After slashing inventory and cutting expenses, the US retail industry is still bracing for the largest overall quarterly profit decline in at least nine years when merchants report their first-quarter earnings this week.

Faced with one of the worst consumer spending climates in almost two decades, stores are going to have to find clever ways to attract increasingly thrifty shoppers contending with higher gas and food bills and a slumping housing market.

Wal-Mart Stores Inc launched a new online feature Friday that offers tips from financial expert Ellie Kay on how consumers can stretch their budgets, even beyond the store. Rival Target Corp aims to add some sizzle to an inexpensive clothing collection by designer Rogan Gregory by selling it first at upscale Barneys New York before shipping it to its own shops for a limited period.

“What smart stores are doing is creating a new store experience — both online and off — so you are not just a merchandise retailer but an experience retailer,” said Craig Johnson, president of consultancy Customer Growth Partners. “It’s all about what you can do to set yourself apart.”

Retailers reported better-than expected sales at established stores last month, but that did not mean that shoppers have been in the mood to splurge. Business was boosted by heavy discounting and a quirk in the calendar that meant an extra shopping day compared with the year-ago period.

The strain is expected to surface in the industry’s first-quarter earnings, which are expected to show an overall 14.9 percent decline, said Ken Perkins, president of RetailMetrics LLC, a research company in Swampscott, Massachusetts. He said that would be the biggest year-over-year quarterly decline since at least 1999, when he started tracking the data.

That outlook compared with a projection in January for 5.3 percent profit growth.

Still, the earnings picture would be worse if retailers had not been prudent about cutting costs and scaling back inventory, Perkins said.

Analysts had feared that increased discounting across the industry would lead more retailers to lower their earnings outlooks, but that didn’t happen. In fact, Kohl’s Corp and teen retailer Aeropostale Inc were among a handful of retailers that raised their earnings forecasts based on better-than-expected sales.

But while plenty of stores, from grocery chains to discounters, are offering enticements to try to grab a share of the US$107 billion in tax rebate checks being distributed to 130 million households, analysts expect that any lift will be modest and temporary.

“I don’t see any fundamental changes that are going to loosen up the wallet for consumers,” said Michael Appel, a managing director of Quest Turnaround Advisors. He said that stores are going to have to keep discounting and also come up with “exciting merchandise.”

Wal-Mart, the world’s largest retailer, reported a better-than-expected sales gain for last month, but said that the “economy continues to get tougher” and customers are increasingly unable to stretch their dollars to the next payday.

FREEDOM OF NAVIGATION: The UK would continue to reinforce ties with Taiwan ‘in a wide range of areas’ as a part of a ‘strong unofficial relationship,’ a paper said The UK plans to conduct more freedom of navigation operations in the Taiwan Strait and the South China Sea, British Secretary of State for Foreign, Commonwealth and Development Affairs David Lammy told the British House of Commons on Tuesday. British Member of Parliament Desmond Swayne said that the Royal Navy’s HMS Spey had passed through the Taiwan Strait “in pursuit of vital international freedom of navigation in the South China Sea.” Swayne asked Lammy whether he agreed that it was “proper and lawful” to do so, and if the UK would continue to carry out similar operations. Lammy replied “yes” to both questions. The

‘OF COURSE A COUNTRY’: The president outlined that Taiwan has all the necessary features of a nation, including citizens, land, government and sovereignty President William Lai (賴清德) discussed the meaning of “nation” during a speech in New Taipei City last night, emphasizing that Taiwan is a country as he condemned China’s misinterpretation of UN Resolution 2758. The speech was the first in a series of 10 that Lai is scheduled to give across Taiwan. It is the responsibility of Taiwanese citizens to stand united to defend their national sovereignty, democracy, liberty, way of life and the future of the next generation, Lai said. This is the most important legacy the people of this era could pass on to future generations, he said. Lai went on to discuss

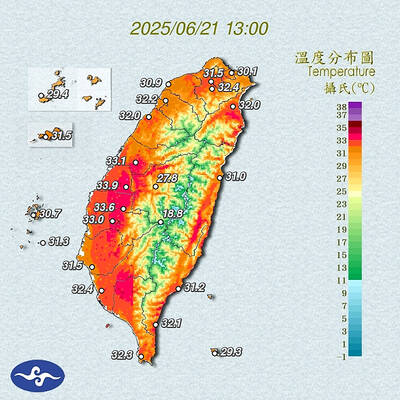

AMENDMENT: Climate change is expected to increase the frequency of high-temperature days, affecting economic productivity and public health, experts said The Central Weather Administration (CWA) is considering amending the Meteorological Act (氣象法) to classify “high temperatures” as “hazardous weather,” providing a legal basis for work or school closures due to extreme heat. CWA Administrator Lu Kuo-chen (呂國臣) yesterday said the agency plans to submit the proposed amendments to the Executive Yuan for review in the fourth quarter this year. The CWA has been monitoring high-temperature trends for an extended period, and the agency contributes scientific data to the recently established High Temperature Response Alliance led by the Ministry of Environment, Lu said. The data include temperature, humidity, radiation intensity and ambient wind,

SECOND SPEECH: All political parties should work together to defend democracy, protect Taiwan and resist the CCP, despite their differences, the president said President William Lai (賴清德) yesterday discussed how pro-Taiwan and pro-Republic of China (ROC) groups can agree to maintain solidarity on the issue of protecting Taiwan and resisting the Chinese Communist Party (CCP). The talk, delivered last night at Taoyuan’s Hakka Youth Association, was the second in a series of 10 that Lai is scheduled to give across Taiwan. Citing Taiwanese democracy pioneer Chiang Wei-shui’s (蔣渭水) slogan that solidarity brings strength, Lai said it was a call for political parties to find consensus amid disagreements on behalf of bettering the nation. All political parties should work together to defend democracy, protect Taiwan and resist