Shares receive boost

Taiwanese shares closed up 1.49 percent yesterday in expanding trade following Wall Street’s overnight gains, dealers said.

The TAIEX index rose 99.19 points to 6,738.60 on turnover of NT$139.56 billion (US$4.23 billion).

Gainers led losers 1,974 to 518, with 111 stocks unchanged.

The market was also boosted by buying of tech shares on Intel’s optimistic earnings outlook, said Andrew Teng (鄧安瀾), an assistant vice president at Taiwan International Securities Corp (金鼎證券).

Shin Kong venture in new deal

Beijing-based Shin Kong & HNA Life Insurance Co (新光海航人壽保險公司), a joint venture between Taipei-based Shin Kong Life Insurance Co (新光人壽) and Hainan Airlines (海航集團), teamed up on Wednesday with Shanghai Pudong Development Bank’s (上海浦東發展銀行) Beijing branch to cooperate in bancassurance businesses.

Executives from both parties signed a collaboration agreement in Beijing, the insurer’s press statement said.

Through the collaboration, the insurer’s chairman, Wen Anmin (聞安民), promised to take advantage of its parent life insurer’s expertise and experience in bancassurance to enhance product innovation and insurance services for policyholders in China.

Chinatrust eyeing Nan Shan

Chinatrust Financial Holding Co (中信金控) is mulling the possibility of teaming up with a private equity fund to acquire Nan Shan Life Insurance Co (南山人壽), chairman Jeffrey Koo (辜濂松) said yesterday.

Nan Shan is 97.5 percent owned by the financially troubled American International Group Inc (AIG).

“We are still studying the feasibility [of partnering with a private equity fund],” Koo told reporters on the sidelines of a business group gathering.

Chinatrust Financial is among several local and foreign financial companies, including Fubon Financial Holding Co (富邦金控) and Cathay Financial Holding Co (國泰金控), that have entered the second round of the bid for Nan Shan to conduct due checks.

THSRC refinancing loans

Taiwan High Speed Rail Corp (THSRC, 台灣高鐵), unprofitable in its two years of operations, is seeking to borrow as much as NT$390 billion (US$11.8 billion) to refinance loans after borrowing costs plunged.

Bank of Taiwan (臺灣銀行) is leading a group of lenders that will provide the new debt, which would replace NT$373.8 billion in loans with interest as high as 8 percent, Ted Chia (賈先德), a vice president of the Taipei-based rail company, said yesterday.

The government would guarantee as much as NT$308.3 billion in new loans, Hu Hsiang-ling (胡湘麟), deputy director-general of the Bureau of High Speed Rail, said yesterday.

More PRC airlines apply

Two more Chinese carriers — Xiamen Airlines (廈門航空) and Hainan Airlines (海南航空) — have applied to open branch offices in Taiwan, the Ministry of Economic Affairs said on Tuesday.

This brings to three the number of Chinese companies seeking to invest in Taiwan in the wake of the ministry’s June 30 announcement allowing Chinese investment in specific categories.

On July 3, Guangzhou-based China Southern Airlines (中國南方航空) submitted a similar application to the ministry, becoming the first Chinese company to apply to invest in Taiwan.

NT dollar gains more ground

The New Taiwan dollar rose against the US dollar on the Taipei Foreign Exchange yesterday, rising NT$0.115 to close at NT$32.975. Turnover was US$868 million.

RECYCLE: Taiwan would aid manufacturers in refining rare earths from discarded appliances, which would fit the nation’s circular economy goals, minister Kung said Taiwan would work with the US and Japan on a proposed cooperation initiative in response to Beijing’s newly announced rare earth export curbs, Minister of Economic Affairs Kung Ming-hsin (龔明鑫) said yesterday. China last week announced new restrictions requiring companies to obtain export licenses if their products contain more than 0.1 percent of Chinese-origin rare earths by value. US Secretary of the Treasury Scott Bessent on Wednesday responded by saying that Beijing was “unreliable” in its rare earths exports, adding that the US would “neither be commanded, nor controlled” by China, several media outlets reported. Japanese Minister of Finance Katsunobu Kato yesterday also

Taiwan’s rapidly aging population is fueling a sharp increase in homes occupied solely by elderly people, a trend that is reshaping the nation’s housing market and social fabric, real-estate brokers said yesterday. About 850,000 residences were occupied by elderly people in the first quarter, including 655,000 that housed only one resident, the Ministry of the Interior said. The figures have nearly doubled from a decade earlier, Great Home Realty Co (大家房屋) said, as people aged 65 and older now make up 20.8 percent of the population. “The so-called silver tsunami represents more than just a demographic shift — it could fundamentally redefine the

China Airlines Ltd (CAL, 中華航空) said it expects peak season effects in the fourth quarter to continue to boost demand for passenger flights and cargo services, after reporting its second-highest-ever September sales on Monday. The carrier said it posted NT$15.88 billion (US$517 million) in consolidated sales last month, trailing only September last year’s NT$16.01 billion. Last month, CAL generated NT$8.77 billion from its passenger flights and NT$5.37 billion from cargo services, it said. In the first nine months of this year, the carrier posted NT$154.93 billion in cumulative sales, up 2.62 percent from a year earlier, marking the second-highest level for the January-September

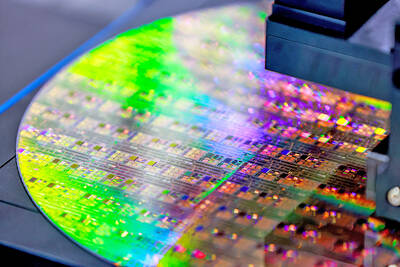

Businesses across the global semiconductor supply chain are bracing themselves for disruptions from an escalating trade war, after China imposed curbs on rare earth mineral exports and the US responded with additional tariffs and restrictions on software sales to the Asian nation. China’s restrictions, the most targeted move yet to limit supplies of rare earth materials, represent the first major attempt by Beijing to exercise long-arm jurisdiction over foreign companies to target the semiconductor industry, threatening to stall the chips powering the artificial intelligence (AI) boom. They prompted US President Donald Trump on Friday to announce that he would impose an additional