apple has realigned its India exports to almost exclusively serve the US market, when previously the devices were more widely distributed to nations including the Netherlands and the Czech Republic. During March to last month, Foxconn, known as Hon Hai Precision Industry

PLANS: MSI is also planning to upgrade its service center in the Netherlands Micro-Star International Co (MSI, 微星) yesterday said it plans to set up a server assembly line at its Poland service center this year at the earliest. The computer and peripherals manufacturer expects that the new server assembly line would shorten transportation times in shipments to European countries, a company spokesperson told the Taipei Times by telephone. MSI manufactures motherboards, graphics cards, notebook computers, servers, optical storage devices and communication devices. The company operates plants in Taiwan and China, and runs a global network of service centers. The company is also considering upgrading its service center in the Netherlands into a

Taiwan’s property market is entering a freeze, with mortgage activity across the nation’s six largest cities plummeting in the first quarter, H&B Realty Co (住商不動產) said yesterday, citing mounting pressure on housing demand amid tighter lending rules and regulatory curbs. Mortgage applications in Taipei, New Taipei City, Taoyuan, Taichung, Tainan and Kaohsiung totaled 28,078 from January to March, a sharp 36.3 percent decline from 44,082 in the same period last year, the nation’s largest real-estate brokerage by franchise said, citing data from the Joint Credit Information Center (JCIC, 聯徵中心). “The simultaneous decline across all six cities reflects just how drastically the market