Did you really think corporate perks were out?

Just in time for the executive who wants to remember colleagues, but is unsure about the rules, Saks Fifth Avenue has issued its new holiday corporate gift catalog, the first one the Fifth Avenue retailer has ever published, featuring desktop tchotchkes, from sterling silver flashlights for US$125 to Baccarat bulls for US$890. Engraving costs extra.

Analysts report that the department stores, faced with flagging demand for clothing, are generally turning more to gifts, and Saks is no exception. Now, besides overhauling its stores' gift departments, Saks is taking on Tiffany's, which previously had the market for corporate gifts pretty much to itself -- with, of course, an occasional gift of, say, his and hers jets from Neiman Marcus. But Tiffany's has always been the one to beat. It is the store with its own special corporate gift catalog.

PHOTO: NY TIMES

To Eric Beder, the director of research with Ladenburg Thalmann, the Saks catalog is part of a changing emphasis at luxury department stores toward gifts: one-size-fits-all and the more "unique," the better. And a big part of the gift market is business customers: CEOs giving to special underlings, events coordinators giving to suppliers, manufacturers giving to top salesmen and finally to say Happy New Year.

"There's a new focus on gifting, on companies coming out with new distinctive boxes, to further leverage the brand names," Beder said. "The market for corporate gifts is huge, with incredibly high profit margins."

Beder said that unlike regular store merchandise, 40 percent of which eventually get marked down, corporate gifts are sold full price or not at all; there are no discounts. So in January, executives will not be getting a chance to buy the New York City toile box in earthenware (Tiffany's) for less than the US$75 asking price. Or Saks' doghouse and bone sterling keychain (for kennel owners and other dog-fanciers), for US$60.

At Saks, the new catalog is part of CEO Christina Johnson's strategy. Johnson, who took over in February 2000, said she wanted to make Saks more of a destination for gifts. And now, the store has just released its first corporate catalog.

"We've never done this before, and we'd like to turn this into a US$30 to US$50 million business over the next five years," said Christina Johnson, Sak's chief executive. That sounds like a lot, but it is not when compared with the total US$16 billion a year corporate gift market cited in the trade magazines. But that number includes the world's supply of company-logoed golf shirts, plastic drinking mugs and monogrammed tennis balls.

These sorts of gifts are not exactly hallmarks of Tiffany -- nor of Saks, where the offerings start with a giant solid 18 karat gold money clip (US$450) on the cover of the new pewter-colored booklet.

Saks, by the way, has placed its money on pewter to rival Tiffany's distinctive cornflower blue boxes. "It's not as iconic as Tiffany's -- yet," conceded Johnson, "but we're building."

For the less generous boss, there is also a silverplated computer mouse (US$35) or a red nubuck mouse pad (US$25), not to mention the Christofle silver-plated Pebble of Peace (US$85), with the word in 32 languages, inspired by Clara Halter, who designed "La Mur pour la Paix" in Paris (US$85).

Regional coverage

At Saks, Johnson has opened the stops: The company has just hired a separate corporate gift sales force, with three regional offices, in the East, Midwest and West.

This week, Mark L. Aaron, Tiffany's vice-president for investor relations, played down the role of the corporate gifts in his company's overall earnings profile. "It's only 5 or 6 percent of the total," he said.

Tiffany's reported earnings of US$708 million in the first half of this year, so even 5 percent -- US$35 million -- isn't exactly chicken feed.

Linda Buckley, also speaking for Tiffany, said the silver and bone china Christmas tree ornaments always sell well, along with their silver stylus for handheld computers (US$65). Pens with the "T" logo are also best sellers, she said.

The difference between the corporate gift catalogs, according to Saks, is that Saks doesn't have to keep its offerings to its own branded products; the company can, and does, offer Burberry raincoats, for example. But on its side, Tiffany argues that because it only sells the Tiffany brand, there is an exclusivity to the products they offer.

But even in the Saks catalog, there are exclusives, sold only by Saks. And there are other items, like the Christofle pebble, that the company says are only offered by the manufacturer -- Christofle itself -- and by Saks.

Johnson pointed to the Dunhill sterling "decision-maker," an inch-and-a-half wide spinner engraved with "Today," "Tomorrow," "Yes" and "No" (US$200).

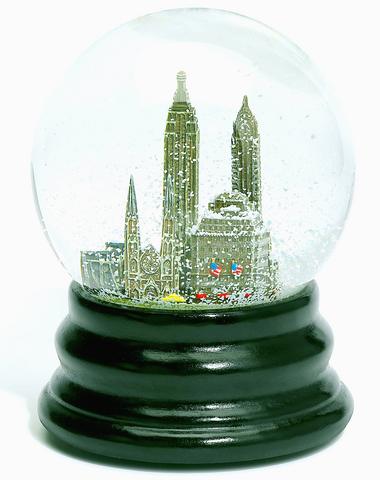

But perhaps the most original gift is shown on the last page of the catalog: an old-fashioned snow globe -- the kind you shake and the white stuff begins to fall -- with your very own skyscraper inside.

Even with your own building sculpted inside, the cost is still only US$35 apiece. The only caveat: You have to order at least 1,500 of them.

Shares in Taiwan closed at a new high yesterday, the first trading day of the new year, as contract chipmaker Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) continued to break records amid an artificial intelligence (AI) boom, dealers said. The TAIEX closed up 386.21 points, or 1.33 percent, at 29,349.81, with turnover totaling NT$648.844 billion (US$20.65 billion). “Judging from a stronger Taiwan dollar against the US dollar, I think foreign institutional investors returned from the holidays and brought funds into the local market,” Concord Securities Co (康和證券) analyst Kerry Huang (黃志祺) said. “Foreign investors just rebuilt their positions with TSMC as their top target,

H200 CHIPS: A source said that Nvidia has asked the Taiwanese company to begin production of additional chips and work is expected to start in the second quarter Nvidia Corp is scrambling to meet demand for its H200 artificial intelligence (AI) chips from Chinese technology companies and has approached contract manufacturer Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) to ramp up production, sources said. Chinese technology companies have placed orders for more than 2 million H200 chips for this year, while Nvidia holds just 700,000 units in stock, two of the people said. The exact additional volume Nvidia intends to order from TSMC remains unclear, they said. A third source said that Nvidia has asked TSMC to begin production of the additional chips and work is expected to start in the second

REVENUE PERFORMANCE: Cloud and network products, and electronic components saw strong increases, while smart consumer electronics and computing products fell Hon Hai Precision Industry Co (鴻海精密) yesterday posted 26.51 percent quarterly growth in revenue for last quarter to NT$2.6 trillion (US$82.44 billion), the strongest on record for the period and above expectations, but the company forecast a slight revenue dip this quarter due to seasonal factors. On an annual basis, revenue last quarter grew 22.07 percent, the company said. Analysts on average estimated about NT$2.4 trillion increase. Hon Hai, which assembles servers for Nvidia Corp and iPhones for Apple Inc, is expanding its capacity in the US, adding artificial intelligence (AI) server production in Wisconsin and Texas, where it operates established campuses. This

US President Donald Trump on Friday blocked US photonics firm HieFo Corp’s US$3 million acquisition of assets in New Jersey-based aerospace and defense specialist Emcore Corp, citing national security and China-related concerns. In an order released by the White House, Trump said HieFo was “controlled by a citizen of the People’s Republic of China” and that its 2024 acquisition of Emcore’s businesses led the US president to believe that it might “take action that threatens to impair the national security of the United States.” The order did not name the person or detail Trump’s concerns. “The Transaction is hereby prohibited,”