Wall Street’s rollercoaster ride showed no sign of ending over the past week as the market churned lower and waited for help from Washington in easing the deep economic crisis.

In the week to Friday, the main indexes lost ground as investors appeared confused by the Obama administration’s bank rescue plan and awaited implementation of a massive economic stimulus.

The Dow Jones Industrial Average slid 5.2 percent over the week to end Friday at 7,850.41, reversing course after gains in the prior week. The tech-rich NASDAQ composite fell 3.6 percent to 1,534.36 and the broad-market Standard & Poor’s 500 tumbled 4.8 percent to 826.84.

The sputtering action on Wall Street, which gets a respite with the Presidents Day holiday tomorrow, has been a reaction to news from Washington as economic reports show the recession deepening.

The markets saw renewed turmoil after US Treasury Secretary Timothy Geithner unveiled a bank rescue plan that was short on details, disappointing many investors. The indexes were unable to recover in the week from Tuesday’s slide.

“The problem with Secretary Geithner’s announcement — and the reason for an almost 5 percent drop in stocks after it was announced — is the continued lack of detail on exactly how the plan will be implemented,” economist Ethan Harris at Barclays Capital said. “Even with aggressive policy action, the markets will punish any lack of clarity or sign of hesitation from policy makers.”

Harris said the market’s fragility “comes from repeated false recoveries in the market and the sense that aggressive policy is the only thing preventing a much more severe recession and capital markets sell-off.”

“The policy playbook is simple: don’t promise more than you can deliver, don’t promise big programs without explaining how they will work, and don’t outline how bad the economy is unless you immediately offer a clear, credible turnaround plan,” he added.

Michael Jones, chief strategist at Riverfront Investment Group, said the new administration “missed a golden opportunity to restore market confidence.”

John Ryding at RDQ Economics pointed out that the markets were disappointed but could recover as details of the plan to help banks remove toxic assets from their balance sheets emerge.

“We are looking forward to getting more information on the [plan] in the very near future and, if properly designed, we think it will be well-received by the markets,” Ryding said.

David Kotok at Cumberland Advisors said the stock market is losing confidence in the new administration.

“We see a Washington in disarray. We see repeated failure in assembling a cabinet,” he said. “What we don’t see is a stimulus bill that will put people back to work promptly.”

Fred Dickson, market strategist at DA Davidson, said markets remain nervous about the impact of the massive economic stimulus and reports that the administration will unveil a new program to help struggling homeowners who are facing defaults.

Bonds gained as investors sought shelter from the turmoil. The yield on the 10-year Treasury bond fell to 2.882 percent from 2.979 percent a week earlier, and that on the 30-year bond eased slightly to 3.682 percent from 3.683 percent. Bond yields and prices move in opposite directions.

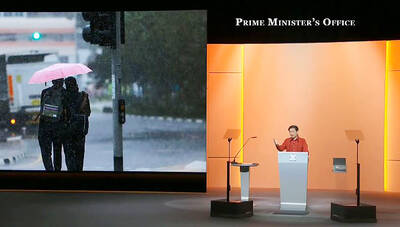

In his National Day Rally speech on Sunday, Singaporean Prime Minister Lawrence Wong (黃循財) quoted the Taiwanese song One Small Umbrella (一支小雨傘) to describe his nation’s situation. Wong’s use of such a song shows Singapore’s familiarity with Taiwan’s culture and is a perfect reflection of exchanges between the two nations, Representative to Singapore Tung Chen-yuan (童振源) said yesterday in a post on Facebook. Wong quoted the song, saying: “As the rain gets heavier, I will take care of you, and you,” in Mandarin, using it as a metaphor for Singaporeans coming together to face challenges. Other Singaporean politicians have also used Taiwanese songs

NORTHERN STRIKE: Taiwanese military personnel have been training ‘in strategic and tactical battle operations’ in Michigan, a former US diplomat said More than 500 Taiwanese troops participated in this year’s Northern Strike military exercise held at Lake Michigan by the US, a Pentagon-run news outlet reported yesterday. The Michigan National Guard-sponsored drill involved 7,500 military personnel from 36 nations and territories around the world, the Stars and Stripes said. This year’s edition of Northern Strike, which concluded on Sunday, simulated a war in the Indo-Pacific region in a departure from its traditional European focus, it said. The change indicated a greater shift in the US armed forces’ attention to a potential conflict in Asia, it added. Citing a briefing by a Michigan National Guard senior

CHIPMAKING INVESTMENT: J.W. Kuo told legislators that Department of Investment Review approval would be needed were Washington to seek a TSMC board seat Minister of Economic Affairs J.W. Kuo (郭智輝) yesterday said he received information about a possible US government investment in Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) and an assessment of the possible effect on the firm requires further discussion. If the US were to invest in TSMC, the plan would need to be reviewed by the Department of Investment Review, Kuo told reporters ahead of a hearing of the legislature’s Economics Committee. Kuo’s remarks came after US Secretary of Commerce Howard Lutnick on Tuesday said that the US government is looking into the federal government taking equity stakes in computer chip manufacturers that

CLAMPING DOWN: At the preliminary stage on Jan. 1 next year, only core personnel of the military, the civil service and public schools would be subject to inspections Regular checks are to be conducted from next year to clamp down on military personnel, civil servants and public-school teachers with Chinese citizenship or Chinese household registration, the Mainland Affairs Council (MAC) said yesterday. Article 9-1 of the Act Governing Relations Between the People of the Taiwan Area and the Mainland Area (臺灣地區與大陸地區人民關係條例) stipulates that Taiwanese who obtain Chinese household registration or a Chinese passport would be deprived of their Taiwanese citizenship and lose their right to work in the military, public service or public schools, it said. To identify and prevent the illegal employment of holders of Chinese ID cards or