Three major Taiwanese banks yesterday signed a cooperation agreement with a Chinese state-controlled peer in the hope of taking advantage of its numerous branches to expedite expansion across the Taiwan Strait.

Cathay United Bank (國泰世華銀行), Mega International Commercial Bank (兆豐國際商銀), the banking units of Cathay Financial Holdings Co (國泰金控) and Mega Financial Holding Co (兆豐金控) respectively, as well as Taiwan Cooperative Bank (合作金庫銀行), signed separate memorandums of understanding (MOU) with Agricultural Bank of China (AgBank, 中國農業銀行) in Taipei to pave the way for cooperation in corporate lending, bancassurance, retail banking and personnel training.

AgBank chairman Xiang Junbo (項俊波) inked the agreements personally with his counterparts of the three Taiwanese lenders at each bank’s respective headquarters.

Cathay Bank expects the pact to facilitate its expansion in China because AgBank provides corporate and consumer banking, underwriting and other services through a massive network at 23,500 outlets throughout China, the lender said in a statement.

Mega Bank, which is waiting for approval from China to establish a branch in Suzhou, Jiangsu Province, expressed in a statement that the memorandum would help speed up its development in the market.

Taiwan Cooperative Bank, which has the largest number of branches throughout Taiwan, expects the agreement to serve as a foundation on which the two lenders can join hands and strengthen bilateral ties in the Greater China area.

AgBank is listed on the Shanghai Stock Exchange and the Hong Kong Stock Exchange and was ranked 141st on the global Fortune 500 list of companies last year.

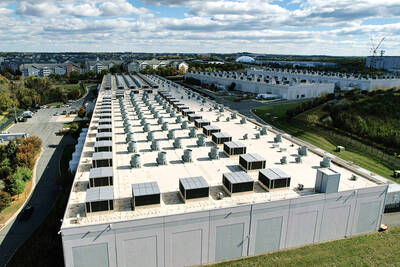

The demise of the coal industry left the US’ Appalachian region in tatters, with lost jobs, spoiled water and countless kilometers of abandoned underground mines. Now entrepreneurs are eyeing the rural region with ambitious visions to rebuild its economy by converting old mines into solar power systems and data centers that could help fuel the increasing power demands of the artificial intelligence (AI) boom. One such project is underway by a non-profit team calling itself Energy DELTA (Discovery, Education, Learning and Technology Accelerator) Lab, which is looking to develop energy sources on about 26,305 hectares of old coal land in

Taiwan’s exports soared 56 percent year-on-year to an all-time high of US$64.05 billion last month, propelled by surging global demand for artificial intelligence (AI), high-performance computing and cloud service infrastructure, the Ministry of Finance said yesterday. Department of Statistics Director-General Beatrice Tsai (蔡美娜) called the figure an unexpected upside surprise, citing a wave of technology orders from overseas customers alongside the usual year-end shopping season for technology products. Growth is likely to remain strong this month, she said, projecting a 40 percent to 45 percent expansion on an annual basis. The outperformance could prompt the Directorate-General of Budget, Accounting and

Netflix on Friday faced fierce criticism over its blockbuster deal to acquire Warner Bros Discovery. The streaming giant is already viewed as a pariah in some Hollywood circles, largely due to its reluctance to release content in theaters and its disruption of traditional industry practices. As Netflix emerged as the likely winning bidder for Warner Bros — the studio behind Casablanca, the Harry Potter movies and Friends — Hollywood’s elite launched an aggressive campaign against the acquisition. Titanic director James Cameron called the buyout a “disaster,” while a group of prominent producers are lobbying US Congress to oppose the deal,

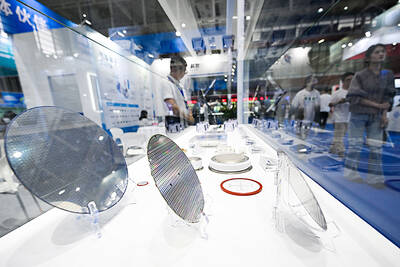

Two Chinese chipmakers are attracting strong retail investor demand, buoyed by industry peer Moore Threads Technology Co’s (摩爾線程) stellar debut. The retail portion of MetaX Integrated Circuits (Shanghai) Co’s (上海沐曦) upcoming initial public offering (IPO) was 2,986 times oversubscribed on Friday, according to a filing. Meanwhile, Beijing Onmicro Electronics Co (北京昂瑞微), which makes radio frequency chips, was 2,899 times oversubscribed on Friday, its filing showed. The bids coincided with Moore Threads’ trading debut, which surged 425 percent on Friday after raising 8 billion yuan (US$1.13 billion) on bets that the company could emerge as a viable local competitor to Nvidia