Studio prices in Taipei’s popular school districts have risen to a new high as Taiwanese parents seek to win residency qualifications for their children following the introduction of the 12-year compulsory education program, Taiwan Realty Co (台灣房屋) said yesterday.

Several pre-sale studio units in the city’s Daan District (大安) were traded at NT$1.6 million (US$53,000) per ping (3.3m2) in June, according to the government’s real-price transaction data released yesterday.

Studios that measure between 8.6 ping and 12.56 ping cost between NT$12.8 million and NT$20.5 million, data showed.

“Studios of such size are too small to house a family, but enable residents to win qualification for their children to go to schools in the vicinity,” Taiwan Realty spokeswoman Charlene Chang (張旭嵐) said.

Many students vie to study at Affiliated Senior High School of National Taiwan Normal University, known as HSNU, one of the highest-ranking high schools in Taiwan.

The competition to get into HSNU is fierce, as the High-School Entrance Exam scores of admitted students are typically among the top 3 percent in the country.

However, this year, many students won admission without the entrance exam thanks to the extension of compulsory education to 12 years from the previous nine, Chang said.

Taipei Mayor Hau Lung-bin (郝龍斌) promised to keep the exam-free admission ratio at more than 50 percent in the future, after parents and students called for reform in protests over the new entrance mechanism.

Concerns over school districts aside, studios in Daan District might benefit from capital gains, given their close proximity to Daan Forest Park and with the MRT Xinyi Line now in service, Chang said.

However, prominent owners of luxury homes are seeking to cash out as the government deepens credit controls and other tightening measures.

Fubon Financial Holding Co (富邦金控) chairman Daniel Tsai (蔡明忠) and his brother Richard Tsai (蔡明興) sold three luxury housing apartments in downtown Taipei in May, data showed.

Hsu Hsien-hsien (許嫺嫺), the wife of Shin Kong Financial Holding Co (新光金控) chairman Eugene Wu (吳東進), sold a luxury apartment in June.

Kwong Fong Industries Group (廣豐實業) chairman Ho Ming-yu (賀鳴玉) also sold an apartment unit in the Palace complex (帝寶) on Renai Road (仁愛路) according to government data.

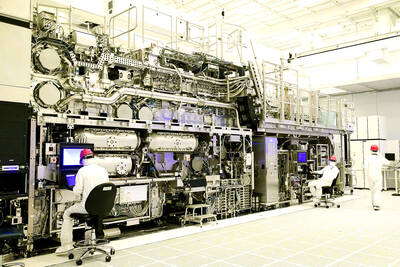

ASML Holding NV’s new advanced chip machines have a daunting price tag, said Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), one of the Dutch company’s biggest clients. “The cost is very high,” TSMC senior vice president Kevin Zhang (張曉強) said at a technology symposium in Amsterdam on Tuesday, referring to ASML’s latest system known as high-NA extreme ultraviolet (EUV). “I like the high-NA EUV’s capability, but I don’t like the sticker price,” Zhang said. ASML’s new chip machine can imprint semiconductors with lines that are just 8 nanometers thick — 1.7 times smaller than the previous generation. The machines cost 350 million euros (US$378 million)

Apple Inc has closed in on an agreement with OpenAI to use the start-up’s technology on the iPhone, part of a broader push to bring artificial intelligence (AI) features to its devices, people familiar with the matter said. The two sides have been finalizing terms for a pact to use ChatGPT features in Apple’s iOS 18, the next iPhone operating system, said the people, who asked not to be identified because the situation is private. Apple also has held talks with Alphabet Inc’s Google about licensing its Gemini chatbot. Those discussions have not led to an agreement, but are ongoing. An OpenAI

‘FULL SUPPORT’: Kumamoto Governor Takashi Kimura said he hopes more companies would settle in the prefecture to create an area similar to Taiwan’s Hsinchu Science Park The newly elected governor of Japan’s Kumamoto Prefecture said he is ready to ensure wide-ranging support to woo Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) to build its third Japanese chip factory there. Concerns of groundwater shortages when TSMC’s two plants begin operations in the prefecture’s Kikuyo have spurred discussions about the possibility of tapping unused dam water, Kumamoto Governor Takashi Kimura said in an interview on Saturday. While Kimura said talks about a third plant have yet to occur, Bloomberg had reported TSMC is already considering its third Japanese fab — also in Kumamoto — which would make more advanced chips. “We are

EXPLOSION: A driver who was transporting waste material from the site was hit by a blunt object after an uncontrolled pressure release and thrown 6m from the truck Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) said yesterday there was no damage to its facilities after an incident at its Arizona factory construction site where a waste disposal truck driver was transported to hospital. Firefighters responded to an explosion on Wednesday afternoon at the TSMC plant in Phoenix, the Arizona Republic reported, citing the local fire department. Cesar Anguiano-Guitron, 41, was transporting waste material from the project site and stopped to inspect the tank when he was made aware of a potential problem, a police report seen by Bloomberg News showed. Following an “uncontrolled pressure release,” he was hit by a blunt