Infineon Technologies AG, Germany’s largest chipmaker, has agreed to buy International Rectifier Corp for about US$3 billion in cash, adding to its power-management technology business.

Infineon is to pay US$40 per share for El Segundo, California-based International Rectifier in a deal approved by both companies’ boards, Infineon said on Wednesday.

That is 51 percent more than the stock’s closing price before the deal was announced. The acquisition is Infineon’s biggest, according to data compiled by Bloomberg.

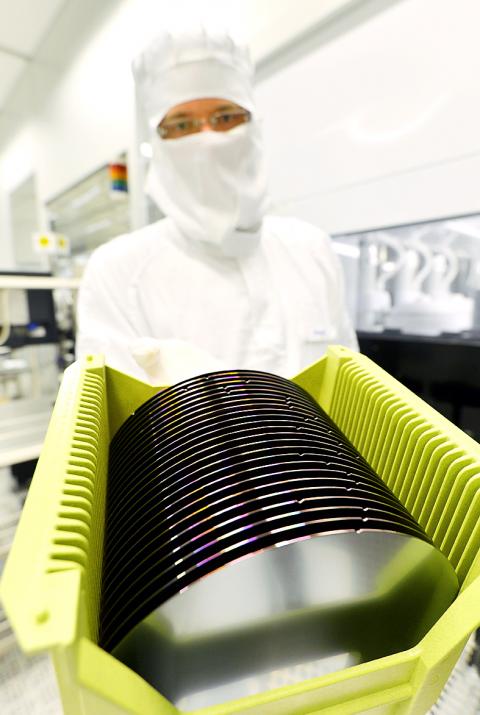

Photo: Bloomberg

Infineon chief executive Reinhard Ploss, seeking a deal since taking the job in 2012, is betting on rising demand for chips, such as those used in car electronics and to manage battery power in mobile devices. The deal also puts Infineon closer to the technology hub of Silicon Valley.

“It is very important for us to be in the US and close to the highly innovative region of California,” Ploss said on a conference call. “International Rectifier does that.”

International Rectifier makes chips that help manage power flow in devices including satellites, cars, lighting systems and aircraft. The company reported a 13 percent increase in revenue in the year ending June to US$1.11 billion and swung to a profit of US$58.7 million after reporting an US$88.8 million loss previously.

The deal is to be funded using cash and a 1.5 billion euro (US$2 billion) line of credit, and is to be accretive to pro-forma earnings per share in the fiscal year ending in September next year, Infineon said.

Infineon, based near Munich, expects to complete the purchase by early next year, subject to regulatory approval.

Infineon expects so-called sector profit at International Rectifier to catch up with its goal of 15 percent of earnings within two years of the deal’s completion, chief financial officer Dominik Asam said during a conference call with journalists, declining to specify what cost savings the integration of the company might generate.

Asam expects to cut jobs at International Rectifier, which has administrative costs that are 4 percent higher than Infineon’s relatively, he said.

There is also scope to manufacture some International Rectifier products at Infineon’s existing facilities, Asam said.

Infineon increased profit for the past four straight quarters and its net cash reached 2.1 billion euros at the end of June. In May, the chipmaker said it would raise its dividend as early as this fiscal year as advances in productivity curb the investment needed to achieve its target growth rate.

“They would like to build a stronger presence in power management,” Liberum Capital Ltd analyst Janardan Menon said.

The part of the industry Infineon is targeting has “high barriers to entry and strong growth prospects,” Menon said.

With this year’s Semicon Taiwan trade show set to kick off on Wednesday, market attention has turned to the mass production of advanced packaging technologies and capacity expansion in Taiwan and the US. With traditional scaling reaching physical limits, heterogeneous integration and packaging technologies have emerged as key solutions. Surging demand for artificial intelligence (AI), high-performance computing (HPC) and high-bandwidth memory (HBM) chips has put technologies such as chip-on-wafer-on-substrate (CoWoS), integrated fan-out (InFO), system on integrated chips (SoIC), 3D IC and fan-out panel-level packaging (FOPLP) at the center of semiconductor innovation, making them a major focus at this year’s trade show, according

DEBUT: The trade show is to feature 17 national pavilions, a new high for the event, including from Canada, Costa Rica, Lithuania, Sweden and Vietnam for the first time The Semicon Taiwan trade show, which opens on Wednesday, is expected to see a new high in the number of exhibitors and visitors from around the world, said its organizer, SEMI, which has described the annual event as the “Olympics of the semiconductor industry.” SEMI, which represents companies in the electronics manufacturing and design supply chain, and touts the annual exhibition as the most influential semiconductor trade show in the world, said more than 1,200 enterprises from 56 countries are to showcase their innovations across more than 4,100 booths, and that the event could attract 100,000 visitors. This year’s event features 17

Germany is to establish its first-ever national pavilion at Semicon Taiwan, which starts tomorrow in Taipei, as the country looks to raise its profile and deepen semiconductor ties with Taiwan as global chip demand accelerates. Martin Mayer, a semiconductor investment expert at Germany Trade & Invest (GTAI), Germany’s international economic promotion agency, said before leaving for Taiwan that the nation is a crucial partner in developing Germany’s semiconductor ecosystem. Germany’s debut at the international semiconductor exhibition in Taipei aims to “show presence” and signal its commitment to semiconductors, while building trust with Taiwanese companies, government and industry associations, he said. “The best outcome

Semiconductor equipment billings in Taiwan are expected to double this year, as manufacturers in the industry are keen to expand production to meet strong global demand for artificial intelligence applications, according to SEMI, which represents companies in the electronics manufacturing and design supply chain. Speaking at a news conference before the opening of Semicon Taiwan trade show tomorrow, SEMI director of industry research and statistics Clark Tseng (曾瑞榆) said semiconductor equipment billings in Taiwan are expected to grow by an annual 100 percent this year, beating an earlier estimate of 70 percent growth. He said that Taiwan received a boost from a