BMW AG stands to become the first foreign car manufacturer to own a majority in a Chinese joint venture (JV), showing Beijing is following through on a pledge to increasingly open up the economy to global corporations.

BMW plans to unveil the new ownership structure in its joint venture with Brilliance China Automotive Holdings Ltd (華晨中國汽車控股) soon, a person familiar with the plan said.

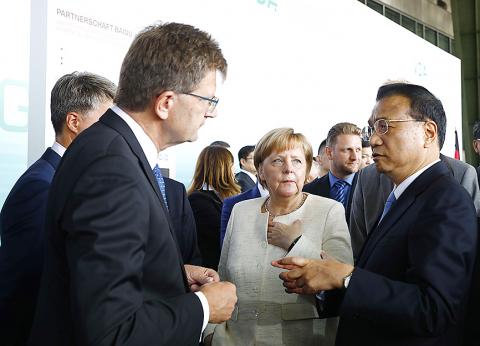

BMW now holds 50 percent of the venture. CEO Harald Krueger was in Berlin at the start of the week during a summit between Chinese Prime Minister Li Keqiang (李克強) and German Chancellor Angela Merkel.

Photo: EPA

Among discussions were opportunities to open up China to more foreign investment. As part of corporate deals signed at the meeting, chemicals company BASF SE agreed to invest as much as US$10 billion in a new factory in China that it would wholly own, also a first for that industry.

BMW declined to comment on the state of its discussions with Brilliance.

The German firm is set to boost its stake in the venture to at least 75 percent, Manager Magazin reported earlier.

Brilliance now owns 40.5 percent of the venture.

Owning a larger slice of BMW Brilliance Automotive would come at an opportune time for BMW. The company is heavily reliant on output from its factory in the US, where BMW makes sports utility vehicles (SUV) for the global market.

That strategy risks coming under strain as a trade war between the US and China starts escalating, potentially raising the prices of vehicles exported from the US.

Daimler AG issued a profit warning a few weeks ago, citing the risk of falling demand from Chinese consumers for US-made SUVs.

Companies such as Volkswagen AG, General Motors Co, Ford Motor Co and Toyota Motor Corp also work with local partners in China.

A move by BMW would follow plans outlined by China in April to ease foreign-ownership restrictions in the country, with the possibility that foreign automakers could eventually buy out their local partners.

Global companies have for decades sought better access to the Chinese car market, now the world’s largest.

China in April said it is scrapping the current 50 percent ownership cap for electric-car ventures as soon as this year.

The cap for commercial vehicles is to be eliminated in 2020 and the one for passenger vehicles is to end in 2022.

The Chinese Ministry of Foreign Affairs on Tuesday said in a statement that China and Germany “for the first time reached the agreement on increasing the share of German automobile companies in the jointly invested projects in China.”

BMW this week said it signed an agreement with Brilliance to expand their joint venture BMW Brilliance Automotive. The pact was one of dozens signed by German and Chinese companies during Li’s visit to Germany.

The remaining 9.5 percent of BMW and Brilliance’s venture is held by Shenyang City.

DIVIDED VIEWS: Although the Fed agreed on holding rates steady, some officials see no rate cuts for this year, while 10 policymakers foresee two or more cuts There are a lot of unknowns about the outlook for the economy and interest rates, but US Federal Reserve Chair Jerome Powell signaled at least one thing seems certain: Higher prices are coming. Fed policymakers voted unanimously to hold interest rates steady at a range of 4.25 percent to 4.50 percent for a fourth straight meeting on Wednesday, as they await clarity on whether tariffs would leave a one-time or more lasting mark on inflation. Powell said it is still unclear how much of the bill would fall on the shoulders of consumers, but he expects to learn more about tariffs

NOT JUSTIFIED: The bank’s governor said there would only be a rate cut if inflation falls below 1.5% and economic conditions deteriorate, which have not been detected The central bank yesterday kept its key interest rates unchanged for a fifth consecutive quarter, aligning with market expectations, while slightly lowering its inflation outlook amid signs of cooling price pressures. The move came after the US Federal Reserve held rates steady overnight, despite pressure from US President Donald Trump to cut borrowing costs. Central bank board members unanimously voted to maintain the discount rate at 2 percent, the secured loan rate at 2.375 percent and the overnight lending rate at 4.25 percent. “We consider the policy decision appropriate, although it suggests tightening leaning after factoring in slackening inflation and stable GDP growth,”

Meta Platforms Inc offered US$100 million bonuses to OpenAI employees in an unsuccessful bid to poach the ChatGPT maker’s talent and strengthen its own generative artificial intelligence (AI) teams, OpenAI CEO Sam Altman has said. Facebook’s parent company — a competitor of OpenAI — also offered “giant” annual salaries exceeding US$100 million to OpenAI staffers, Altman said in an interview on the Uncapped with Jack Altman podcast released on Tuesday. “It is crazy,” Sam Altman told his brother Jack in the interview. “I’m really happy that at least so far none of our best people have decided to take them

PLANS: MSI is also planning to upgrade its service center in the Netherlands Micro-Star International Co (MSI, 微星) yesterday said it plans to set up a server assembly line at its Poland service center this year at the earliest. The computer and peripherals manufacturer expects that the new server assembly line would shorten transportation times in shipments to European countries, a company spokesperson told the Taipei Times by telephone. MSI manufactures motherboards, graphics cards, notebook computers, servers, optical storage devices and communication devices. The company operates plants in Taiwan and China, and runs a global network of service centers. The company is also considering upgrading its service center in the Netherlands into a