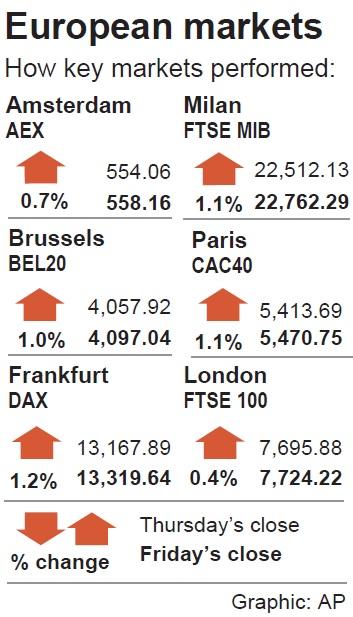

This year’s global equity rally continued apace on Friday, with European markets posting healthy gains.

“After a soft start to the New Year, the bulls have come charging back for European equities with the large gains seen in recent sessions,” XTB chief market analyst David Cheetham said.

All main European markets were higher at the close on Friday, with standout Frankfurt clocking up a gain of just less than 1.2 percent to close at 13,319.64, ending up 3.1 percent from 12,917.64 a week earlier, despite a share price plunge for heavyweight Deutsche Bank AG after a profit warning.

Paris followed not far behind with a 1.1 percent rise.

London on Friday hit a new intraday record peak at 7,727.73 points, and also set a new closing high of 7,724.22, a daily increase of 0.4 percent and a rise of 0.5 percent from a close of 7,687.77 on Dec. 29 last year, buoyed by the weak pound, which lifted the share prices of multinationals.

The pan-European STOXX 600 on Friday rose 0.9 percent at 397.35, an increase of 2.1 percent from a close of 389.18 a week earlier.

Additional reporting by staff writer

Merida Industry Co (美利達) has seen signs of recovery in the US and European markets this year, as customers are gradually depleting their inventories, the bicycle maker told shareholders yesterday. Given robust growth in new orders at its Taiwanese factory, coupled with its subsidiaries’ improving performance, Merida said it remains confident about the bicycle market’s prospects and expects steady growth in its core business this year. CAUTION ON CHINA However, the company must handle the Chinese market with great caution, as sales of road bikes there have declined significantly, affecting its revenue and profitability, Merida said in a statement, adding that it would

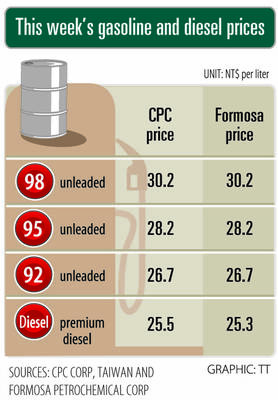

i Gasoline and diesel prices at fuel stations are this week to rise NT$0.1 per liter, as tensions in the Middle East pushed crude oil prices higher last week, CPC Corp, Taiwan (台灣中油) and Formosa Petrochemical Corp (台塑石化) said yesterday. International crude oil prices last week rose for the third consecutive week due to an escalating conflict between Israel and Iran, as the market is concerned that the situation in the Middle East might affect crude oil supply, CPC and Formosa said in separate statements. Front-month Brent crude oil futures — the international oil benchmark — rose 3.75 percent to settle at US$77.01

RISING: Strong exports, and life insurance companies’ efforts to manage currency risks indicates the NT dollar would eventually pass the 29 level, an expert said The New Taiwan dollar yesterday rallied to its strongest in three years amid inflows to the nation’s stock market and broad-based weakness in the US dollar. Exporter sales of the US currency and a repatriation of funds from local asset managers also played a role, said two traders, who asked not to be identified as they were not authorized to speak publicly. State-owned banks were seen buying the greenback yesterday, but only at a moderate scale, the traders said. The local currency gained 0.77 percent, outperforming almost all of its Asian peers, to close at NT$29.165 per US dollar in Taipei trading yesterday. The

RECORD LOW: Global firms’ increased inventories, tariff disputes not yet impacting Taiwan and new graduates not yet entering the market contributed to the decrease Taiwan’s unemployment rate last month dropped to 3.3 percent, the lowest for the month in 25 years, as strong exports and resilient domestic demand boosted hiring across various sectors, the Directorate-General of Budget, Accounting and Statistics (DGBAS) said yesterday. After seasonal adjustments, the jobless rate eased to 3.34 percent, the best performance in 24 years, suggesting a stable labor market, although a mild increase is expected with the graduation season from this month through August, the statistics agency said. “Potential shocks from tariff disputes between the US and China have yet to affect Taiwan’s job market,” Census Department Deputy Director Tan Wen-ling