China National Petroleum Corp (CNPC, 中國石油天然氣) has offered between US$13.2 billion and US$14.5 billion for a 75 percent stake in an affiliate of Spanish oil major Repsol, a report said yesterday.

Executives at China’s biggest energy producer held talks on the offer for YPF, Repsol’s Argentine unit, and the initial reaction from the Spanish side was receptive, the South China Morning Post quoted unnamed sources as saying. It also said China National Offshore Oil Corp (CNOOC, 中國海洋石油), the country’s biggest offshore oil and gas producer, was understood to be eyeing up to a 25 percent stake in YPF.

CNOOC has reportedly proposed injecting at least US$15 billion into a joint venture that will own some of Repsol’s core exploration and production assets.

Repsol YPF announced last Thursday that it had received interest but no firm offers for a minority stake in its 84.14 percent-owned YPF.

Earlier reports said talks were continuing through Goldman Sachs, which has been in touch with a number of Asian groups, of which CNPC and CNOOC appear the most interested.

China’s government-backed oil companies are seizing on the economic crisis and the accompanying low asset prices to make landmark overseas acquisitions in a bid to feed the country’s growing economy.

The country’s three biggest oil companies may take part in Iraq’s second auction of oil and gas fields, as the Asian giant seeks to strengthen its foothold in the oil-rich nation, state media said yesterday.

The country’s top oil producer CNPC, Asia’s biggest refiner Sinopec (中國石化) and CNOOC, all bid last week in Iraq’s first auction of oil contracts since 2003, the China Daily said.

Only CNPC, in a tie up with British energy giant BP, won a service contract to develop the Rumaila oil field, which was also the only contract awarded in the auction.

CNPC and Sinopec may take part in the second auction, reported to be scheduled for the end of this year, as they “cannot neglect the rich oil and gas reserves in Iraq,” the China Daily said, citing an unnamed source.

CNOOC president Fu Chengyu (傅成玉) has said that the company might participate in the second round of bidding as well, the report said.

“Domestic oil companies will not miss this unprecedented opportunity,” said the source, adding that the firms may again join forces with foreign companies for the second round of bidding to reduce risk.

China has been active in gaining a share in the oil market in Iraq, which has the world’s third-biggest proven petroleum reserves.

Last year, CNPC signed a US$3 billion deal to develop the al-Ahdab oil field, marking the first major oil development deal that a foreign firm has secured in Iraq since the fall of former Iraqi president Saddam Hussein in 2003.

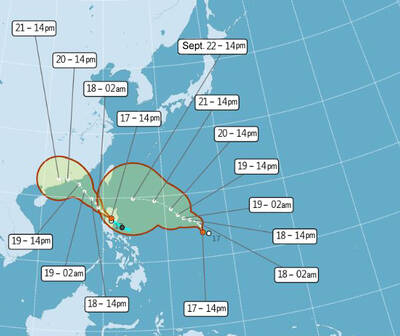

One of two tropical depressions that formed off Taiwan yesterday morning could turn into a moderate typhoon by the weekend, the Central Weather Administration (CWA) said yesterday. Tropical Depression No. 21 formed at 8am about 1,850km off the southeast coast, CWA forecaster Lee Meng-hsuan (李孟軒) said. The weather system is expected to move northwest as it builds momentum, possibly intensifying this weekend into a typhoon, which would be called Mitag, Lee said. The radius of the storm is expected to reach almost 200km, she said. It is forecast to approach the southeast of Taiwan on Monday next week and pass through the Bashi Channel

NO CHANGE: The TRA makes clear that the US does not consider the status of Taiwan to have been determined by WWII-era documents, a former AIT deputy director said The American Institute in Taiwan’s (AIT) comments that World War-II era documents do not determine Taiwan’s political status accurately conveyed the US’ stance, the US Department of State said. An AIT spokesperson on Saturday said that a Chinese official mischaracterized World War II-era documents as stating that Taiwan was ceded to the China. The remarks from the US’ de facto embassy in Taiwan drew criticism from the Ma Ying-jeou Foundation, whose director said the comments put Taiwan in danger. The Chinese-language United Daily News yesterday reported that a US State Department spokesperson confirmed the AIT’s position. They added that the US would continue to

The number of Chinese spouses applying for dependent residency as well as long-term residency in Taiwan has decreased, the Mainland Affairs Council said yesterday, adding that the reduction of Chinese spouses staying or living in Taiwan is only one facet reflecting the general decrease in the number of people willing to get married in Taiwan. The number of Chinese spouses applying for dependent residency last year was 7,123, down by 2,931, or 29.15 percent, from the previous year. The same census showed that the number of Chinese spouses applying for long-term residency and receiving approval last year stood at 2,973, down 1,520,

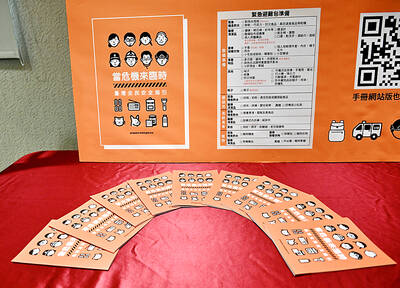

EASING ANXIETY: The new guide includes a section encouraging people to discuss the threat of war with their children and teach them how to recognize disinformation The Ministry of National Defense’s All-Out Defense Mobilization Agency yesterday released its updated civil defense handbook, which defines the types of potential military aggression by an “enemy state” and self-protection tips in such scenarios. The agency has released three editions of the handbook since 2022, covering information from the preparation of go-bags to survival tips during natural disasters and war. Compared with the previous edition, released in 2023, the latest version has a clearer focus on wartime scenarios. It includes a section outlining six types of potential military threats Taiwan could face, including destruction of critical infrastructure and most undersea cables, resulting in