Barclays Plc is in talks to sell Barclays Global Investors (BGI), the British bank said yesterday, with US fund manager BlackRock the frontrunner to land the asset manager, people familiar with the matter said.

BlackRock and Bank of New York Mellon are both in talks to buy BGI in a deal that could be worth about US$12 billion and might come early this week, the sources said, who asked not to be named as the talks are confidential.

PROPOSALS

The deal could see Barclays take a stake of up to 20 percent in the enlarged asset manager in a deal structured similarly to its planned sale of iShares, the sources said.

Barclays said yesterday it had received proposals for BGI and iShares from a number of parties, including BlackRock, and was continuing talks. But there were still “a number of significant open issues which could affect the nature and terms of any transaction,” it said.

Blackrock confirmed in a separate statement that it was still in talks with Barclays about its potential purchase of BGI, but there was no certainty a transaction would be agreed upon “or, if agreed upon, completed.”

‘GO SHOP’ CLAUSE

Barclays agreed to sell iShares, which is part of BGI, to buy-out house CVC for £3 billion (US$4.8 billion) in April, but a “go shop” clause allows it to seek higher offers until June 18.

Barclays shares were roughly flat, shortly after opening. They closed at £2.85 on Friday.

Bankers said last month the bank would be willing to sell BGI if offers approached the US$12 billion price level.

BlackRock is likely to get funding for a deal from Middle Eastern investors, possibly including some Barclays shareholders, media reports said.

The Qatar Investment Authority and Adia, the government investment arm of Abu Dhabi, are in talks alongside Kuwait’s KIO to inject US$3 billion in BlackRock for a 12 percent stake, the UK’s Sunday Telegraph newspaper said.

BOARD SEATS

Barclays is likely to get two seats on BlackRock’s board if it completes a deal, one of which is likely to go to Bob Diamond, president of the bank and head of BGI, the Telegraph said.

A deal would land a windfall for Diamond and hundreds of BGI employees because of a lucrative equity ownership plan dating back to 2000 that could leave staff owning 10 percent of BGI.

CVC has the right to match any rival bids for iShares — or all of BGI — and gets a US$175 million break fee if it is left out of the deal.

FREEDOM OF NAVIGATION: The UK would continue to reinforce ties with Taiwan ‘in a wide range of areas’ as a part of a ‘strong unofficial relationship,’ a paper said The UK plans to conduct more freedom of navigation operations in the Taiwan Strait and the South China Sea, British Secretary of State for Foreign, Commonwealth and Development Affairs David Lammy told the British House of Commons on Tuesday. British Member of Parliament Desmond Swayne said that the Royal Navy’s HMS Spey had passed through the Taiwan Strait “in pursuit of vital international freedom of navigation in the South China Sea.” Swayne asked Lammy whether he agreed that it was “proper and lawful” to do so, and if the UK would continue to carry out similar operations. Lammy replied “yes” to both questions. The

‘OF COURSE A COUNTRY’: The president outlined that Taiwan has all the necessary features of a nation, including citizens, land, government and sovereignty President William Lai (賴清德) discussed the meaning of “nation” during a speech in New Taipei City last night, emphasizing that Taiwan is a country as he condemned China’s misinterpretation of UN Resolution 2758. The speech was the first in a series of 10 that Lai is scheduled to give across Taiwan. It is the responsibility of Taiwanese citizens to stand united to defend their national sovereignty, democracy, liberty, way of life and the future of the next generation, Lai said. This is the most important legacy the people of this era could pass on to future generations, he said. Lai went on to discuss

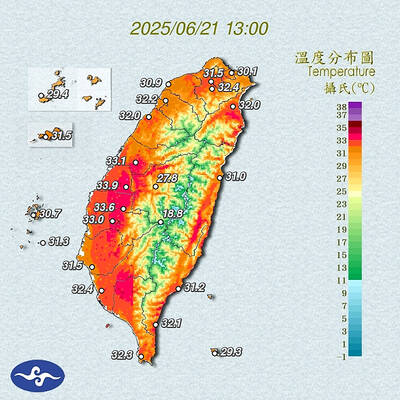

AMENDMENT: Climate change is expected to increase the frequency of high-temperature days, affecting economic productivity and public health, experts said The Central Weather Administration (CWA) is considering amending the Meteorological Act (氣象法) to classify “high temperatures” as “hazardous weather,” providing a legal basis for work or school closures due to extreme heat. CWA Administrator Lu Kuo-chen (呂國臣) yesterday said the agency plans to submit the proposed amendments to the Executive Yuan for review in the fourth quarter this year. The CWA has been monitoring high-temperature trends for an extended period, and the agency contributes scientific data to the recently established High Temperature Response Alliance led by the Ministry of Environment, Lu said. The data include temperature, humidity, radiation intensity and ambient wind,

SECOND SPEECH: All political parties should work together to defend democracy, protect Taiwan and resist the CCP, despite their differences, the president said President William Lai (賴清德) yesterday discussed how pro-Taiwan and pro-Republic of China (ROC) groups can agree to maintain solidarity on the issue of protecting Taiwan and resisting the Chinese Communist Party (CCP). The talk, delivered last night at Taoyuan’s Hakka Youth Association, was the second in a series of 10 that Lai is scheduled to give across Taiwan. Citing Taiwanese democracy pioneer Chiang Wei-shui’s (蔣渭水) slogan that solidarity brings strength, Lai said it was a call for political parties to find consensus amid disagreements on behalf of bettering the nation. All political parties should work together to defend democracy, protect Taiwan and resist