One-third of laptops fail within three years because of malfunctions or accidents, a study found, with notebooks from Asustek Computer Inc (華碩) and Toshiba Corp being the most reliable among surveyed brands. Those from Hewlett-Packard Co and Acer Inc (宏碁) were the least reliable, it said.

The failure rate for laptops within the first three years is 31 percent, US-based warranty provider SquareTrade said in its report, released last Monday.

“Given that the typical laptop endures more use and abuse than nearly any other consumer electronic device (with the possible exception of cell phones), it is not surprising to see such a high failure rate,” the report said.

PHOTO: BLOOMBERG

Keyboards, pointer devices, media drives and hard drives are all mechanical components that wear out under heavy use, while motherboard circuitry, memory and wireless devices are sensitive to heat and environmental factors, the report said.

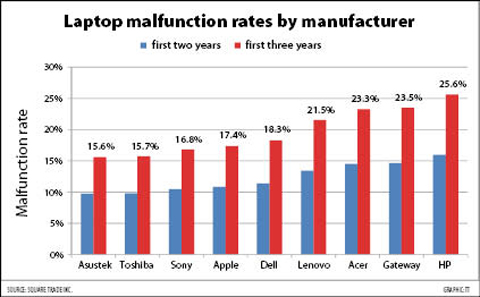

Broken down by brand, Asustek and Toshiba notebooks have malfunction rates under 16 percent — the lowest among the nine brands surveyed — while notebooks from Sony Corp and Apple Inc followed closely with malfunction rates of about 17 percent, it said.

By contrast, more than one-fourth of HP laptops malfunction within three years, the study found. Acer and its sub-brand Gateway, meanwhile, had malfunction rates of about 23 percent.

SquareTrade, which sells extended warranties for products bought in stores or online, said that malfunctions were 20 percent more frequent in netbooks — a more basic and cheaper version of the conventional notebooks — than in laptops after one year.

The study predicted that netbook malfunction rates are 25 percent for the first three years of use, compared with 21 percent for entry-level laptops and 18 percent for premium notebooks.

Acer questioned the results.

“We were surprised to learn that our [local] competitor [Asustek’s] rating was ahead of us,” a public relations official from Acer told the Taipei Times.

Both companies outsource notebook production to similar contract makers, she said, and producing larger quantities usually offers better yield rates because of higher quality control, meaning there should be fewer failures.

A significant portion of the repair requests Acer receives are related to software, not hardware, she said.

Acer, the world’s No. 2 notebook maker, has vowed to take the No. 1 spot next year, while Asustek, at No. 5, aims to be the No. 3 notebook brand by 2011.

To better serve local customers, the company has added service centers across the country by roping in authorized distributors, increasing the number of its service centers to 25 outlets, up from 12 in 2005.

RUN IT BACK: A succesful first project working with hyperscalers to design chips encouraged MediaTek to start a second project, aiming to hit stride in 2028 MediaTek Inc (聯發科), the world’s biggest smartphone chip supplier, yesterday said it is engaging a second hyperscaler to help design artificial intelligence (AI) accelerators used in data centers following a similar project expected to generate revenue streams soon. The first AI accelerator project is to bring in US$1 billion revenue next year and several billion US dollars more in 2027, MediaTek chief executive officer Rick Tsai (蔡力行) told a virtual investor conference yesterday. The second AI accelerator project is expected to contribute to revenue beginning in 2028, Tsai said. MediaTek yesterday raised its revenue forecast for the global AI accelerator used

TEMPORARY TRUCE: China has made concessions to ease rare earth trade controls, among others, while Washington holds fire on a 100% tariff on all Chinese goods China is effectively suspending implementation of additional export controls on rare earth metals and terminating investigations targeting US companies in the semiconductor supply chain, the White House announced. The White House on Saturday issued a fact sheet outlining some details of the trade pact agreed to earlier in the week by US President Donald Trump and Chinese President Xi Jinping (習近平) that aimed to ease tensions between the world’s two largest economies. Under the deal, China is to issue general licenses valid for exports of rare earths, gallium, germanium, antimony and graphite “for the benefit of US end users and their suppliers

Dutch chipmaker Nexperia BV’s China unit yesterday said that it had established sufficient inventories of finished goods and works-in-progress, and that its supply chain remained secure and stable after its parent halted wafer supplies. The Dutch company suspended supplies of wafers to its Chinese assembly plant a week ago, calling it “a direct consequence of the local management’s recent failure to comply with the agreed contractual payment terms,” Reuters reported on Friday last week. Its China unit called Nexperia’s suspension “unilateral” and “extremely irresponsible,” adding that the Dutch parent’s claim about contractual payment was “misleading and highly deceptive,” according to a statement

Artificial intelligence (AI) giant Nvidia Corp’s most advanced chips would be reserved for US companies and kept out of China and other countries, US President Donald Trump said. During an interview that aired on Sunday on CBS’ 60 Minutes program and in comments to reporters aboard Air Force One, Trump said only US customers should have access to the top-end Blackwell chips offered by Nvidia, the world’s most valuable company by market capitalization. “The most advanced, we will not let anybody have them other than the United States,” he told CBS, echoing remarks made earlier to reporters as he returned to Washington