Asian stocks rose, with the regional benchmark index on course for its biggest quarterly advance since the first three months of 2012, after China’s central bank indicated that more stimulus is on the way.

“Asia has gotten off to a positive start to the week, with China leading the region,” said Stan Shamu, Melbourne-based market strategist at IG Ltd. “Comments by PBOC [People’s Bank of China Governor Zhou Xiaochuan (周小川)] from the weekend have set the tone for Chinese equities with stimulus expectations ramping up.”

The Shanghai Composite surged by 2.6 percent, extending its advance in the past 12 months to 86 percent. A gauge of China manufacturing slid to an 11-month low this month, a private report showed last week.

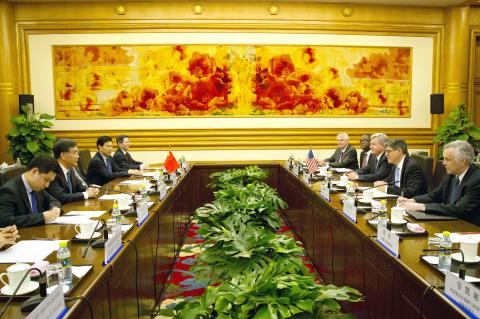

Photo: AFP

Economists surveyed by Bloomberg News expect the PBOC to lower benchmark lending rates and banks’ required reserve ratios, adding to cuts made in recent months.

Activity was guarded elsewhere in a week bounded by holidays in the US and a US jobs report that could affect the timing of interest rate hikes there.

The Hang Seng China Enterprises Index also added 3.5 percent after China allowed mainland mutual funds to buy Hong Kong stocks.

After some early dithering, Japan’s Nikkei firmed by 0.8 percent, helped by talk of demand for the new quarter and financial year.

MSCI’s broadest index of Asia-Pacific shares outside Japan recouped early losses to gain 0.4 percent. European bourses were expected to open firmer, while S&P E-mini stock futures were quoted up 0.4 percent.

US Federal Reserve Chair Janet Yellen on Friday reaffirmed that US rates would likely start rising later this year, but emphasized that the pace of tightening would be gradual and data-dependent.

The conditional outlook helped nudge longer-dated US Treasury yields lower and left the US dollar listless for the moment. It fetched ¥119.21 yesterday, a whisker higher than at the end of last week and short of the near eight-year peak of ¥122.04 set early this month.

The euro eased back to US$1.0861, having in the last two weeks pulled up from a 12-year trough of US$1.0457.

Oil prices fell further, as Iran and six world powers tried to reach a nuclear deal that could add more supply to the market if sanctions against Tehran are lifted.

US crude eased US$0.77 to US$48.10 a barrel and Brent lost US$0.42 to US$55.99.

The data diary in Asia was rather sparse, with Japan reporting a disappointing decline in industrial output for February.

Figures on German inflation, European confidence and US personal income and spending are due later in the session.

Flash inflation data for the eurozone are expected today and manufacturing surveys on China tomorrow. That should be just an appetizer for Friday’s US payrolls report.

Economists polled by Reuters are forecasting a healthy rise of 244,000 in non-farm payrolls this month. If confirmed, it would be the 13th straight month of job gains of more than 200,000, a run not seen since from 1994 to 1995.

The market reaction is expected to be complicated by holidays across much of the western world on Friday. Only some US markets will be open and then only for shortened hours.

Investors will again have to keep a wary eye on Greece and its talks with international creditors where the parties are struggling to come up with a list of acceptable reforms.

Greece is expected run out of money by April 20 if it does not secure funding from its European partners, a source familiar with the matter told reporters last week.

Meta Platforms Inc offered US$100 million bonuses to OpenAI employees in an unsuccessful bid to poach the ChatGPT maker’s talent and strengthen its own generative artificial intelligence (AI) teams, OpenAI CEO Sam Altman has said. Facebook’s parent company — a competitor of OpenAI — also offered “giant” annual salaries exceeding US$100 million to OpenAI staffers, Altman said in an interview on the Uncapped with Jack Altman podcast released on Tuesday. “It is crazy,” Sam Altman told his brother Jack in the interview. “I’m really happy that at least so far none of our best people have decided to take them

BYPASSING CHINA TARIFFS: In the first five months of this year, Foxconn sent US$4.4bn of iPhones to the US from India, compared with US$3.7bn in the whole of last year Nearly all the iPhones exported by Foxconn Technology Group (富士康科技集團) from India went to the US between March and last month, customs data showed, far above last year’s average of 50 percent and a clear sign of Apple Inc’s efforts to bypass high US tariffs imposed on China. The numbers, being reported by Reuters for the first time, show that Apple has realigned its India exports to almost exclusively serve the US market, when previously the devices were more widely distributed to nations including the Netherlands and the Czech Republic. During March to last month, Foxconn, known as Hon Hai Precision Industry

PLANS: MSI is also planning to upgrade its service center in the Netherlands Micro-Star International Co (MSI, 微星) yesterday said it plans to set up a server assembly line at its Poland service center this year at the earliest. The computer and peripherals manufacturer expects that the new server assembly line would shorten transportation times in shipments to European countries, a company spokesperson told the Taipei Times by telephone. MSI manufactures motherboards, graphics cards, notebook computers, servers, optical storage devices and communication devices. The company operates plants in Taiwan and China, and runs a global network of service centers. The company is also considering upgrading its service center in the Netherlands into a

Taiwan’s property market is entering a freeze, with mortgage activity across the nation’s six largest cities plummeting in the first quarter, H&B Realty Co (住商不動產) said yesterday, citing mounting pressure on housing demand amid tighter lending rules and regulatory curbs. Mortgage applications in Taipei, New Taipei City, Taoyuan, Taichung, Tainan and Kaohsiung totaled 28,078 from January to March, a sharp 36.3 percent decline from 44,082 in the same period last year, the nation’s largest real-estate brokerage by franchise said, citing data from the Joint Credit Information Center (JCIC, 聯徵中心). “The simultaneous decline across all six cities reflects just how drastically the market