European stocks rose for a third straight week after Standard & Poor’s said it was no longer planning an imminent downgrade of Greece’s debt and as the US Federal Reserve repeated a pledge to maintain record-low borrowing costs for an extended period.

UniCredit SpA gained 4.7 percent after Italy’s biggest bank posted earnings that beat estimates. Lloyds Banking Group PLC rallied after saying it may be profitable this year. Arriva PLC jumped 24 percent after the operator of Britain’s longest rail route said it received a takeover approach.

The STOXX Europe 600 Index gained 0.7 percent to 260.20, a third straight weekly advance. The measure retreated for the first two months of 2010 amid concern that Greece will struggle to rein in Europe’s biggest budget deficit.

“We were strongly caught in uncertainty over Greece, which hasn’t gone away but has brightened up,” said Rolf Biland, Zurich-based chief investment officer at VZ Vermoegenszentrum, which oversees about US$5.7 billion. “Markets are reacting again to the state of the economy and debt concerns have moved to the background. In the short-term we may see the recovery continue.”

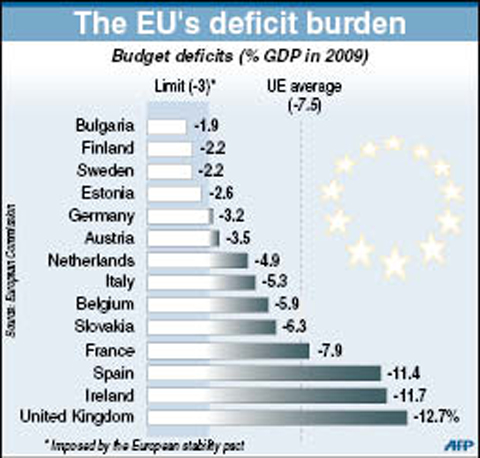

Greece had the threat of a cut to its credit rating reduced by S&P, which cited the country’s efforts to narrow a budget deficit that is more than four times the EU’s 3 percent limit. S&P affirmed the nation’s BBB+ rating, removing it from “creditwatch negative,” meaning the company is no longer considering an imminent reduction to the grade.

Officials from the 16 countries using the euro this week worked out a strategy for emergency loans in case Greece’s plan for 4.8 billion euros (US$6.6 billion) in tax increases and wage cuts fails to bring the deficit under control.

Acting Dutch Finance Minister Jan Kees de Jager said the IMF “will probably do part” of Greece’s financing needs. The EU said that “all EU states” are determined to help Greece if needed.

The STOXX 600 has surged 65 percent since March 9 last year as governments and central banks around the world maintained low interest rates and committed more than US$12 trillion to stimulate the economy.

The Fed said low rates were still needed to drive the world’s largest economy. The US central bank also said the labor market is stabilizing and business spending has risen, while inflation remains subdued.

National benchmark indexes rose in 12 out of 18 western European markets. The UK’s FTSE 100 rose 0.4 percent and Germany’s DAX advanced 0.6 percent, while France’s CAC 40 dropped 0.1 percent. Greece’s ASE Index slid 3.1 percent as the nation’s banks tumbled.

FREEDOM OF NAVIGATION: The UK would continue to reinforce ties with Taiwan ‘in a wide range of areas’ as a part of a ‘strong unofficial relationship,’ a paper said The UK plans to conduct more freedom of navigation operations in the Taiwan Strait and the South China Sea, British Secretary of State for Foreign, Commonwealth and Development Affairs David Lammy told the British House of Commons on Tuesday. British Member of Parliament Desmond Swayne said that the Royal Navy’s HMS Spey had passed through the Taiwan Strait “in pursuit of vital international freedom of navigation in the South China Sea.” Swayne asked Lammy whether he agreed that it was “proper and lawful” to do so, and if the UK would continue to carry out similar operations. Lammy replied “yes” to both questions. The

‘OF COURSE A COUNTRY’: The president outlined that Taiwan has all the necessary features of a nation, including citizens, land, government and sovereignty President William Lai (賴清德) discussed the meaning of “nation” during a speech in New Taipei City last night, emphasizing that Taiwan is a country as he condemned China’s misinterpretation of UN Resolution 2758. The speech was the first in a series of 10 that Lai is scheduled to give across Taiwan. It is the responsibility of Taiwanese citizens to stand united to defend their national sovereignty, democracy, liberty, way of life and the future of the next generation, Lai said. This is the most important legacy the people of this era could pass on to future generations, he said. Lai went on to discuss

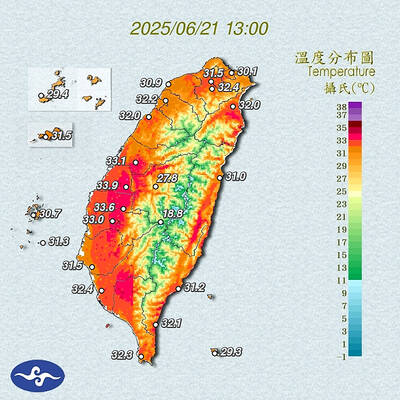

AMENDMENT: Climate change is expected to increase the frequency of high-temperature days, affecting economic productivity and public health, experts said The Central Weather Administration (CWA) is considering amending the Meteorological Act (氣象法) to classify “high temperatures” as “hazardous weather,” providing a legal basis for work or school closures due to extreme heat. CWA Administrator Lu Kuo-chen (呂國臣) yesterday said the agency plans to submit the proposed amendments to the Executive Yuan for review in the fourth quarter this year. The CWA has been monitoring high-temperature trends for an extended period, and the agency contributes scientific data to the recently established High Temperature Response Alliance led by the Ministry of Environment, Lu said. The data include temperature, humidity, radiation intensity and ambient wind,

SECOND SPEECH: All political parties should work together to defend democracy, protect Taiwan and resist the CCP, despite their differences, the president said President William Lai (賴清德) yesterday discussed how pro-Taiwan and pro-Republic of China (ROC) groups can agree to maintain solidarity on the issue of protecting Taiwan and resisting the Chinese Communist Party (CCP). The talk, delivered last night at Taoyuan’s Hakka Youth Association, was the second in a series of 10 that Lai is scheduled to give across Taiwan. Citing Taiwanese democracy pioneer Chiang Wei-shui’s (蔣渭水) slogan that solidarity brings strength, Lai said it was a call for political parties to find consensus amid disagreements on behalf of bettering the nation. All political parties should work together to defend democracy, protect Taiwan and resist