Asian stocks rose for the fourth week in five after better-than-estimated earnings and economic reports bolstered optimism the global economy is recovering.

Li & Fung Ltd (利豐), the biggest supplier of clothes and toys to Wal-Mart Stores Inc, surged in Hong Kong after earnings beat analyst estimates. James Hardie Industries NV, the No. 1 seller of home siding in the US, jumped 15 percent in Sydney, after the Federal Reserve said the recession was easing and the nation’s unemployment rate dropped. Komatsu Ltd and Hitachi Construction Machinery Co, Asia’s two largest makers of earthmoving equipment, rose in Tokyo following ratings upgrades.

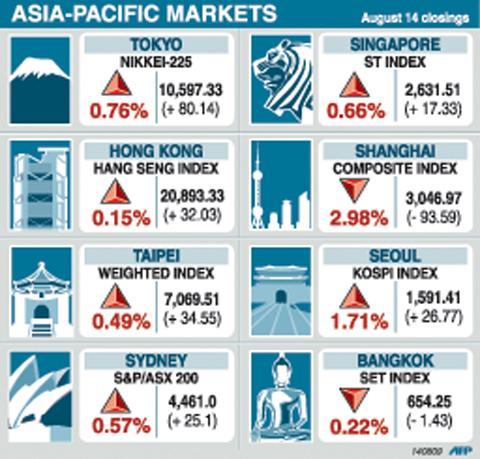

The MSCI Asia-Pacific Index rose 3.2 percent to 114.23 this week, with about five stocks advancing for every three that fell. The gauge has climbed 62 percent from its March 9 five-year low on speculation the worst of the global recession has passed. Japan’s Nikkei 225 Stock Average and Australia’s S&P/ASX 200 Index both advanced for the fifth straight week.

“With earnings and economic data coming in better than expected, there’s an element of panic buying going on,” said Prasad Patkar, who helps manage the equivalent of US$1.2 billion at Platypus Asset Management in Sydney. “The market’s full of reluctant bulls praying for the market to pull back because they want to deploy cash at better levels.”

Economic reports worldwide have driven stocks higher since March, lifting the average valuation of companies on the MSCI Asia-Pacific Index to 25 times estimated profit as of Thursday, compared with 16.8 times for the Standard & Poor’s 500 Index

In China, the Shanghai Composite Index sank 6.6 percent, its biggest weekly decline since February and the steepest drop among global benchmarks. Chinese shares entered a so-called correction on Aug. 12 amid concern a rally in equities had outpaced earnings prospects.

Li & Fung surged 19 percent to HK$27.80, the leading advance in Hong Kong’s Hang Seng Index. First-half profit growth of 13 percent beat analysts’ estimates, mainly on cost cuts.

Taiwanese share prices are expected to consolidate next week in the aftermath of the deadly Typhoon Morakot, while investors also wait for a cue from more US economic data, dealers said.

For the week to Friday, the weighted index rose 200.86 points, or 2.92 percent, to 7,069.51 after a 2.95 percent fall a week earlier.

Average daily turnover stood at NT$111.04 billion (US$3.47 billion), compared with last week’s NT$138.87 billion.

“The mood is cautious as the full impact of Typhoon Morakot begins to unfold. Investors are also waiting to see Wall Street’s performance after more economic data are due to be released next week,” Mars Hsu of Grand Cathay Securities Corp (大華證券) said.

“Trading volume would need to reach NT$150 billion to push the index above 7,200 points,” Hsu said, expecting the shares to consolidate in the 6,900-7,200 range in the week ahead.

“Reconstruction efforts [in the aftermath of Typhoon Morakot] are a must and investors see a tangible benefit” to construction and cement stocks, Andrew Teng (鄧安瀾) of Taiwan International Securities Corp (金鼎證券) said.

Other markets on Friday:

SYDNEY: Up 0.57 percent. The S&P/ASX 200 gained 25.1 points to close at 4,461.0. Dealers said sentiment was boosted by good results this week including a 10.3 percent jump in profits from telecoms giant Telstra.

SINGAPORE: Up 0.66 percent. The Straits Times Index advanced 17.33 points to 2,631.51.

JAKARTA: Down 0.40 percent. The Jakarta Composite Index lost 9.62 points to 2,386.86.

KUALA LUMPUR: Up 0.2 percent. The Kuala Lumpur Composite Index gained 2.38 points to 1,188.57.

MANILA: Down 0.21 percent. The composite index closed 6.05 points down at 2,850.01.

WELLINGTON: Up 0.72 percent. The NZX-50 rose 22.41 points to 3,151.26.

MUMBAI: Down 0.69 percent. The 30-share SENSEX fell 106.86 points to 15,411.63.

FALSE DOCUMENTS? Actor William Liao said he was ‘voluntarily cooperating’ with police after a suspect was accused of helping to produce false medical certificates Police yesterday questioned at least six entertainers amid allegations of evasion of compulsory military service, with Lee Chuan (李銓), a member of boy band Choc7 (超克7), and actor Daniel Chen (陳大天) among those summoned. The New Taipei City District Prosecutors’ Office in January launched an investigation into a group that was allegedly helping men dodge compulsory military service using falsified medical documents. Actor Darren Wang (王大陸) has been accused of being one of the group’s clients. As the investigation expanded, investigators at New Taipei City’s Yonghe Precinct said that other entertainers commissioned the group to obtain false documents. The main suspect, a man surnamed

DEMOGRAPHICS: Robotics is the most promising answer to looming labor woes, the long-term care system and national contingency response, an official said Taiwan is to launch a five-year plan to boost the robotics industry in a bid to address labor shortages stemming from a declining and aging population, the Executive Yuan said yesterday. The government approved the initiative, dubbed the Smart Robotics Industry Promotion Plan, via executive order, senior officials told a post-Cabinet meeting news conference in Taipei. Taiwan’s population decline would strain the economy and the nation’s ability to care for vulnerable and elderly people, said Peter Hong (洪樂文), who heads the National Science and Technology Council’s (NSTC) Department of Engineering and Technologies. Projections show that the proportion of Taiwanese 65 or older would

Democracies must remain united in the face of a shifting geopolitical landscape, former president Tsai Ing-wen (蔡英文) told the Copenhagen Democracy Summit on Tuesday, while emphasizing the importance of Taiwan’s security to the world. “Taiwan’s security is essential to regional stability and to defending democratic values amid mounting authoritarianism,” Tsai said at the annual forum in the Danish capital. Noting a “new geopolitical landscape” in which global trade and security face “uncertainty and unpredictability,” Tsai said that democracies must remain united and be more committed to building up resilience together in the face of challenges. Resilience “allows us to absorb shocks, adapt under

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) yesterday said it is building nine new advanced wafer manufacturing and packaging factories this year, accelerating its expansion amid strong demand for high-performance computing (HPC) and artificial intelligence (AI) applications. The chipmaker built on average five factories per year from 2021 to last year and three from 2017 to 2020, TSMC vice president of advanced technology and mask engineering T.S. Chang (張宗生) said at the company’s annual technology symposium in Hsinchu City. “We are quickening our pace even faster in 2025. We plan to build nine new factories, including eight wafer fabrication plants and one advanced