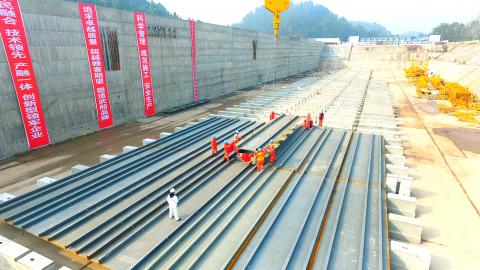

Construction of the world’s first full-size replica of the Titanic has begun in China, Xinhua news agency reported yesterday, where it is expected to enjoy smoother sailing as a lakeside tourist draw than its namesake.

The 269m-long, 28m-wide ship is to be docked permanently on a reservoir in a rural area of Sichuan Province, the report cited a senior executive at the shipbuilder as saying.

It is to feature an interior reproducing some of the grandeur of the original, including a ballroom, theater, swimming pool and first-class cabins, with the addition of Wi-Fi, Wuchang Shipbuilding Industry Group (武昌船舶重工集團) deputy general manager Wang Weiling (王渭齡) said.

Photo: Reuters

The supposedly unsinkable ocean liner, which struck an iceberg and went down in the north Atlantic in 1912, killing more than 1,500 people, is a subject of immense fascination for many in China.

Interest became particularly intense after the 1997 movie starring Kate Winslet and Leonardo DiCaprio, which was hugely popular in China. Director James Cameron had a 90 percent scale replica vessel built for filming purposes.

The new ship will be the centerpiece of a theme park hundreds of kilometers from China’s coast, bankrolled by Chinese energy company Seven Star Energy Investment Group (七星能源投資集團).

The company first announced plans for the 1 billion yuan (US$145.1 million) project in 2014.

The ship’s design is based on the original, and construction will involve assistance from US and British designers and technicians, Xinhua said.

Flamboyant Australian tycoon Clive Palmer in 2013 unveiled plans to build a replica of the Titanic that could actually take to sea and would seek to complete the original ship’s doomed Atlantic crossing, but that project has reportedly run aground amid funding difficulties.

Domestic tourism is booming in China, promoted by the government as a way of fueling consumer-driven growth rather than its decades-old model of investment and industry.

Theme parks are being built in the country faster than anywhere else in the world, with more than 300 projects reportedly funded in recent years.

SEEKING CLARITY: Washington should not adopt measures that create uncertainties for ‘existing semiconductor investments,’ TSMC said referring to its US$165 billion in the US Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) told the US that any future tariffs on Taiwanese semiconductors could reduce demand for chips and derail its pledge to increase its investment in Arizona. “New import restrictions could jeopardize current US leadership in the competitive technology industry and create uncertainties for many committed semiconductor capital projects in the US, including TSMC Arizona’s significant investment plan in Phoenix,” the chipmaker wrote in a letter to the US Department of Commerce. TSMC issued the warning in response to a solicitation for comments by the department on a possible tariff on semiconductor imports by US President Donald Trump’s

The government has launched a three-pronged strategy to attract local and international talent, aiming to position Taiwan as a new global hub following Nvidia Corp’s announcement that it has chosen Taipei as the site of its Taiwan headquarters. Nvidia cofounder and CEO Jensen Huang (黃仁勳) on Monday last week announced during his keynote speech at the Computex trade show in Taipei that the Nvidia Constellation, the company’s planned Taiwan headquarters, would be located in the Beitou-Shilin Technology Park (北投士林科技園區) in Taipei. Huang’s decision to establish a base in Taiwan is “primarily due to Taiwan’s talent pool and its strength in the semiconductor

Industrial production expanded 22.31 percent annually last month to 107.51, as increases in demand for high-performance computing (HPC) and artificial intelligence (AI) applications drove demand for locally-made chips and components. The manufacturing production index climbed 23.68 percent year-on-year to 108.37, marking the 14th consecutive month of increase, the Ministry of Economic Affairs said. In the first four months of this year, industrial and manufacturing production indices expanded 14.31 percent and 15.22 percent year-on-year, ministry data showed. The growth momentum is to extend into this month, with the manufacturing production index expected to rise between 11 percent and 15.1 percent annually, Department of Statistics

An earnings report from semiconductor giant and artificial intelligence (AI) bellwether Nvidia Corp takes center stage for Wall Street this week, as stocks hit a speed bump of worries over US federal deficits driving up Treasury yields. US equities pulled back last week after a torrid rally, as investors turned their attention to tax and spending legislation poised to swell the US government’s US$36 trillion in debt. Long-dated US Treasury yields rose amid the fiscal worries, with the 30-year yield topping 5 percent and hitting its highest level since late 2023. Stocks were dealt another blow on Friday when US President Donald