After sending tech stocks surging in recent months, Wall Street is now placing bets on a much stodgier investment: a batch of material, construction and industrial stocks known as cyclicals.

The sector has remained strong while technology stocks faltered after investors, ever mindful of the bursting of the tech bubble in 2000, worried that the recent rally might have come too fast.

Analysts say cyclicals' gains result largely from investor optimism of a rebounding economy, which would be a boon for industries that do particularly well at times of faster growth.

"With the rise in interest rates linked to an improving economy, and a lot of anecdotal evidence showing the economy is recovering, which companies' earnings are most tied to the business cycle? By definition, it's cyclical stocks," said Richard Dickson, senior market strategist at Lowry's Research Reports.

Indeed, the Morgan Stanley Cyclical Index has climbed about 42 percent since the stock rally began March 11. That's compared to a 34 percent gain for the tech-focused NASDAQ composite and a 23 percent rise for the Standard & Poor's 500 index.

LEADERS

Among the leading cyclicals: equipment maker Caterpillar, up 59 percent since mid-March; lumber giant Georgia-Pacific, which has jumped 68 percent; and aluminum maker Alcoa, up about 48 percent.

Mitch Zacks, vice president and director of research at Zacks Investment Research, said his firm has found that consumer cyclicals such as Procter & Gamble and transportation stocks tend to do well in the early stages of a recovery, while during an economic expansion, basic materials flourish.

He explained that many of these cyclical companies have fixed costs which can't be reduced significantly during a downturn. In a recovery, however, their costs don't rise as rapidly as their revenues, leading to much bigger gains.

"Investors are buying stocks whose earnings will improve dramatically when the economy improves," Zacks said. "That sounds kind of counterintuitive -- wouldn't all stocks improve?"

"The answer is, not necessarily," he said. "Some stocks, like the drug companies, earn the same amount regardless of the expansionary mode. Those stocks will underperform if we have a recovery.''

There was evidence of the strength of cyclicals in recent weeks. A week ago, the Dow Jones Industrials posted weekly gains while the other gauges faltered, mostly on the performance of cyclical companies such as Caterpillar, International Paper and United Technologies.

And in the past week, 3M accounted for an intraday turnaround for the blue chips on Monday after the manufacturer announced a 2-for-1 stock split.

it's the economy

Still, while share prices are rising in anticipation of a recovery, analysts caution their fortunes could quickly turn should economic growth falter. They note much of the stock gains have often come regardless of a particular company's fundamentals.

"It's a sector that is going to be significantly affected by continuing perceptions about the economic cycle and where we are," Dickson said. "Stocks could quickly go in the doghouse if people say the economy won't grow as expected."

Other analysts agreed, noting that much of cyclicals' runup remains speculative until investors can see whether the largely anticipated rebound by year's end actually comes to fruition in the next couple of months.

"Stock markets have rallied since the low point in March, and you have a lot of good news built in," said Chris Wolfe, equity market strategist for J.P. Morgan Private Bank. "A lot now hinges on how the third-quarter earnings season shapes up."

The Dow ended the week up 130.60, closing Friday at 9,321.69.

The NASDAQ composite index had a weekly advance of 57.98, finishing at 1,702.01 on Friday. The Standard & Poor's 500 had a weekly gain of 13.08, closing at 990.67.

For the week, the Russell 2000 index, the barometer of smaller company stocks, rose 17.98, closing at 471.92.

The Wilshire 5000 Total Market Index, which tracks more than 5,700 US-based companies, ended the week at 9,547.51, up 154.78 from the previous week. A year ago, the index was at 8,770.28.

Merida Industry Co (美利達) has seen signs of recovery in the US and European markets this year, as customers are gradually depleting their inventories, the bicycle maker told shareholders yesterday. Given robust growth in new orders at its Taiwanese factory, coupled with its subsidiaries’ improving performance, Merida said it remains confident about the bicycle market’s prospects and expects steady growth in its core business this year. CAUTION ON CHINA However, the company must handle the Chinese market with great caution, as sales of road bikes there have declined significantly, affecting its revenue and profitability, Merida said in a statement, adding that it would

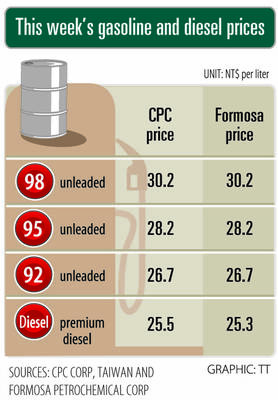

i Gasoline and diesel prices at fuel stations are this week to rise NT$0.1 per liter, as tensions in the Middle East pushed crude oil prices higher last week, CPC Corp, Taiwan (台灣中油) and Formosa Petrochemical Corp (台塑石化) said yesterday. International crude oil prices last week rose for the third consecutive week due to an escalating conflict between Israel and Iran, as the market is concerned that the situation in the Middle East might affect crude oil supply, CPC and Formosa said in separate statements. Front-month Brent crude oil futures — the international oil benchmark — rose 3.75 percent to settle at US$77.01

RISING: Strong exports, and life insurance companies’ efforts to manage currency risks indicates the NT dollar would eventually pass the 29 level, an expert said The New Taiwan dollar yesterday rallied to its strongest in three years amid inflows to the nation’s stock market and broad-based weakness in the US dollar. Exporter sales of the US currency and a repatriation of funds from local asset managers also played a role, said two traders, who asked not to be identified as they were not authorized to speak publicly. State-owned banks were seen buying the greenback yesterday, but only at a moderate scale, the traders said. The local currency gained 0.77 percent, outperforming almost all of its Asian peers, to close at NT$29.165 per US dollar in Taipei trading yesterday. The

RECORD LOW: Global firms’ increased inventories, tariff disputes not yet impacting Taiwan and new graduates not yet entering the market contributed to the decrease Taiwan’s unemployment rate last month dropped to 3.3 percent, the lowest for the month in 25 years, as strong exports and resilient domestic demand boosted hiring across various sectors, the Directorate-General of Budget, Accounting and Statistics (DGBAS) said yesterday. After seasonal adjustments, the jobless rate eased to 3.34 percent, the best performance in 24 years, suggesting a stable labor market, although a mild increase is expected with the graduation season from this month through August, the statistics agency said. “Potential shocks from tariff disputes between the US and China have yet to affect Taiwan’s job market,” Census Department Deputy Director Tan Wen-ling