Cathay Financial Holding Co (國泰金控), the nation's biggest financial services provider, denied it planned to acquire the debt-ridden Chinfon Commercial Bank (慶豐銀行), a company filing to the Taiwan Stock Exchange said yesterday.

Lee Chang-ken (

The Chinese-language Econo-mic Daily News said in a front-page story yesterday that Cathay's board would meet on Dec. 31 to approve the purchase of Chinfon's assets and liabilities at NT$1.8 per share.

The report said the acquisition would add 36 branches to Cathay Financial's existing local network of 161.

In October, Cathay Financial said it wanted to increase its network to more than 200 branches nationwide after it won a government auction to take control of China United Trust and Investment (中聯信託), which has 15 branches and a license to open five more.

Commenting on the news, SinoPac Securities Corp (永豐金證券) considered the reported acquisition price "reasonable," the Taipei-based brokerage said in a note to its clients yesterday.

But "we are neutral on the news and will closely monitor the following progress," SinoPac said.

Shares of Cathay Financial rose 0.15 percent to close at NT$66.2 yesterday, underperforming a 0.39-percent rise in the benchmark TAIEX index. Chinfon is not a listed company.

Chinfon has seen its capital base decline significantly in the first three quarters of the year, making it increasingly difficult to meet the regulatory adequate capital requirement should no new capital injection materialize in the next few months.

The Taipei-based lender's capital adequacy ratio -- which measures a bank's financial strength by dividing its assets by its capital -- has dropped below the mandatory 8 percent since the fourth quarter of last year. The ratio declined to 1.25 percent at the end of September from 9.21 percent a year earlier, according to Financial Supervisory Commission's (FSC) statistics released yesterday.

At the end of October, the bank reported NT$91.48 billion (US$2.18 billion) in total deposits and NT$64 billion in outstanding loans, falling from NT$93.33 billion and NT$66.28 billion respectively in the previous month, the commission's figures showed.

The bank's bad loans increased to NT$14.4 billion in October or a non-performing loan (NPL) ratio of 22.5 percent, from NT$14 billion or a NPL ratio of 21.19 in September, the same data showed.

Chinfon's net value declined to NT$866 million at the end of October from NT$1.44 billion in September, while its losses expanded to NT$4.96 billion from NT$4.4 billion during the same period, according to the government data.

The FSC has set a month-end deadline for Chinfon to raise fresh capital to improve its financial condition.

FSC's chairwoman Susan Chang (張秀蓮) said last night a local financial holding company, not Cathay Financial, was interested in the bank, although the details remained unclear.

Chinfon could be under government supervision and taken over by the state-run Central Deposit Insurance Corp (中央存保) if the lender fails to meet the regulator's recapitalization deadline.

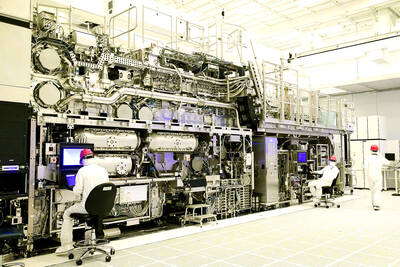

ASML Holding NV’s new advanced chip machines have a daunting price tag, said Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), one of the Dutch company’s biggest clients. “The cost is very high,” TSMC senior vice president Kevin Zhang (張曉強) said at a technology symposium in Amsterdam on Tuesday, referring to ASML’s latest system known as high-NA extreme ultraviolet (EUV). “I like the high-NA EUV’s capability, but I don’t like the sticker price,” Zhang said. ASML’s new chip machine can imprint semiconductors with lines that are just 8 nanometers thick — 1.7 times smaller than the previous generation. The machines cost 350 million euros (US$378 million)

Apple Inc has closed in on an agreement with OpenAI to use the start-up’s technology on the iPhone, part of a broader push to bring artificial intelligence (AI) features to its devices, people familiar with the matter said. The two sides have been finalizing terms for a pact to use ChatGPT features in Apple’s iOS 18, the next iPhone operating system, said the people, who asked not to be identified because the situation is private. Apple also has held talks with Alphabet Inc’s Google about licensing its Gemini chatbot. Those discussions have not led to an agreement, but are ongoing. An OpenAI

‘FULL SUPPORT’: Kumamoto Governor Takashi Kimura said he hopes more companies would settle in the prefecture to create an area similar to Taiwan’s Hsinchu Science Park The newly elected governor of Japan’s Kumamoto Prefecture said he is ready to ensure wide-ranging support to woo Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) to build its third Japanese chip factory there. Concerns of groundwater shortages when TSMC’s two plants begin operations in the prefecture’s Kikuyo have spurred discussions about the possibility of tapping unused dam water, Kumamoto Governor Takashi Kimura said in an interview on Saturday. While Kimura said talks about a third plant have yet to occur, Bloomberg had reported TSMC is already considering its third Japanese fab — also in Kumamoto — which would make more advanced chips. “We are

EXPLOSION: A driver who was transporting waste material from the site was hit by a blunt object after an uncontrolled pressure release and thrown 6m from the truck Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) said yesterday there was no damage to its facilities after an incident at its Arizona factory construction site where a waste disposal truck driver was transported to hospital. Firefighters responded to an explosion on Wednesday afternoon at the TSMC plant in Phoenix, the Arizona Republic reported, citing the local fire department. Cesar Anguiano-Guitron, 41, was transporting waste material from the project site and stopped to inspect the tank when he was made aware of a potential problem, a police report seen by Bloomberg News showed. Following an “uncontrolled pressure release,” he was hit by a blunt