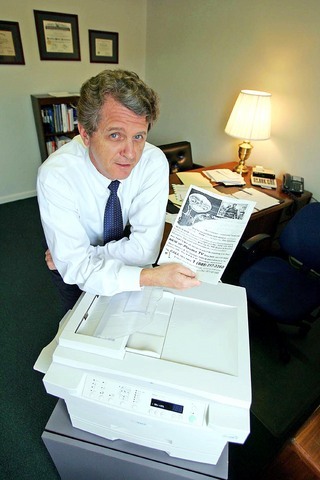

If any of Rodney Eddins' accounting clients want his undivided attention at work first thing in the morning, they should shun e-mail or his telephone answering machine. Instead, they should send him a fax.

"The first thing I look at when I arrive is the incoming tray of my fax machine," said Eddins, a certified public accountant in Orlando, Florida, who has had his own practice for a decade. "If there's paper there, I feel like I have to look at it."

Only after he sorts through the morning's faxes -- though most on a recent day were ads like one for a workplace deodorizing service -- does Eddins log on to his computer and listen to his phone messages.

PHOTO: THE NEW YORK TIMES

Still, like many other people, Eddins readily acknowledges a tortured relationship with his fax machine. Finding it essential for transmitting sensitive accounting documents and forms that require signatures, like tax returns, he grudgingly tolerates the noise and mess, not to mention the deluge of junk faxes.

"I actually hate my fax machine," he said. "But I need it."

In an office world that has gone largely digital, hand-held and wireless, the fax machine is ancient technology that just won't go away. No one shows off her fax machine the way she might, say, a BlackBerry. Yet the fax persists as a mockery of the much-predicted paperless society.

"Back in the mid-1990s, when e-mail was really coming into its own, we had high-priced consultants telling us that the fax was going the way of the horse and buggy," said Jonathan Bees, then a product manager for office machines at Konica; he is now editor in chief of Better Buys for Business magazine. Among the products he reviews for consumers these days are fax machines. "They're better than ever -- quieter, faster and with clearer reproduction," he said. "They haven't been passed by, after all."

Some 1.5 million fax machines were sold in the US last year for use at both businesses and homes, according to the Consumer Electronics Association, based in Arlington, Virginia. Manufacturers estimate that they sold 500,000 more machines that combined a fax function with other functions, like copying and scanning.

Although sales of stand-alone fax machines are well below their peak of 3.6 million in 1997, some manufacturers say that if the multi-use machines are included, demand has been rising of late.

"We have been seeing an increase in fax sales for the last four or five years," said Paul Fountain, marketing product manager at Hewlett-Packard in San Diego.

In 1994, Hewlett-Packard left the fax market, believing the predictions of impending obsolescence. But, Fountain said, "We came back in 1998 because we realized the fax was not going away."

While fax machines are not as prevalent as computers in the workplace or home offices, Bill Young, a communications coach at the Strickland Group in New York City, said, "The fax has important functions that e-mail simply hasn't been able to take over."

Those would include reproducing signatures on documents like contracts, business proposals and medical prescriptions.

Another factor in the fax's favor is security.

"With a fax, you don't have to worry about computer hackers or someone stealing the password to the recipient's e-mail," Young said. "As long as there's a person at the receiving fax ready to remove the paper, the message is confidential." (Some computers have the capacity to convert the image of an incoming fax to e-mail, but that method loses the privacy advantage.)

Falling prices have helped to maintain the fax's popularity.

"The fax machine you would buy at Costco or Staples 10 years ago for the home office would typically cost about US$200," Fountain said. "Better machines are available today for US$45."

The US$200 machine a decade ago would have been a stand-alone fax. Now, Hewlett offers the Fax 1050 -- a combination fax, copier and answering machine -- for US$99.

But faxes priced at US$100 and less can have at least one drawback: they typically transmit and print at a rate of only about four pages a minute. More money buys more speed, among other things. One business model from Sharp is the FO DC525, which costs US$3,000 and transmits and prints 20 pages a minute.

Commercial machines are available for mass faxing of more than 100 pages a minute. But the prices of such machines can reach US$70,000, and they are usually more the size of mainframe computers than office machines, so you won't find them in the fax aisle at Staples.

All of this has come too late to benefit the fax's inventor, the Scottish physicist Alexander Bain. He patented the first primitive fax machine in 1843, some 30 years before the telephone. Called the "recording telegraph," Bain's invention used a stylus attached to a pendulum, which passed over metal type to sense light or dark spots on the plated "document" being sent. A pendulum on the receiving device made a stain on chemically treated paper when electric charges were sent on a telegraph line. But Bain's innovation came nearly 100 years before the Information Age, and there was little demand for it. He died poor.

Bain might have been mortified at one problem with today's fax machines: their vulnerability to their own version of junk mail. Junk faxers can tie up machines and delay important messages, and some critics label them thieves.

"They can steal a lot of paper from recipients who don't even want to get their ads," said Lawrence Markey, a lawyer at the Foundation for Taxpayer and Consumer Rights in Santa Monica, California.

He started suing junk faxers in 2001, in California small-claims courts. Such litigation is painstaking, he said.

"I have collected about US$5,000 so far from various companies," he said, "not nearly enough to compensate for my time."

One plus, though, he said, is that junk faxers don't seem to be dialing his number as often.

TEMPORARY TRUCE: China has made concessions to ease rare earth trade controls, among others, while Washington holds fire on a 100% tariff on all Chinese goods China is effectively suspending implementation of additional export controls on rare earth metals and terminating investigations targeting US companies in the semiconductor supply chain, the White House announced. The White House on Saturday issued a fact sheet outlining some details of the trade pact agreed to earlier in the week by US President Donald Trump and Chinese President Xi Jinping (習近平) that aimed to ease tensions between the world’s two largest economies. Under the deal, China is to issue general licenses valid for exports of rare earths, gallium, germanium, antimony and graphite “for the benefit of US end users and their suppliers

Dutch chipmaker Nexperia BV’s China unit yesterday said that it had established sufficient inventories of finished goods and works-in-progress, and that its supply chain remained secure and stable after its parent halted wafer supplies. The Dutch company suspended supplies of wafers to its Chinese assembly plant a week ago, calling it “a direct consequence of the local management’s recent failure to comply with the agreed contractual payment terms,” Reuters reported on Friday last week. Its China unit called Nexperia’s suspension “unilateral” and “extremely irresponsible,” adding that the Dutch parent’s claim about contractual payment was “misleading and highly deceptive,” according to a statement

The Chinese government has issued guidance requiring new data center projects that have received any state funds to only use domestically made artificial intelligence (AI) chips, two sources familiar with the matter told Reuters. In recent weeks, Chinese regulatory authorities have ordered such data centers that are less than 30 percent complete to remove all installed foreign chips, or cancel plans to purchase them, while projects in a more advanced stage would be decided on a case-by-case basis, the sources said. The move could represent one of China’s most aggressive steps yet to eliminate foreign technology from its critical infrastructure amid a

Nissan Motor Co has agreed to sell its global headquarters in Yokohama for ¥97 billion (US$630 million) to a group sponsored by Taiwanese autoparts maker Minth Group (敏實集團), as the struggling automaker seeks to shore up its financial position. The acquisition is led by a special purchase company managed by KJR Management Ltd, a Japanese real-estate unit of private equity giant KKR & Co, people familiar with the matter said. KJR said it would act as asset manager together with Mizuho Real Estate Management Co. Nissan is undergoing a broad cost-cutting campaign by eliminating jobs and shuttering plants as it grapples