Asian stocks posted their biggest weekly gain since August 2007 amid optimism governments worldwide will succeed in reviving lending and global growth.

The MSCI Asia Pacific Index has rallied 21 percent from a five-year low on March 9, technically entering a bull market.

Toyota Motor Corp, which gets 37 percent of its sales from North America, gained 10 percent in Tokyo on optimism the US Treasury’s plan to remove banks’ “toxic” assets will revive economic growth.

BHP Billiton Ltd, the world’s No. 1 mining company, climbed 5.7 percent in Sydney after prices for oil and metals advanced.

MSCI’s Asian benchmark gauge rose 7.5 percent to 85.49 last week, its best weekly performance since the week ended on Aug. 24, 2007.

A measure tracking energy stocks on the MSCI gauge rallied 11 percent this week, the sharpest jump among the 10 industry groups on the MSCI Asia Pacific Index.

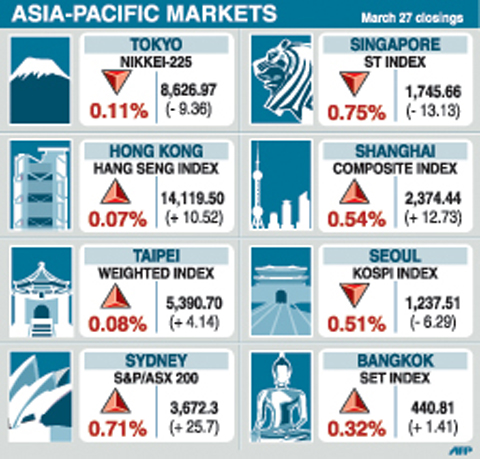

Hong Kong’s Hang Seng Index rose 10 percent, its best week since October. Japan’s Nikkei 225 Stock Average climbed 8.6 percent while South Korea’s Kospi Index added 5.7 percent.

Governments from the US to Japan are widening measures to ease the financial crisis, which has caused more than US$1 trillion of losses worldwide, and to avert what the World Bank predicts will be the first global economic contraction since World War II.

Toyota jumped 10 percent to ¥3,260 (US$33.31) in Tokyo last week. Sony Corp, which gets a quarter of its sales from the US, surged 13 percent to ¥2,225.

Samsung Electronics Co, the world’s biggest maker of computer memory, rose 7.8 percent to 584,000 won in Seoul.

BHP climbed 5.7 percent to A$34.01 (US$23.56) in Sydney. Cnooc Ltd., China’s biggest offshore oil producer, jumped 11 percent to HK$8.33 (US$1.07) in Hong Kong. Crude oil added 2.6 percent to US$52.38 a barrel in New York last week.

A measure of six primary metals traded in London fell 0.1 percent.

Rio Tinto Group, the world’s third-largest mining company, soared 21 percent to A$56.88. The company said on Thursday that it had an alternative plan should Aluminum Corp of China’s US$19.5 billion investment deal fail.

MSCI’s Asian benchmark gauge rose 13.7 percent this month, which was the biggest monthly gain since October 1998, when governments were cutting interest rates to alleviate the Asian financial crisis.

The gains pared the measure’s drop this year to 4.6 percent and raised the average valuation of companies on the MSCI Asia Pacific Index yesterday to 16.7 times profit, the highest level since December 2007.

TAIPEI

Taiwanese share prices could face resistance in the week ahead after their recent strong showing, amid worries about earnings reports from high-tech firms scheduled for early next month, dealers said.

They said profit-taking could cap any gains, although the financial and industrial sectors could see a bounce from rotational buying.

“It is time for the market to have a correction, which is expected to make it technically healthier for another round of upside,” President Securities analyst Steven Huang said.

For the week to Friday, the weighted index rose 429.09 points or 8.65 percent to 5,390.70. The index gained 1.31 percent the previous week.

Huang said a central bank decision to stop a cycle of interest rate cuts, after seven reductions since September, had boosted investor confidence.

“I do not expect the market will suffer any plunge at a time when there seems to be some light at the end of the tunnel in an economic recession,” he said.

Other regional markets

KUALA LUMPUR: Flat. The Kuala Lumpur Composite Index lost 0.04 points to 885.43.

Genting fell 2.1 percent to 3.78 ringgit while Sime Darby gained 1.7 percent to 5.90.

JAKARTA: Up 3.01 percent. The Jakarta Composite Index jumped 42.77 points to 1,462.74. The market was closed on Thursday for a national holiday.

MANILA: Up 2.61 percent. The composite index added 51.99 points to 2,040.25.

WELLINGTON: Up 1.42 percent. The benchmark NZX-50 index rose 37.22 points to 2,653.48.

MUMBAI: Up 0.45 percent. The 30-share SENSEX index rose 45.39 points to 10,048.49, its fifth straight day of gains.

Nvidia Corp yesterday unveiled its new high-speed interconnect technology, NVLink Fusion, with Taiwanese application-specific IC (ASIC) designers Alchip Technologies Ltd (世芯) and MediaTek Inc (聯發科) among the first to adopt the technology to help build semi-custom artificial intelligence (AI) infrastructure for hyperscalers. Nvidia has opened its technology to outside users, as hyperscalers and cloud service providers are building their own cost-effective AI chips, or accelerators, used in AI servers by leveraging ASIC firms’ designing capabilities to reduce their dependence on Nvidia. Previously, NVLink technology was only available for Nvidia’s own AI platform. “NVLink Fusion opens Nvidia’s AI platform and rich ecosystem for

‘WORLD’S LOSS’: Taiwan’s exclusion robs the world of the benefits it could get from one of the foremost practitioners of disease prevention and public health, Minister Chiu said Taiwan should be allowed to join the World Health Assembly (WHA) as an irreplaceable contributor to global health and disease prevention efforts, Minister of Foreign Affairs Lin Chia-lung (林佳龍) said yesterday. He made the comment at a news conference in Taipei, hours before a Taiwanese delegation was to depart for Geneva, Switzerland, seeking to meet with foreign representatives for a bilateral meeting on the sidelines of the WHA, the WHO’s annual decisionmaking meeting, which would be held from Monday next week to May 27. As of yesterday, Taiwan had yet to receive an invitation. Taiwan has much to offer to the international community’s

CAUSE AND EFFECT: China’s policies prompted the US to increase its presence in the Indo-Pacific, and Beijing should consider if this outcome is in its best interests, Lai said China has been escalating its military and political pressure on Taiwan for many years, but should reflect on this strategy and think about what is really in its best interest, President William Lai (賴清德) said. Lai made the remark in a YouTube interview with Mindi World News that was broadcast on Saturday, ahead of the first anniversary of his presidential inauguration tomorrow. The US has clearly stated that China is its biggest challenge and threat, with US President Donald Trump and US Secretary of Defense Pete Hegseth repeatedly saying that the US should increase its forces in the Indo-Pacific region

ALL TOGETHER: Only by including Taiwan can the WHA fully exemplify its commitment to ‘One World for Health,’ the representative offices of eight nations in Taiwan said The representative offices in Taiwan of eight nations yesterday issued a joint statement reiterating their support for Taiwan’s meaningful engagement with the WHO and for Taipei’s participation as an observer at the World Health Assembly (WHA). The joint statement came as Taiwan has not received an invitation to this year’s WHA, which started yesterday and runs until Tuesday next week. This year’s meeting of the decisionmaking body of the WHO in Geneva, Switzerland, would be the ninth consecutive year Taiwan has been excluded. The eight offices, which reaffirmed their support for Taiwan, are the British Office Taipei, the Australian Office Taipei, the