Takashimaya Co, a leading Japanese retailer, has decided to sell its stake in a jointly owned department store in Taipei to its partner as a way of withdrawing from the Taiwan retail market, the department store said yesterday.

Takashimaya is to sell its 50 percent stake in the Dayeh Takashimaya Department Store (大葉高島屋百貨) in Taipei’s Shilin District (士林) to Dayeh Group (大葉集團), which owns the other half.

The stake is to be sold at a price of NT$492 million (US$15.04 million), according to local media reports.

In 1994, Takashimaya and Dayeh teamed up to open the department store in the affluent Tianmu (天母) neighborhood, where many expatriates live.

The store once generated annual revenue of NT$5.8 billion, but has been encountering stiff competition in the Tianmu area since the Pacific Sogo Department Store (太平洋崇光百貨) and the Shin Kong Mitsukoshi Department Store (新光三越百貨) entered the market, analysts said.

In 2014, Takashimaya Dayeh spent NT$1.2 billion on a remodeling project, hoping that a new image would attract young consumers, but it has not been able to meet its goal of NT$5 billion in annual revenue.

Meanwhile, Pacific Sogo and Shin Kong Mitsukoshi have been increasing their share of business in Tianmu, which is estimated to be NT$10 billion a year.

Takashimaya Dayeh said that over the past 20 years, it has built a management team that largely comprises local talent, adding that the share sale is unlikely to affect its operations.

Dayeh Group is a Taiwanese conglomerate that has a wide range of businesses, including retail, restaurants, healthcare, car engine development and property development.

The withdrawal of Takashimaya from the department store business in Taipei follows a similar move in March by Japan-based Hankyu Hanshin Department Stores, which was a joint owner of the Uni-President Hankyu department stores (統一阪急百貨) in Taipei and Kaohsiung for about 10 years.

RECYCLE: Taiwan would aid manufacturers in refining rare earths from discarded appliances, which would fit the nation’s circular economy goals, minister Kung said Taiwan would work with the US and Japan on a proposed cooperation initiative in response to Beijing’s newly announced rare earth export curbs, Minister of Economic Affairs Kung Ming-hsin (龔明鑫) said yesterday. China last week announced new restrictions requiring companies to obtain export licenses if their products contain more than 0.1 percent of Chinese-origin rare earths by value. US Secretary of the Treasury Scott Bessent on Wednesday responded by saying that Beijing was “unreliable” in its rare earths exports, adding that the US would “neither be commanded, nor controlled” by China, several media outlets reported. Japanese Minister of Finance Katsunobu Kato yesterday also

Taiwan’s rapidly aging population is fueling a sharp increase in homes occupied solely by elderly people, a trend that is reshaping the nation’s housing market and social fabric, real-estate brokers said yesterday. About 850,000 residences were occupied by elderly people in the first quarter, including 655,000 that housed only one resident, the Ministry of the Interior said. The figures have nearly doubled from a decade earlier, Great Home Realty Co (大家房屋) said, as people aged 65 and older now make up 20.8 percent of the population. “The so-called silver tsunami represents more than just a demographic shift — it could fundamentally redefine the

China Airlines Ltd (CAL, 中華航空) said it expects peak season effects in the fourth quarter to continue to boost demand for passenger flights and cargo services, after reporting its second-highest-ever September sales on Monday. The carrier said it posted NT$15.88 billion (US$517 million) in consolidated sales last month, trailing only September last year’s NT$16.01 billion. Last month, CAL generated NT$8.77 billion from its passenger flights and NT$5.37 billion from cargo services, it said. In the first nine months of this year, the carrier posted NT$154.93 billion in cumulative sales, up 2.62 percent from a year earlier, marking the second-highest level for the January-September

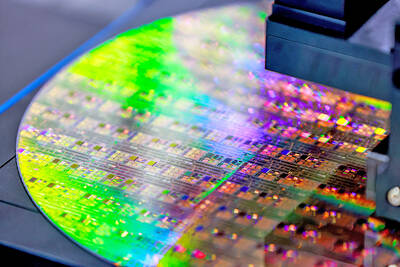

Businesses across the global semiconductor supply chain are bracing themselves for disruptions from an escalating trade war, after China imposed curbs on rare earth mineral exports and the US responded with additional tariffs and restrictions on software sales to the Asian nation. China’s restrictions, the most targeted move yet to limit supplies of rare earth materials, represent the first major attempt by Beijing to exercise long-arm jurisdiction over foreign companies to target the semiconductor industry, threatening to stall the chips powering the artificial intelligence (AI) boom. They prompted US President Donald Trump on Friday to announce that he would impose an additional