,

Asian stocks fell for the first week in three on mounting signs the deepening global recession is hurting corporate profits.

PetroChina Co (中石油), the nation’s largest oil producer, lost 9.3 percent as crude prices plunged amid mounting signs of weakness in global economies. Toyota Motor Corp’s forecast for its first-ever operating loss dragged South Korean rivals Hyundai Motor Co and Kia Motors Corp more than 16 percent lower on concern automobile demand is plummeting.

“The global economic situation is continuing to deteriorate,” said Karma Wilson, Sydney-based head of Asian equities at AMP Capital Investors, which manages about US$61 billion.

The MSCI Asia Pacific Index fell 2.4 percent to 87.40 this week. Gauges of energy stocks and raw-material producers posted the biggest declines among the benchmark index’s 10 industry groups last week.

The MSCI Asia Pacific has slumped 45 percent this year, the worst annual performance in its two-decade history, as the most severe financial crisis since the Great Depression dragged economies worldwide into recessions. Losses and writedowns tied to the collapse the US subprime-mortgage market rose above US$1 trillion last week.

Analysts have cut their average earnings-per-share estimate for companies on the index by 29 percent since the beginning of the year, data compiled by Bloomberg shows.

Japanese government reports in the week showed that factory output tumbled last month, while unemployment rose and exports plunged the most on record.

TAIPEI

Taiwan shares are expected to trade in a strict range this week ahead of the upcoming four-day New Year holiday, dealers said on Friday.

With many foreign institutional investors away for their holidays, daily turnover was expected to remain low, keeping the market quiet, they said.

Mid and small cap stocks may have a better chance to turn active, while electronic and financial heavyweights are likely to remain mired in low liquidity, they added.

The market is expected to face strong technical resistance at about 4,500 points this week, while there may be a floor at around 4,300 points, dealers said.

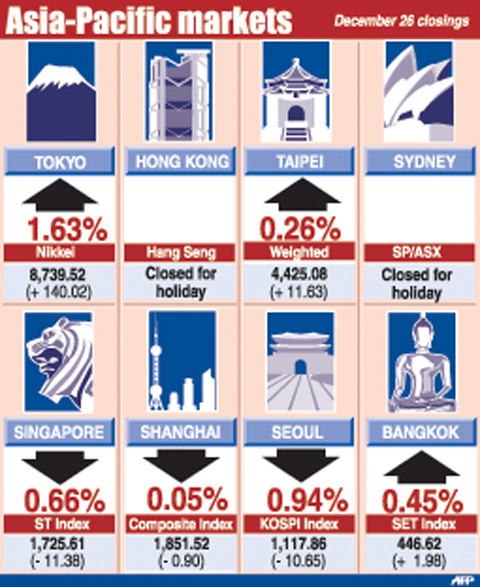

For the week to Friday, the weighted index fell 269.44 points or 5.74 percent to 4,425.08 after a 4.76 percent increase a week earlier.

Average daily turnover stood at NT$44.08 billion (US1.34 billion), compared with US$71.38 billion dollars a week ago.

Taiwan International Securities (金鼎證券) analyst Arch Shih (施博元) said consolidation was a good way for the market to digest remaining selling pressure after recent heavy losses.

“The pre-holiday sessions with many investors sidelined could not come at a better time to facilitate narrow fluctuations and make the market technically healthier,” Shih said.

Shih said small and medium-sized shipping, cement and chemical stocks may attract more market attention after they were recently hit hard.

Other regional markets:

KUALA LUMPUR: Malaysian shares closed 0.3 percent lower.

The Kuala Lumpur Composite Index lost 2.27 points to close at 867.35 with a thin volume of 178 million shares worth 156.34 million ringgit.

JAKARTA: Indonesian shares ended 0.3 percent higher.

The Jakarta Composite Index rose 4.28 points to 1,340.89.

Bank Mandiri closed 1.3 percent higher at 2,025 rupiah while Bank Negara ended three percent up at 680.

Cellular provider Indosat rose 3.7 percent to 5,600 rupiah.

MUMBAI: Indian shares fell 2.51 percent.

The benchmark 30-share Sensex index fell 239.8 points to 9,328.92 as investors unwound positions on concerns of weak corporate quarterly earnings in January, dealers said.

Taiwan is projected to lose a working-age population of about 6.67 million people in two waves of retirement in the coming years, as the nation confronts accelerating demographic decline and a shortage of younger workers to take their place, the Ministry of the Interior said. Taiwan experienced its largest baby boom between 1958 and 1966, when the population grew by 3.78 million, followed by a second surge of 2.89 million between 1976 and 1982, ministry data showed. In 2023, the first of those baby boom generations — those born in the late 1950s and early 1960s — began to enter retirement, triggering

ECONOMIC BOOST: Should the more than 23 million people eligible for the NT$10,000 handouts spend them the same way as in 2023, GDP could rise 0.5 percent, an official said Universal cash handouts of NT$10,000 (US$330) are to be disbursed late next month at the earliest — including to permanent residents and foreign residents married to Taiwanese — pending legislative approval, the Ministry of Finance said yesterday. The Executive Yuan yesterday approved the Special Act for Strengthening Economic, Social and National Security Resilience in Response to International Circumstances (因應國際情勢強化經濟社會及民生國安韌性特別條例). The NT$550 billion special budget includes NT$236 billion for the cash handouts, plus an additional NT$20 billion set aside as reserve funds, expected to be used to support industries. Handouts might begin one month after the bill is promulgated and would be completed within

NO CHANGE: The TRA makes clear that the US does not consider the status of Taiwan to have been determined by WWII-era documents, a former AIT deputy director said The American Institute in Taiwan’s (AIT) comments that World War-II era documents do not determine Taiwan’s political status accurately conveyed the US’ stance, the US Department of State said. An AIT spokesperson on Saturday said that a Chinese official mischaracterized World War II-era documents as stating that Taiwan was ceded to the China. The remarks from the US’ de facto embassy in Taiwan drew criticism from the Ma Ying-jeou Foundation, whose director said the comments put Taiwan in danger. The Chinese-language United Daily News yesterday reported that a US State Department spokesperson confirmed the AIT’s position. They added that the US would continue to

IMPORTANT BACKER: China seeks to expel US influence from the Indo-Pacific region and supplant Washington as the global leader, MAC Minister Chiu Chui-cheng said China is preparing for war to seize Taiwan, Mainland Affairs Council (MAC) Minister Chiu Chui-cheng (邱垂正) said in Washington on Friday, warning that Taiwan’s fall would trigger a regional “domino effect” endangering US security. In a speech titled “Maintaining the Peaceful and Stable Status Quo Across the Taiwan Strait is in Line with the Shared Interests of Taiwan and the United States,” Chiu said Taiwan’s strategic importance is “closely tied” to US interests. Geopolitically, Taiwan sits in a “core position” in the first island chain — an arc stretching from Japan, through Taiwan and the Philippines, to Borneo, which is shared by