Morgan Stanley said yesterday it will sell its retail asset management business, including the Van Kampen division, to money manager Invesco Ltd for US$1.5 billion in a move to focus on institutional clients.

The deal, which includes US$500 million in cash and 44.1 million shares, will make Morgan Stanley Invesco’s largest shareholder, with a 9.4 percent equity stake. It boosts Invesco’s assets under management by US$119 billion to about US$536 billion.

New York-based Morgan Stanley said the sale allows it to focus on institutional clients such as pension plans, endowments, sovereign wealth funds and central banks, among others.

“By taking a minority interest in Invesco, Morgan Stanley will be able to realize significant value in partnership with a world-class player,” said Morgan Stanley co-president James Gorman, in a statement. “In addition, this transaction will mitigate certain affiliated product sales restrictions faced by Van Kampen portfolio managers since the closing of the Morgan Stanley Smith Barney joint venture.”

The transaction, which has been approved by the boards of both companies, is expected to close in the middle of next year.

At closing, Invesco will have about 700 investment professionals across all major global markets. Chief financial officer Loren Starr said the company expects the deal to add 11 percent to profit in the first 12 months after closing.

Despite the recent market rebound, Atlanta-based Invesco has continued to be hurt by sharply falling markets last year and early this year that reduced the value of the assets it manages for retail, institutional and wealthy clients around the world. The company’s second-quarter profit shrank by nearly 54 percent, as the value of the assets the company manages declined, eroding investment-fee revenue.

As of Sept. 30, assets under management totaled US$417 billion, up slightly year-over-year. Invesco was scheduled to report results for the third quarter yesterday.

In the second quarter, Morgan Stanley’s asset management operations reported a slightly wider pretax loss of US$239 million.

Assets under management at June 30 tumbled to US$361 billion from US$579 billion a year earlier. The decline reflected net customer outflows of US$121.5 billion over the course of the year, mainly in the company’s money market and long-term fixed income funds.

Morgan Stanley said its investment management group would include several institutional-focused businesses, including a long-only business (equity and fixed income), a direct hedge fund business, and a fund of funds business. It also will include a liquidity business and a merchant banking business, with the bank’s real estate, private equity and infrastructure units.

In Japan, Morgan Stanley Investment Management’s (MSIM) equity management operations will be sold to Invesco as part of the transaction, but the bank will retain its fixed income investment team and a sales and client service team to serve Japanese investors.

FREEDOM OF NAVIGATION: The UK would continue to reinforce ties with Taiwan ‘in a wide range of areas’ as a part of a ‘strong unofficial relationship,’ a paper said The UK plans to conduct more freedom of navigation operations in the Taiwan Strait and the South China Sea, British Secretary of State for Foreign, Commonwealth and Development Affairs David Lammy told the British House of Commons on Tuesday. British Member of Parliament Desmond Swayne said that the Royal Navy’s HMS Spey had passed through the Taiwan Strait “in pursuit of vital international freedom of navigation in the South China Sea.” Swayne asked Lammy whether he agreed that it was “proper and lawful” to do so, and if the UK would continue to carry out similar operations. Lammy replied “yes” to both questions. The

‘OF COURSE A COUNTRY’: The president outlined that Taiwan has all the necessary features of a nation, including citizens, land, government and sovereignty President William Lai (賴清德) discussed the meaning of “nation” during a speech in New Taipei City last night, emphasizing that Taiwan is a country as he condemned China’s misinterpretation of UN Resolution 2758. The speech was the first in a series of 10 that Lai is scheduled to give across Taiwan. It is the responsibility of Taiwanese citizens to stand united to defend their national sovereignty, democracy, liberty, way of life and the future of the next generation, Lai said. This is the most important legacy the people of this era could pass on to future generations, he said. Lai went on to discuss

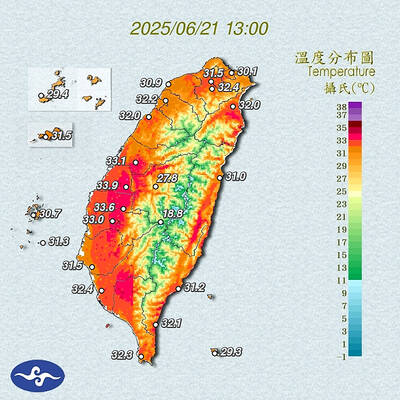

AMENDMENT: Climate change is expected to increase the frequency of high-temperature days, affecting economic productivity and public health, experts said The Central Weather Administration (CWA) is considering amending the Meteorological Act (氣象法) to classify “high temperatures” as “hazardous weather,” providing a legal basis for work or school closures due to extreme heat. CWA Administrator Lu Kuo-chen (呂國臣) yesterday said the agency plans to submit the proposed amendments to the Executive Yuan for review in the fourth quarter this year. The CWA has been monitoring high-temperature trends for an extended period, and the agency contributes scientific data to the recently established High Temperature Response Alliance led by the Ministry of Environment, Lu said. The data include temperature, humidity, radiation intensity and ambient wind,

SECOND SPEECH: All political parties should work together to defend democracy, protect Taiwan and resist the CCP, despite their differences, the president said President William Lai (賴清德) yesterday discussed how pro-Taiwan and pro-Republic of China (ROC) groups can agree to maintain solidarity on the issue of protecting Taiwan and resisting the Chinese Communist Party (CCP). The talk, delivered last night at Taoyuan’s Hakka Youth Association, was the second in a series of 10 that Lai is scheduled to give across Taiwan. Citing Taiwanese democracy pioneer Chiang Wei-shui’s (蔣渭水) slogan that solidarity brings strength, Lai said it was a call for political parties to find consensus amid disagreements on behalf of bettering the nation. All political parties should work together to defend democracy, protect Taiwan and resist