Asian stocks fell for a second week after a US jobs report missed economists’ estimates and concern grew that Europe’s crisis of government debt is spreading.

LG Electronics Inc, which counts North America as its biggest market, slumped 11 percent in Seoul this week after a government report showed US employers hired fewer workers last month than forecast. Nintendo Co, a Japanese game maker that gets 34 percent of its sales in Europe, retreated 8.1 percent after the euro weakened. Mitsui & Co, which holds a stake in an oil field operated by BP PLC where an oil spill is unfolding, tumbled 9.5 percent in Tokyo on concern earnings will suffer.

The MSCI Asia-Pacific Index slid 0.9 percent to 112.44 this week. The gauge plunged 3.3 percent on Monday, its steepest drop since March 30 last year after a Hungarian government official said the country’s economy was in a “very grave situation.”

“What I’m afraid of is that the volatility of the euro can trigger turmoil in the financial markets, prompting investors to reduce risk assets including stocks,” said Akio Yoshino, chief economist in Tokyo at Societe Generale Asset Management (Japan) Inc, which manages the equivalent of US$18 billion.

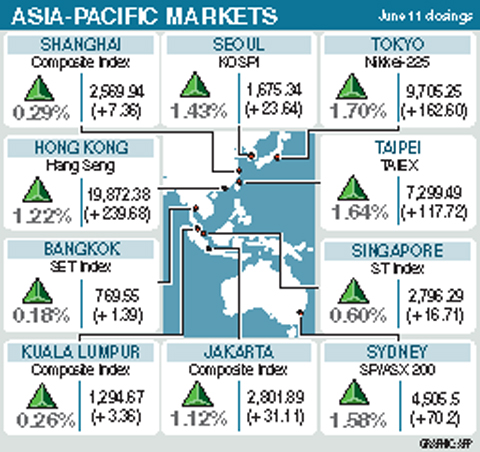

Japan’s Nikkei 225 Stock Average tumbled 2 percent this week even as a government report showed Japan’s GDP rose at an annualized 5 percent rate in the three months ended March 31, faster than the 4.2 percent projected by economists.

The S&P/ASX 200 Index gained 1.3 percent in Sydney, as gains in oil and copper prices lifted mining companies. The statistics bureau reported on Thursday that the jobless rate fell to 5.2 percent last month from 5.4 percent from the previous month.

The MSCI Asia-Pacific Index has slumped about 13 percent from its high this year on April 15 amid growing concern European countries in addition to Greece will struggle to curb their budget deficits or repay debt. The decline has dragged the average price of companies in the gauge to 14.4 times estimated earnings, compared with 20.1 times at the beginning of this year, according to data compiled by Bloomberg.

Taiwan’s TAIEX rose 117.72, or 1.63 percent, to 7,299.49 at the close of Taipei trading on Friday after a strong showing on Wall Street overnight as a euro rebound against the US dollar gave investors at home and abroad some relief from concerns over debt problems in the eurozone, according to dealers.

The TAIEX fell 0.6 percent this week.

The financial sector posted the largest gains, up 2.7 percent. Paper and pulp, and plastics and chemicals closed up 1.6 percent each, while machinery and electronics shares were 1.5 percent higher.

Other markets on Friday:

Manila closed 1.27 percent, or 40.95 points, higher from Thursday at 3,265.44.

Wellington rose 1.30 percent, or 38.94 points, from Thursday to 3,041.27.

Mumbai rose 0.84 percent, or 142.87 points, from Thursday to 17,064.95.

GAINING STEAM: The scheme initially failed to gather much attention, with only 188 cards issued in its first year, but gained popularity amid the COVID-19 pandemic Applications for the Employment Gold Card have increased in the past few years, with the card having been issued to a total of 13,191 people from 101 countries since its introduction in 2018, the National Development Council (NDC) said yesterday. Those who have received the card have included celebrities, such as former NBA star Dwight Howard and Australian-South Korean cheerleader Dahye Lee, the NDC said. The four-in-one Employment Gold Card combines a work permit, resident visa, Alien Resident Certificate (ARC) and re-entry permit. It was first introduced in February 2018 through the Act Governing Recruitment and Employment of Foreign Professionals (外國專業人才延攬及雇用法),

RESILIENCE: Deepening bilateral cooperation would extend the peace sustained over the 45 years since the Taiwan Relations Act, Greene said Taiwan-US relations are built on deep economic ties and shared values, American Institute in Taiwan (AIT) Director Raymond Greene said yesterday, adding that strengthening supply chain security in critical industries, enhancing societal resilience through cooperation and deepening partnerships are key to ensuring peace and stability for Taiwan in the years ahead. Greene made the remarks at the National Security Youth Forum, organized by National Taiwan University’s National Security and Strategy Studies Institution in Taipei. In his address in Mandarin Chinese, Greene said the Taiwan-US relationship is built on deep economic ties and shared interests, and grows stronger through the enduring friendship between

CAUTION URGED: Xiaohongshu and Douyin — the Chinese version of TikTok — are tools the Chinese government uses for its ‘united front’ propaganda, the MAC said Mainland Affairs Council (MAC) Minister Chiu Chui-cheng (邱垂正) yesterday urged people who use Chinese social media platforms to be cautious of being influenced by Beijing’s “united front” propaganda and undermining Taiwan’s sovereignty. Chiu made the remarks in response to queries about Chinese academic Zhang Weiwei (張維為) saying that as young Taiwanese are fond of interacting on Chinese app Xiaohongshu (小紅書, known as RedNote in English), “after unification with China, it would be easier to govern Taiwan than Hong Kong.” Zhang is professor of international relations at Shanghai’s Fudan University and director of its China Institute. When giving a speech at China’s Wuhan

The Ministry of Transportation and Communications yesterday said that it would redesign the written portion of the driver’s license exam to make it more rigorous. “We hope that the exam can assess drivers’ understanding of traffic rules, particularly those who take the driver’s license test for the first time. In the past, drivers only needed to cram a book of test questions to pass the written exam,” Minister of Transportation and Communications Chen Shih-kai (陳世凱) told a news conference at the Taoyuan Motor Vehicle Office. “In the future, they would not be able to pass the test unless they study traffic regulations