Fubon Financial Holding Co (富邦金控), the nation’s second-largest financial services provider by assets, aims to boost its presence in China, using its banking branch in Hong Kong as a bargaining chip, company president Victor Kung (龔天行) said yesterday.

The group, which already owns a 20 percent stake in China’s Xiamen City Commercial Bank (廈門商銀), said it is also in strategic partnership talks to push its service network beyond the southeastern coastal province of Fujian.

“Our ambition in China goes beyond owning shares in Xiamen Bank,” Kung told an investors’ conference.

The most profitable financial conglomerate in Taiwan is mulling trading shares in its Hong Kong banking branch for easier and quicker access to the Chinese market, Kung said.

Toward that end, Fubon Financial in May tapped veteran banker Raymond Lee to head Fubon Bank in Hong Kong, which reported an increase of 17 percent year-on-year in first-half net profit to HK$200 million (US$25.8 million). Lee has more than 30 years of international banking experience at home and overseas, including yuan settlement and clearing businesses, Kung said.

“We deem the Hong Kong branch as a valuable asset and plan to use it as a bargaining chip to trade partnerships that would allow us to further tap into the Chinese market,” Kung said.

He added that branch has been actively pursued by Chinese financial institutions intent on gaining a foothold in the special administrative region.

In addition, Fubon Financial is in talks with a Chinese city-level lender for potential joint ventures through share investment or other channels, Kung said. He refused to name potential partners in either case.

Fubon Financial may benefit from an extra NT$8.46 billion (US$282.43 million) in cash dividends this year, after booking NT$691 million in the first half, company data showed.

With the eurozone mired in fiscal debt problems, the group intends to cut its hold-to-maturity portfolio and boost available-for-sale positions, adjustments that could boost the overall net worth by about NT$25 billion, Kung said.

The upcoming currency settlement agreement, likely to be signed next week with China, is a prerequisite, but not enough to make Taiwan a yuan offshore banking hub like Hong Kong, Kung said.

Authorities must also set up a real-time direct yuan clearing mechanism with China, he urged.

Kung confirmed tighter profitability stress ahead, as the Financial Supervisory Commission intends to raise general provision requirements to 1 percent next year, from the current 0.5 percent. The group’s loan provision stands at 0.6 percent, he said.

Nvidia Corp chief executive officer Jensen Huang (黃仁勳) on Monday introduced the company’s latest supercomputer platform, featuring six new chips made by Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), saying that it is now “in full production.” “If Vera Rubin is going to be in time for this year, it must be in production by now, and so, today I can tell you that Vera Rubin is in full production,” Huang said during his keynote speech at CES in Las Vegas. The rollout of six concurrent chips for Vera Rubin — the company’s next-generation artificial intelligence (AI) computing platform — marks a strategic

REVENUE PERFORMANCE: Cloud and network products, and electronic components saw strong increases, while smart consumer electronics and computing products fell Hon Hai Precision Industry Co (鴻海精密) yesterday posted 26.51 percent quarterly growth in revenue for last quarter to NT$2.6 trillion (US$82.44 billion), the strongest on record for the period and above expectations, but the company forecast a slight revenue dip this quarter due to seasonal factors. On an annual basis, revenue last quarter grew 22.07 percent, the company said. Analysts on average estimated about NT$2.4 trillion increase. Hon Hai, which assembles servers for Nvidia Corp and iPhones for Apple Inc, is expanding its capacity in the US, adding artificial intelligence (AI) server production in Wisconsin and Texas, where it operates established campuses. This

Garment maker Makalot Industrial Co (聚陽) yesterday reported lower-than-expected fourth-quarter revenue of NT$7.93 billion (US$251.44 million), down 9.48 percent from NT$8.76 billion a year earlier. On a quarterly basis, revenue fell 10.83 percent from NT$8.89 billion, company data showed. The figure was also lower than market expectations of NT$8.05 billion, according to data compiled by Yuanta Securities Investment and Consulting Co (元大投顧), which had projected NT$8.22 billion. Makalot’s revenue this quarter would likely increase by a mid-teens percentage as the industry is entering its high season, Yuanta said. Overall, Makalot’s revenue last year totaled NT$34.43 billion, down 3.08 percent from its record NT$35.52

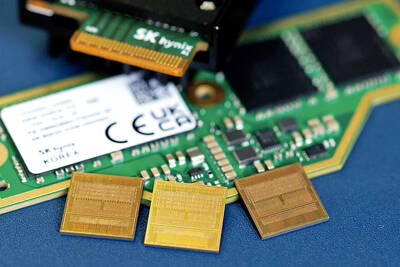

OPPORTUNITY: Supply of conventional DRAM chips tightened after the world’s major memory makers focused on manufacturing chips utilized in AI servers DRAM chipmaker Nanya Technology Corp (南亞科技) yesterday reported a spike in revenue for last month, as severe supply constraints prompted chip price hikes, almost doubling the company’s annual revenue last year from the previous year. Revenue soared 444.87 percent last month to NT$12.02 billion (US$381.4 million), from NT$2.21 billion a year earlier. That brought fourth-quarter revenue to NT$30.17 billion, from NT$6.58 billion for the same period in 2024. On a quarterly basis, revenue jumped 60.65 percent from NT$18.78 billion. Last year, revenue soared 95.09 percent to NT$66.59 billion from NT$32.13 billion in 2024, the company said. Supply of conventional DRAM