Asian currencies declined this week after reports in Taiwan, Malaysia, the Philippines and China showed exports slumped as the global slowdown reduced consumer spending overseas.

South Korea’s won led the losses after the central bank cut its benchmark interest rate to a record on Thursday to revive an economy headed for the first recession in more than a decade. Investor appetite for riskier emerging-market assets has faded this year, sending eight of the 10 most-active Asian currencies lower against the US dollar. A regional gauge of stocks has dropped more than 8 percent this year.

“Most Asian currencies will continue to weaken at least through to the middle of this year,” said David Mann, senior foreign-exchange strategist at Standard Chartered PLC in Hong Kong. “The worsening data in the region are likely to keep policy makers comfortable with seeing some weakness in their exchange rates.”

The New Taiwan dollar declined 0.9 percent this week to NT$34.05, near the weakest level since 2004.

The won declined 1.5 percent for the week to 1,404.20 per dollar, according to Seoul Money Brokerage Services. Indonesia’s rupiah fell 0.7 percent this week to 11,760.

The MSCI Asia-Pacific Index of regional shares lost 2 percent this week, snapping a two-week gain.

The peso rose 0.4 percent to 47.115 a dollar on Friday in Manila for a five-day gain of 0.2 percent, according to Tullett Prebon PLC.

The Philippine currency may still weaken to 49 by the end of the quarter as exports and remittances from Filipinos working abroad falter, said Radhika Rao, an economist at IDEAglobal Ltd in Singapore.

The yen had its first weekly gain versus the euro in three weeks, trading at ¥117.96 from ¥118.85 a week ago. The dollar traded at ¥91.41 from ¥91.89 last week.

Elsewhere, the Thai baht depreciated 0.4 percent for the week to 35.14 and Malaysia’s ringgit dropped 0.3 percent to 3.6055 per US dollar. India’s rupee strengthened 0.08 percent to 48.6538, from 48.6950 a week ago. Vietnam’s dong was little changed at 17,484.5.

“Our outlook for the Taiwan dollar is still weak,” said Thio Chin Loo, senior currency strategist at BNP Paribas in Singapore. Regarding the US stimulus plan, she said “the situation is still gloomy, which supports the dollar against Taiwan.”

The euro slipped slightly against the US dollar on Friday after dismal eurozone data and as G7 finance chiefs began a two-day meeting on the spreading global financial crisis.

The euro was at US$1.2856 at 10pm GMT after US$1.2861 late on Thursday in New York.

The euro spent the week trading in a narrow band around US$1.30.

“Any sign of optimism that is able to bubble up in the markets recently has been consistently battered down by fading returns and the constant sense of risk looming over investors heads,” John Kicklighter at Forex Capital Markets said.

In late New York trading, the US dollar fell to 1.1622 Swiss francs from SF1.1630 late on Thursday.

The pound rose to US$1.4349 from US$1.4266.

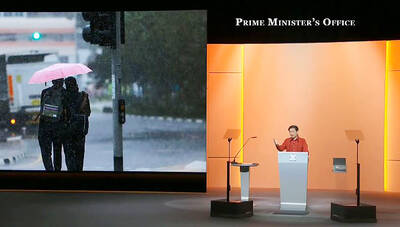

In his National Day Rally speech on Sunday, Singaporean Prime Minister Lawrence Wong (黃循財) quoted the Taiwanese song One Small Umbrella (一支小雨傘) to describe his nation’s situation. Wong’s use of such a song shows Singapore’s familiarity with Taiwan’s culture and is a perfect reflection of exchanges between the two nations, Representative to Singapore Tung Chen-yuan (童振源) said yesterday in a post on Facebook. Wong quoted the song, saying: “As the rain gets heavier, I will take care of you, and you,” in Mandarin, using it as a metaphor for Singaporeans coming together to face challenges. Other Singaporean politicians have also used Taiwanese songs

NORTHERN STRIKE: Taiwanese military personnel have been training ‘in strategic and tactical battle operations’ in Michigan, a former US diplomat said More than 500 Taiwanese troops participated in this year’s Northern Strike military exercise held at Lake Michigan by the US, a Pentagon-run news outlet reported yesterday. The Michigan National Guard-sponsored drill involved 7,500 military personnel from 36 nations and territories around the world, the Stars and Stripes said. This year’s edition of Northern Strike, which concluded on Sunday, simulated a war in the Indo-Pacific region in a departure from its traditional European focus, it said. The change indicated a greater shift in the US armed forces’ attention to a potential conflict in Asia, it added. Citing a briefing by a Michigan National Guard senior

CHIPMAKING INVESTMENT: J.W. Kuo told legislators that Department of Investment Review approval would be needed were Washington to seek a TSMC board seat Minister of Economic Affairs J.W. Kuo (郭智輝) yesterday said he received information about a possible US government investment in Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) and an assessment of the possible effect on the firm requires further discussion. If the US were to invest in TSMC, the plan would need to be reviewed by the Department of Investment Review, Kuo told reporters ahead of a hearing of the legislature’s Economics Committee. Kuo’s remarks came after US Secretary of Commerce Howard Lutnick on Tuesday said that the US government is looking into the federal government taking equity stakes in computer chip manufacturers that

CLAMPING DOWN: At the preliminary stage on Jan. 1 next year, only core personnel of the military, the civil service and public schools would be subject to inspections Regular checks are to be conducted from next year to clamp down on military personnel, civil servants and public-school teachers with Chinese citizenship or Chinese household registration, the Mainland Affairs Council (MAC) said yesterday. Article 9-1 of the Act Governing Relations Between the People of the Taiwan Area and the Mainland Area (臺灣地區與大陸地區人民關係條例) stipulates that Taiwanese who obtain Chinese household registration or a Chinese passport would be deprived of their Taiwanese citizenship and lose their right to work in the military, public service or public schools, it said. To identify and prevent the illegal employment of holders of Chinese ID cards or