Asian stocks fell for a third week, dragging the MSCI Asia-Pacific Index to its longest stretch of declines in eight months, on concern the easing of government stimulus measures will jeopardize the global economic recovery.

Hyundai Motor Co sank 4.6 percent this week after South Korea’s government said it’s “unclear” if the economic rebound will be sustained. National Australia Bank Ltd, Australia’s largest bank by sales, lost 3.7 percent after the nation’s central bank lifted borrowing costs.

The MSCI Asia-Pacific Index slumped 0.08 percent to 116.37 this week. The gauge has surged 64 percent from its lowest in more than five years on March 9 amid signs lower borrowing costs and spending packages are reviving the global economy.

“We’re tending towards the view that we will see some relapse next year as people basically lose faith in governments’ ability to continue to come to the rescue,” said Peter Elston, a Singapore-based strategist at Aberdeen Asset Management PLC, which manages about US$234 billon.

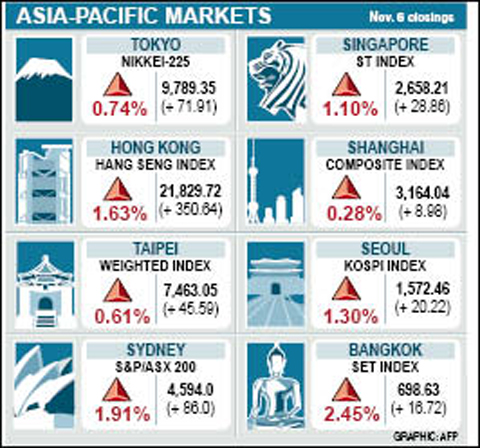

Japan’s Nikkei 225 Stock Average lost 2.5 percent this holiday-shortened week. Australia’s S&P/ASX 200 Index dropped 1.1 percent. The KOSPI Index fell 0.5 percent in Seoul. The Hang Seng Index rose 0.4 percent in Hong Kong.

Global policymakers are trying to ensure growth continues after the withdrawal of measures introduced to drag the global economy out of recession. This week, Australia raised benchmark interest rates for the second time in four weeks, and the Bank of Japan said it would maintain “the accommodative financial environment” even after deciding to end the purchase of corporate debt next month.

The MSCI Asia-Pacific Index has declined 4.3 percent from a 13-month high on Oct. 20, driving down its price-estimated earnings ratio to 21.7 on Thursday, the lowest level since May 1.

Taiwanese share prices are expected to move in a narrow range in the week ahead before market heavyweights report their sales figures for last month, dealers said on Friday.

With institutional investors sidelined amid cautious sentiment, the bellwether electronic sector is unlikely to gain sufficient momentum to steam ahead and lift the broader market, they said.

Worries over possible volatility on Wall Street may prevent investors from chasing prices here even if the market stages a rebound, they added.

The market is expected to encounter a cap at around 7,600 points next week, while downward pressure may see a technical floor at 7,300, dealers said.

For the week to Friday, the TAIEX rose 122.97 points, or 1.68 percent to 7,463.05 after a 4.04 percent increase a week earlier.

President Securities (統一證券) analyst Steven Huang said institutional investors may continue to pocket recent profit, in particular on large cap electronic firms ahead of their sales data for last month.

Other markets on Friday:

BANGKOK: Up 2.45 percent from Thursday. The Stock Exchange of Thailand rose 16.72 points to 698.63.

KUALA LUMPUR: Up 0.54 percent from Thursday. The Kuala Lumpur Composite Index gained 6.80 points to 1,260.76.

JAKARTA: Up 1.18 percent from Thursday. The Jakarta Composite Index gained 27.89 points to 2,395.10. The index has gained 77 percent since the start of the year.

MANILA: Down 0.44 percent from Thursday. The index fell 13.04 points to 2,931.47.

WELLINGTON: Up 0.50 percent from Thursday. The NZX-50 closed up 15.66 points at 3,160.16.

MUMBAI: Up 0.59 percent from Thursday. The 30-share SENSEX rose 94.38 points to 16,158.28.

Nvidia Corp yesterday unveiled its new high-speed interconnect technology, NVLink Fusion, with Taiwanese application-specific IC (ASIC) designers Alchip Technologies Ltd (世芯) and MediaTek Inc (聯發科) among the first to adopt the technology to help build semi-custom artificial intelligence (AI) infrastructure for hyperscalers. Nvidia has opened its technology to outside users, as hyperscalers and cloud service providers are building their own cost-effective AI chips, or accelerators, used in AI servers by leveraging ASIC firms’ designing capabilities to reduce their dependence on Nvidia. Previously, NVLink technology was only available for Nvidia’s own AI platform. “NVLink Fusion opens Nvidia’s AI platform and rich ecosystem for

‘WORLD’S LOSS’: Taiwan’s exclusion robs the world of the benefits it could get from one of the foremost practitioners of disease prevention and public health, Minister Chiu said Taiwan should be allowed to join the World Health Assembly (WHA) as an irreplaceable contributor to global health and disease prevention efforts, Minister of Foreign Affairs Lin Chia-lung (林佳龍) said yesterday. He made the comment at a news conference in Taipei, hours before a Taiwanese delegation was to depart for Geneva, Switzerland, seeking to meet with foreign representatives for a bilateral meeting on the sidelines of the WHA, the WHO’s annual decisionmaking meeting, which would be held from Monday next week to May 27. As of yesterday, Taiwan had yet to receive an invitation. Taiwan has much to offer to the international community’s

CAUSE AND EFFECT: China’s policies prompted the US to increase its presence in the Indo-Pacific, and Beijing should consider if this outcome is in its best interests, Lai said China has been escalating its military and political pressure on Taiwan for many years, but should reflect on this strategy and think about what is really in its best interest, President William Lai (賴清德) said. Lai made the remark in a YouTube interview with Mindi World News that was broadcast on Saturday, ahead of the first anniversary of his presidential inauguration tomorrow. The US has clearly stated that China is its biggest challenge and threat, with US President Donald Trump and US Secretary of Defense Pete Hegseth repeatedly saying that the US should increase its forces in the Indo-Pacific region

ALL TOGETHER: Only by including Taiwan can the WHA fully exemplify its commitment to ‘One World for Health,’ the representative offices of eight nations in Taiwan said The representative offices in Taiwan of eight nations yesterday issued a joint statement reiterating their support for Taiwan’s meaningful engagement with the WHO and for Taipei’s participation as an observer at the World Health Assembly (WHA). The joint statement came as Taiwan has not received an invitation to this year’s WHA, which started yesterday and runs until Tuesday next week. This year’s meeting of the decisionmaking body of the WHO in Geneva, Switzerland, would be the ninth consecutive year Taiwan has been excluded. The eight offices, which reaffirmed their support for Taiwan, are the British Office Taipei, the Australian Office Taipei, the