Intel Corp, Microsoft Corp and the technology companies that so far have escaped the credit crisis relatively unscathed will lose out on as much as US$170 billion in sales next year as the crunch catches up with them.

Corporate spending on computers, software and communications equipment may be little changed or fall as much as 5 percent next year as the lending freeze spooks clients, said Jane Snorek, an analyst at First American Funds in Minneapolis who has followed the industry for 13 years. It would be the first decline in the US$3.41 trillion market since 2001 after the dot-com bubble burst.

“Business kind of stopped dead in the last two weeks,” said Snorek, whose firm owns Microsoft and Intel stock among more than US$100 billion in assets. “People are pushing off orders and saying, ‘I have no idea if we’re going to have a global meltdown, so I’m not going to buy anything right now.’”

While consumer spending growth slowed this year as the economy slumped, corporate budgets stayed fairly constant until now. Snorek said the collapse of financial-services customers, who account for a quarter of technology outlays, and a subsequent surge in interest rates persuaded clients to pare back.

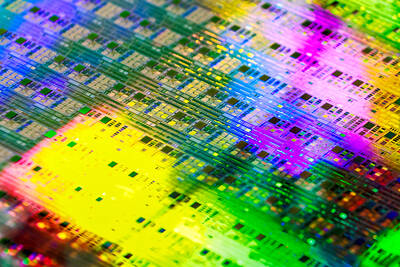

More data was to have emerged yesterday when Intel, whose chips run more than three-quarters of the world’s personal computers, kicks off two weeks of third-quarter reports from technology companies. Software maker SAP AG said last week orders froze last month, and a Forrester Research Inc survey found clients pressing outsourcing and services providers to renegotiate at lower rates.

In 2001, technology spending sank 7 percent, UBS AG said. The reason Snorek estimates that next year’s slump won’t be as bad as that is that companies have less inventory built now than they did in 2000 and 2001.

Gartner Inc said on Monday that spending growth would slow to 2.3 percent next year in a “worst-case scenario,” down from its earlier projection of 5.8 percent, while iSuppli Corp last week cut its forecast for this year’s global semiconductor revenue growth to 3.5 percent from 4 percent, saying the industry faces “significant potential downside” if the economic slump deepens.

Intel may post its lowest sales increase in six quarters, reporting 2 percent growth to US$10.3 billion, the average of 30 analysts’ estimates shows. Profit probably rose to US$0.34 a share, the survey found.

“We’re seeing the beginning of the end,” said JPMorgan Chase semiconductor analyst Chris Danely in San Francisco. “For the fourth quarter, I think they’ll guide lower. Then the first quarter is a total disaster.”

Microsoft, which reports on Friday next week, may say profit increased to US$0.47 a share last quarter on a 7.6 percent sales gain to US$14.8 billion, the survey showed. Analysts anticipate that earnings per share will rise to US$0.56 and that sales will climb to US$18.3 billion in the current quarter.

Microsoft projects that sales in the year ending in June will climb 11 percent to at least US$67.3 billion. Slowing growth in PC shipments may hamper that effort, Morgan Stanley analyst Adam Holt in San Francisco said last week. He cut his estimate for Microsoft to US$65.3 billion, an 8 percent increase.

Dozens of technology companies will report results in the next two weeks, including Apple Inc and chipmakers Broadcom Corp and Advanced Micro Devices Inc.

“I would expect to see some misses that will raise red flags and ultimately could be the beginning of the slowdown that so far has eluded the tech industry,” said Jason Pompeii, a Chicago-based technology analyst for Fitch. “We could really start to see the effects of the broader economy.”

NO BREAKTHROUGH? More substantial ‘deliverables,’ such as tariff reductions, would likely be saved for a meeting between Trump and Xi later this year, a trade expert said China launched two probes targeting the US semiconductor sector on Saturday ahead of talks between the two nations in Spain this week on trade, national security and the ownership of social media platform TikTok. China’s Ministry of Commerce announced an anti-dumping investigation into certain analog integrated circuits (ICs) imported from the US. The investigation is to target some commodity interface ICs and gate driver ICs, which are commonly made by US companies such as Texas Instruments Inc and ON Semiconductor Corp. The ministry also announced an anti-discrimination probe into US measures against China’s chip sector. US measures such as export curbs and tariffs

The US on Friday penalized two Chinese firms that acquired US chipmaking equipment for China’s top chipmaker, Semiconductor Manufacturing International Corp (SMIC, 中芯國際), including them among 32 entities that were added to the US Department of Commerce’s restricted trade list, a US government posting showed. Twenty-three of the 32 are in China. GMC Semiconductor Technology (Wuxi) Co (吉姆西半導體科技) and Jicun Semiconductor Technology (Shanghai) Co (吉存半導體科技) were placed on the list, formally known as the Entity List, for acquiring equipment for SMIC Northern Integrated Circuit Manufacturing (Beijing) Corp (中芯北方積體電路) and Semiconductor Manufacturing International (Beijing) Corp (中芯北京), the US Federal Register posting said. The

READY TO HELP: Should TSMC require assistance, the government would fully cooperate in helping to speed up the establishment of the Chiayi plant, an official said Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) yesterday said its investment plans in Taiwan are “unchanged” amid speculation that the chipmaker might have suspended construction work on its second chip packaging plant in Chiayi County and plans to move equipment arranged for the plant to the US. The Chinese-language Economic Daily News reported earlier yesterday that TSMC had halted the construction of the chip packaging plant, which was scheduled to be completed next year and begin mass production in 2028. TSMC did not directly address whether construction of the plant had halted, but said its investment plans in Taiwan remain “unchanged.” The chipmaker started

MORTGAGE WORRIES: About 34% of respondents to a survey said they would approach multiple lenders to pay for a home, while 29.2% said they would ask family for help New housing projects in Taiwan’s six special municipalities, as well as Hsinchu city and county, are projected to total NT$710.65 billion (US$23.61 billion) in the upcoming fall sales season, a record 30 percent decrease from a year earlier, as tighter mortgage rules prompt developers to pull back, property listing platform 591.com (591新建案) said yesterday. The number of projects has also fallen to 312, a more than 20 percent decrease year-on-year, underscoring weakening sentiment and momentum amid lingering policy and financing headwinds. New Taipei City and Taoyuan bucked the downturn in project value, while Taipei, Hsinchu city and county, Taichung, Tainan and Kaohsiung