Asian stocks declined for the third consecutive week as the deepening global recession crimped earnings and forced companies to raise capital.

Nomura Holdings Inc, Japan’s largest brokerage, slumped 7.8 percent on concern its US$3.1 billion stock sale will dilute shareholder value. Woolworths Ltd, Australia’s biggest retailer, lost 5.4 percent on lower-than-expected profit. BlueScope Steel Ltd, the nation’s largest steelmaker, tumbled 29 percent after forecasting a second-half loss and slashing its dividend.

“Pessimism about company earnings hasn’t yet run its course,” said Naoyuki Torii, general manager of equities at Fukoku Mutual Life Insurance Co, which manages about US$59 billion. “As massive losses are eating into companies’ capital, investors are expecting more businesses will sell new shares and dilute shareholders’ equity.”

The MSCI Asia-Pacific Index lost 1.1 percent in the past five days to 75.19, extending losses after posting its steepest weekly plunge since October in the previous week. The gauge, which has lost 16 percent this year, fell to the lowest in more than five years on Feb. 24.

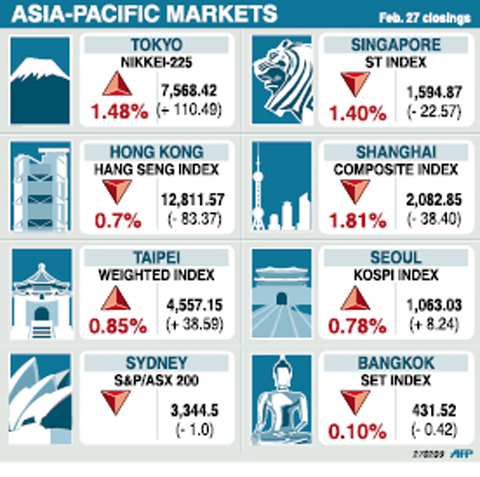

The Nikkei 225 Stock Average gained 2.1 percent this week, while Hong Kong’s Hang Seng index added 0.9 percent. China’s Shanghai Composite Index slumped 8.7 percent and Australia’s S&P/ASX 200 Index dropped 1.7 percent.

MSCI’s Asian index slumped by a record 43 percent last year as the credit crunch tipped the world’s largest economies into recession, forcing companies to cut jobs amid falling profits. Earnings estimates for companies in the gauge have been slashed 44 percent since the beginning of this year, data compiled by Bloomberg show.

Taiwanese share prices are expected to extend momentum next week, as the market is full of liquidity with bargain hunters eager to take advantage of low valuations, dealers said on Friday.

The market is expected to test 4,700 points next week, while the market is likely to see support at around 4,400 points as investors pocket profits, they said.

For the week ended Friday, the weighted index rose 120.21 points, or 2.71 percent, to 4,557.15 after a 3.35 percent fall the previous week.

Average daily turnover stood at NT$62.53 billion (US$1.79 billion), compared with NT$65.84 billion a week ago.

“After the central bank repeatedly cut its key interest rates, the market is immersed with idle money. Many investors are seeking buying opportunities,” Grand Cathay Securities (大華證券) analyst Mars Hsu said.

Last week, the central bank slashed rates for the seventh time in four months to boost the domestic economy, which contracted 8.36 percent in the fourth quarter of last year.

“Electronics stocks may have a better chance to gain as major companies have received large orders from China. It is an encouraging sign,” Hsu said.

In other markets on Friday it was:

KUALA LUMPUR: Down 0.3 percent. The Kuala Lumpur Composite Index lost 2.75 points to 890.67 as negative leads from Wall Street kept investors on the sidelines.

MANILA: Down 0.4 percent. The composite index fell 8.16 points to 1,872.22.

MUMBAI: Down 0.71 percent. The benchmark 30-share SENSEX index slid 63.25 points to 8,891.61, snapping two consecutive days of gains.

WELLINGTON: Up 0.99 percent. The benchmark NZX-50 index gained 24.88 points to 2,522.32.

Taiwan’s rapidly aging population is fueling a sharp increase in homes occupied solely by elderly people, a trend that is reshaping the nation’s housing market and social fabric, real-estate brokers said yesterday. About 850,000 residences were occupied by elderly people in the first quarter, including 655,000 that housed only one resident, the Ministry of the Interior said. The figures have nearly doubled from a decade earlier, Great Home Realty Co (大家房屋) said, as people aged 65 and older now make up 20.8 percent of the population. “The so-called silver tsunami represents more than just a demographic shift — it could fundamentally redefine the

The US government on Wednesday sanctioned more than two dozen companies in China, Turkey and the United Arab Emirates, including offshoots of a US chip firm, accusing the businesses of providing illicit support to Iran’s military or proxies. The US Department of Commerce included two subsidiaries of US-based chip distributor Arrow Electronics Inc (艾睿電子) on its so-called entity list published on the federal register for facilitating purchases by Iran’s proxies of US tech. Arrow spokesman John Hourigan said that the subsidiaries have been operating in full compliance with US export control regulations and his company is discussing with the US Bureau of

Taiwan’s foreign exchange reserves hit a record high at the end of last month, surpassing the US$600 billion mark for the first time, the central bank said yesterday. Last month, the country’s foreign exchange reserves rose US$5.51 billion from a month earlier to reach US$602.94 billion due to an increase in returns from the central bank’s portfolio management, the movement of other foreign currencies in the portfolio against the US dollar and the bank’s efforts to smooth the volatility of the New Taiwan dollar. Department of Foreign Exchange Director-General Eugene Tsai (蔡炯民)said a rate cut cycle launched by the US Federal Reserve

Businesses across the global semiconductor supply chain are bracing themselves for disruptions from an escalating trade war, after China imposed curbs on rare earth mineral exports and the US responded with additional tariffs and restrictions on software sales to the Asian nation. China’s restrictions, the most targeted move yet to limit supplies of rare earth materials, represent the first major attempt by Beijing to exercise long-arm jurisdiction over foreign companies to target the semiconductor industry, threatening to stall the chips powering the artificial intelligence (AI) boom. They prompted US President Donald Trump on Friday to announce that he would impose an additional