European stocks rose for a third week, the longest streak of gains in more than 10 months, after the Obama administration’s plan to rid lenders of toxic assets spurred a rally in banks.

Barclays PLC soared 66 percent as the US Treasury said it would finance as much as US$1 trillion in purchases of distressed assets and the UK’s third-biggest bank passed stress tests conducted by the UK financial regulator. Lloyds Banking Group PLC and Commerzbank AG jumped more than 30 percent.

The Dow Jones STIOXX 600 Index advanced 2.7 percent to 177.17 last week. The measure has rebounded 12 percent since reaching a 12-year low on March 9 as US Treasury Secretary Timothy Geithner outlined plans to buy illiquid securities and loans that have caused credit to dry up.

“The market right now is ready to give him the benefit of the doubt,” said Monika Rosen, head of research at Bank of Austria Asset Management in Vienna, which oversees about US$41 billion. “We are getting more substance but we still want to see a little more fundamental news.”

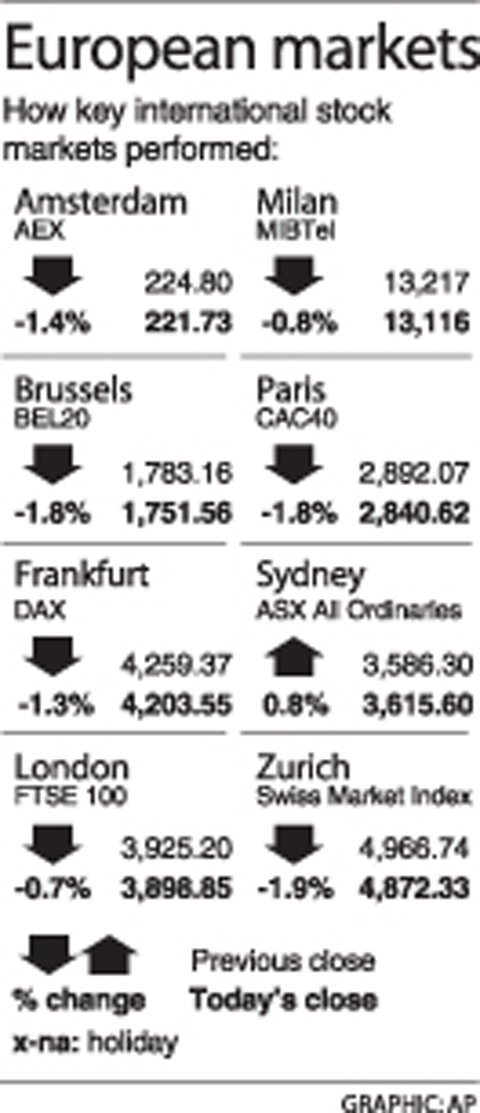

National benchmark indexes climbed in 14 out of 18 western European markets. The UK’s FTSE 100 rose 1.5 percent, while France’s CAC 40 advanced 1.8 percent. German’s DAX added 3.3 percent as Volkswagen AG surged.

European banks have led a 21-month market rout as they notched up more than US$380 billion in credit losses and writedowns, contributing to worldwide losses of more than IS$1.2 trillion. The US Treasury’s proposal to remove toxic assets from balance sheets will use between US$75 billion and US$100 billion from the US$700 billion Troubled Asset Relief Program enacted last year, giving the government “purchasing power” of US$500 billion. The Treasury said the program could double “over time.”

Barclays soared 66 percent on optimism the bank may not need to raise additional capital after it passed the Financial Services Authority’s tests.

Barclays has asked bidders to submit offers for its iShares exchange-traded funds business by Friday. The unit could be valued at as much as £4.5 billion (US$6.5 billion), said Jonathan Pierce, an analyst at Credit Suisse Group AG in London.

Lloyds surged 38 percent as the UK’s biggest mortgage lender this week offered to exchange more than £7.5 billion in bonds into senior unsecured debt to boost its financial strength.

Commerzbank, the second-largest German lender, jumped 63 percent as supervisory Board Chairman Klaus-Peter Mueller said he doesn’t expect the German government to raise its stake after agreeing to buy a holding as part of an earlier rescue plan.

Larger rival Deutsche Bank AG also advanced, rising 16 percent. Chief executive officer Josef Ackermann said Germany’s biggest bank had a good start to this year and is expected to return to profit after scaling back risky businesses and shedding toxic assets.

Volkswagen soared 19 percent as part-owner Porsche SE refinanced a 10 billion euro (US$13.3 billion) loan, spurring speculation the sports-car maker will increase its stake.

DEFENSE: The first set of three NASAMS that were previously purchased is expected to be delivered by the end of this year and deployed near the capital, sources said Taiwan plans to procure 28 more sets of M-142 High Mobility Artillery Rocket Systems (HIMARS), as well as nine additional sets of National Advanced Surface-to-Air Missile Systems (NASAMS), military sources said yesterday. Taiwan had previously purchased 29 HIMARS launchers from the US and received the first 11 last year. Once the planned purchases are completed and delivered, Taiwan would have 57 sets of HIMARS. The army has also increased the number of MGM-140 Army Tactical Missile Systems (ATACMS) purchased from 64 to 84, the sources added. Each HIMARS launch pod can carry six Guided Multiple Launch Rocket Systems, capable of

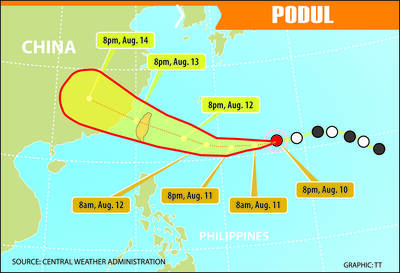

TRAJECTORY: The severe tropical storm is predicted to be closest to Taiwan on Wednesday and Thursday, and would influence the nation to varying degrees, a forecaster said The Central Weather Administration (CWA) yesterday said it would likely issue a sea warning for Tropical Storm Podul tomorrow morning and a land warning that evening at the earliest. CWA forecaster Lin Ting-yi (林定宜) said the severe tropical storm is predicted to be closest to Taiwan on Wednesday and Thursday. As of 2pm yesterday, the storm was moving west at 21kph and packing sustained winds of 108kph and gusts of up to 136.8kph, the CWA said. Lin said that the tropical storm was about 1,710km east of Oluanpi (鵝鑾鼻), Taiwan’s southernmost tip, with two possible trajectories over the next one

Tropical Storm Podul strengthened into a typhoon at 8pm yesterday, the Central Weather Administration (CWA) said, with a sea warning to be issued late last night or early this morning. As of 8pm, the typhoon was 1,020km east of Oluanpi (鵝鑾鼻), Taiwan’s southernmost tip, moving west at 23kph. The storm carried maximum sustained winds of 119kph and gusts reaching 155kph, the CWA said. Based on the tropical storm’s trajectory, a land warning could be issued any time from midday today, it added. CWA forecaster Chang Chun-yao (張竣堯) said Podul is a fast-moving storm that is forecast to bring its heaviest rainfall and strongest

CRITICISM: It is deeply regrettable that China, which is pursuing nuclear weapons, has suppressed Taiwan, which is pursuing peace, a government official said Representative to Japan Lee Yi-yang (李逸洋) yesterday accused Beijing of interference after Taiwan’s official delegation to the Nagasaki Peace Memorial Ceremony in Japan was assigned seating in the “international non-governmental organizations [NGO]” area. “Taiwan is by no means an international NGO, but a sovereign nation that is active on the international stage,” Lee said. Lee and Chen Ming-chun (陳銘俊), head of the Taipei Economic and Cultural Office (TECO) in Fukuoka, attended the ceremony in Nagasaki yesterday, which marked the 80th anniversary of the atomic bombing of the city. That followed Lee’s attendance at the Hiroshima Peace Memorial Ceremony on Wednesday