The US Federal Reserve is expected to aggressively lower interest rates in its intensified battle against the US credit crisis and spreading economic weakness. The question is whether all of the effort will turn the tide.

Fed Chairman Ben Bernanke and his colleagues have already been working overtime, employing a variety of novel approaches to keep the economy out of a recession or at least moderate the impact of any downturn.

More relief was expected yesterday when the central bank was expected to cut a key interest rate by between one-half and a full percentage point.

"There is no reason for the Fed not to be aggressive," said Mark Zandi, chief economist at Moody's Economy.com. "The economy is in a recession, the financial system is in disarray and inflation is low."

The federal funds rate, the interest that banks charge each other on overnight loans, currently stands at 3 percent, down from 4.25 percent at the beginning of this year. That was before global market turmoil in January prompted an emergency three-quarter-point cut on Jan. 22 and a half-point move eight days later, the biggest reductions in a single month in more than a quarter-century.

Many economists believe that the Fed was to deliver another three-quarter-point cut or perhaps even a full one-point reduction at yesterday's meetings because Fed officials will not want to disappoint fragile financial markets, which have been on a rollercoaster ride in recent days as they have watched Bear Stearns Cos, the fifth-largest US investment house, suddenly be brought down by the equivalent of a run on the bank.

JPMorgan Chase & Co stepped in to announce it was purchasing Bear Stearns at a fire-sale price on Sunday in a deal helped along with a pledge that the Fed would supply a US$30 billion line of credit to back up Bear Stearns' assets.

That offer over the weekend was the latest move by a central bank that has been pulling out all of the stops, including using procedures from the Depression era of the 1930s, to pump cash into the financial system. Analysts, who faulted Bernanke for being slow to recognize the gravity of the situation last year, now give him high praise for bringing all the Fed's powers to bear.

"The Fed is doing what it can to come to rescue an economy that faces potentially a huge meltdown in financial markets," said Lyle Gramley, a former Fed governor and now an analyst with Stanford Financial Group. "The Fed is acting as a lender of last resort and being very aggressive and innovative."

In addition to providing support for the Bear Stearns sale, the Fed also announced on Sunday one of the broadest expansions of its lending authority since the 1930s, saying it would allow securities dealers for at least the next six months to borrow directly from the Fed. That privilege, until now, had been confined to commercial banks.

At the same time, the Fed announced it was cutting the interest rate on those direct loans from the Fed, through a facility known as the Fed's discount window, by a quarter-point to 3.25 percent.

In other moves, the Fed last week announced that it would lend up to US$200 billion of Treasury securities that it owns to investment banks starting next Thursday for a period of up to 28 days in return for a like amount of the investment banks' shunned mortgage-backed securities. The Fed also announced recently that it was boosting the size of special loans it has been making since December to commercial banks.

The scale of these actions underscored the threat facing the economy from a severe credit squeeze that began with a wave of defaults on subprime mortgages last year but has now spread to other parts of the credit markets, triggering multibillion-dollar losses by some of the US' largest financial institutions.

Analysts said it will take some time to determine whether the Fed has done enough to stem the wave of panic among investors.

The rapid decline of Bear Stearns stock -- which had a market value of about US$20 billion in January, only to collapse to a sales price of US$2 per share, or about US$236 million this past weekend -- has given investors the chills.

"The Fed is trying very hard to figure out how to calm the markets down, but so far it hasn't been very successful," said David Wyss, chief economist at Standard & Poor's in New York. "Markets are worried that there might be another Bear Stearns out there."

NATIONAL SECURITY THREAT: An official said that Guan Guan’s comments had gone beyond the threshold of free speech, as she advocated for the destruction of the ROC China-born media influencer Guan Guan’s (關關) residency permit has been revoked for repeatedly posting pro-China content that threatens national security, the National Immigration Agency said yesterday. Guan Guan has said many controversial things in her videos posted to Douyin (抖音), including “the red flag will soon be painted all over Taiwan” and “Taiwan is an inseparable part of China,” while expressing hope for expedited “reunification.” The agency received multiple reports alleging that Guan Guan had advocated for armed reunification last year. After investigating, the agency last month issued a notice requiring her to appear and account for her actions. Guan Guan appeared as required,

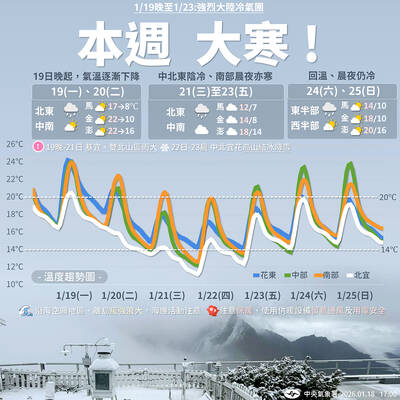

A strong cold air mass is expected to arrive tonight, bringing a change in weather and a drop in temperature, the Central Weather Administration (CWA) said. The coldest time would be early on Thursday morning, with temperatures in some areas dipping as low as 8°C, it said. Daytime highs yesterday were 22°C to 24°C in northern and eastern Taiwan, and about 25°C to 28°C in the central and southern regions, it said. However, nighttime lows would dip to about 15°C to 16°C in central and northern Taiwan as well as the northeast, and 17°C to 19°C elsewhere, it said. Tropical Storm Nokaen, currently

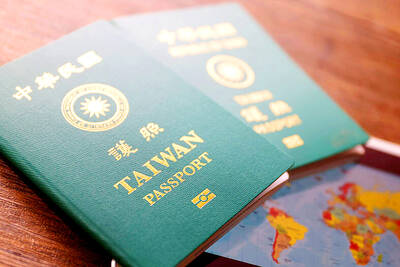

PAPERS, PLEASE: The gang exploited the high value of the passports, selling them at inflated prices to Chinese buyers, who would treat them as ‘invisibility cloaks’ The Yilan District Court has handed four members of a syndicate prison terms ranging from one year and two months to two years and two months for their involvement in a scheme to purchase Taiwanese passports and resell them abroad at a massive markup. A Chinese human smuggling syndicate purchased Taiwanese passports through local criminal networks, exploiting the passports’ visa-free travel privileges to turn a profit of more than 20 times the original price, the court said. Such criminal organizations enable people to impersonate Taiwanese when entering and exiting Taiwan and other countries, undermining social order and the credibility of the nation’s

‘SALAMI-SLICING’: Beijing’s ‘gray zone’ tactics around the Pratas Islands have been slowly intensifying, with the PLA testing Taiwan’s responses and limits, an expert said The Ministry of National Defense yesterday condemned an intrusion by a Chinese drone into the airspace of the Pratas Islands (Dongsha Islands, 東沙群島) as a serious disruption of regional peace. The ministry said it detected the Chinese surveillance and reconnaissance drone entering the southwestern parts of Taiwan’s air defense identification zone early yesterday, and it approached the Pratas Islands at 5:41am. The ministry said it immediately notified the garrison stationed in the area to enhance aerial surveillance and alert levels, and the drone was detected in the islands’ territorial airspace at 5:44am, maintaining an altitude outside the effective range of air-defense weaponry. Following