With unemployment high and inflation low, the Federal Reserve is in no hurry to raise interest rates, two Federal Reserve officials said on Tuesday.

The Fed cut its key target rate to near zero in December 2008 and pumped more than US$1 trillion into the world’s biggest economy to blunt the worst downturn since the Great Depression.

While a mild recovery has taken hold and the jobs market has begun to stabilize, the officials said scant signs of inflation mean the Fed’s vow to keep near-zero rates for an extended period continued to be warranted.

“Such an accommodative policy is currently appropriate, in my view, because the economy is operating well below its potential and inflation is subdued,” San Francisco Federal Reserve president Janet Yellen said at a Town Hall Los Angeles luncheon.

“I don’t believe this is yet the time to be tightening monetary policy,” she said.

Earlier on Monday in Shanghai, Chicago Federal Reserve Bank president Charles Evans said he believed the Fed’s “extended period” language means no change to rates for at least three to four meetings of the policy-setting Federal Open Market Committee (FOMC) — or about six months.

“I’m hopeful that businesses will be surprised by the strength of demand over the next year and that they will actually begin to add workers, but it is quite a cautionary prospect for the US and that leads me to think that monetary policy is likely to continue to be accommodative for an extended period of time,” said Evans, who is not a voting member of the Fed’s policy-setting committee this year.

Yellen is US President Barack Obama’s top pick for vice chairman of the Fed board to replace Donald Kohn, a 40-year Fed veteran who plans to retire on June 23.

She is not a voting member of the policy-setting FOMC this year, but she will gain a vote if confirmed in the role of vice chairman.

Yellen said as the recovery takes hold, the time will come for the Fed to boost short-term interest rates.

To do so, it will likely increase the rate the Fed pays on the reserves banks hold at the Fed, an increase that should bring up other short-term interest rates as well.

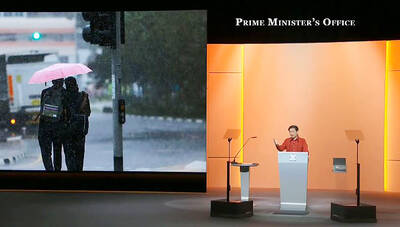

In his National Day Rally speech on Sunday, Singaporean Prime Minister Lawrence Wong (黃循財) quoted the Taiwanese song One Small Umbrella (一支小雨傘) to describe his nation’s situation. Wong’s use of such a song shows Singapore’s familiarity with Taiwan’s culture and is a perfect reflection of exchanges between the two nations, Representative to Singapore Tung Chen-yuan (童振源) said yesterday in a post on Facebook. Wong quoted the song, saying: “As the rain gets heavier, I will take care of you, and you,” in Mandarin, using it as a metaphor for Singaporeans coming together to face challenges. Other Singaporean politicians have also used Taiwanese songs

NORTHERN STRIKE: Taiwanese military personnel have been training ‘in strategic and tactical battle operations’ in Michigan, a former US diplomat said More than 500 Taiwanese troops participated in this year’s Northern Strike military exercise held at Lake Michigan by the US, a Pentagon-run news outlet reported yesterday. The Michigan National Guard-sponsored drill involved 7,500 military personnel from 36 nations and territories around the world, the Stars and Stripes said. This year’s edition of Northern Strike, which concluded on Sunday, simulated a war in the Indo-Pacific region in a departure from its traditional European focus, it said. The change indicated a greater shift in the US armed forces’ attention to a potential conflict in Asia, it added. Citing a briefing by a Michigan National Guard senior

CHIPMAKING INVESTMENT: J.W. Kuo told legislators that Department of Investment Review approval would be needed were Washington to seek a TSMC board seat Minister of Economic Affairs J.W. Kuo (郭智輝) yesterday said he received information about a possible US government investment in Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) and an assessment of the possible effect on the firm requires further discussion. If the US were to invest in TSMC, the plan would need to be reviewed by the Department of Investment Review, Kuo told reporters ahead of a hearing of the legislature’s Economics Committee. Kuo’s remarks came after US Secretary of Commerce Howard Lutnick on Tuesday said that the US government is looking into the federal government taking equity stakes in computer chip manufacturers that

US President Donald Trump on Friday said that Chinese President Xi Jinping (習近平) told him China would not invade Taiwan while Trump is in office. Trump made the remarks in an interview with Fox News, ahead of talks with Russian President Vladimir Putin over Moscow’s invasion of Ukraine. “I will tell you, you know, you have a very similar thing with President Xi of China and Taiwan, but I don’t believe there’s any way it’s going to happen as long as I’m here. We’ll see,” Trump said during an interview on Fox News’ Special Report. “He told me: ‘I will never do