As sovereign wealth funds ride to the rescue of ailing Western banks, Japan is considering investing some of its trillion-dollar currency reserves to help revitalize its own economy.

The debate about whether to shift public funds into riskier assets comes as Asia's largest economy wrestles with huge national debts and a shrinking population that is struggling to support a growing number of pensioners.

The architects of Japan's sovereign fund plan hope that it will reverse Tokyo's slow decline as an international financial center and perhaps even bring a return to the heyday of the late 1980s.

PHOTO: AFP

"After the bubble economy collapsed, Japan's financial sector became ultra-conservative," former financial services minister Yuji Yamamoto, who is spearheading the sovereign fund initiative, said in an interview.

"If Japan could attract market players as competitive as those in Singapore, then I think the corporate culture of Japanese banks and securities firms will also have to change," he said.

"Japan will never recover the global standards that it had before just by leaving everything up to Japan's megabanks and investment banks," he said.

The plan is to lure star fund managers from overseas to manage the money, giving a boost to the financial services industry at a time when foreign investors are becoming increasingly disillusioned with Japan.

Supporters of the scheme hope that the presence of the major league fund managers will help to reinvigorate the Tokyo markets in the same way that Singapore has benefitted from the creation of its sovereign funds.

"If we continue to let the Tokyo market go down it will probably be too late to solve the problem," said Yukari Sato, a ruling party lawmaker and former economist with a US investment bank.

Japan's foreign exchange reserves -- which topped US$1 trillion last month -- are the second-largest in the world after those of China, whose sovereign fund has invested US$3 billion in private equity firm Blackstone and US$5 billion in Wall Street giant Morgan Stanley.

About 95 percent of Japan's foreign reserves are invested in US Treasuries, which are seen as a safe asset and it would be hard to sell those without the approval of the US government, Yamamoto said.

But Japan also has ¥1.75 trillion (US$17 billion) from interest and dividend income in the reserves which could be invested without selling any US government bonds, he said.

Some of Japan's ¥150 trillion in public pension funds may also be more actively managed to try to improve returns.

"We should seek full risk diversification. Right now public pension funds are basically being managed using Japanese government bonds with very low returns," Sato said.

The rise of sovereign wealth funds in Russia, Asia and the Middle East has led to concerns in some recipient countries about a lack of transparency.

The funds have already set their sights on Japan. Last year a Dubai fund bought a chunk of electronics icon Sony Corp and just last month a fund controlled by Singapore snapped up the Tokyo Westin hotel.

A Japanese sovereign fund could potentially have a huge impact on global financial markets, but experts say there are many obstacles to its creation.

Japan's huge foreign reserves stash is the result of years of currency intervention by the government to keep the yen down against the dollar and help its companies compete with international rivals.

If Japan dumps even some of its dollar holdings, the ailing greenback could plunge even further, hurting Japan's exporters and threatening the gradual recovery of its economy from recession in the 1990s, experts warned.

"There have been big fights with the US about this intervention," said Martin Schulz, an economist at the Fujitsu Research Institute.

He said if Japan now started to invest the funds, it would feel the political heat from Washington and risk driving down the dollar.

Last week the greenback slumped to an eight-year low in the &yound;101 range.

If the dollar falls below the symbolic ¥100 level, "there will be strong discussions about intervention again," Schulz said.

"If one hand is buying dollars against yen and the other hand starts to sell dollars for international investments you have the opposite effect on the exchange rate," he said.

Indeed, the powerful Finance Ministry, which oversees the foreign reserves, has shown little enthusiasm for a sovereign fund. Finance Minister Fukushiro Nukaga has suggested that the risks might be too high.

Even if the fund is set up, there are doubts about whether the finance ministry would allow foreign brokers to run the show.

"It might happen elsewhere like in the Middle East but not in Japan. You would have bureaucrats sitting there," Schulz said.

FREEDOM OF NAVIGATION: The UK would continue to reinforce ties with Taiwan ‘in a wide range of areas’ as a part of a ‘strong unofficial relationship,’ a paper said The UK plans to conduct more freedom of navigation operations in the Taiwan Strait and the South China Sea, British Secretary of State for Foreign, Commonwealth and Development Affairs David Lammy told the British House of Commons on Tuesday. British Member of Parliament Desmond Swayne said that the Royal Navy’s HMS Spey had passed through the Taiwan Strait “in pursuit of vital international freedom of navigation in the South China Sea.” Swayne asked Lammy whether he agreed that it was “proper and lawful” to do so, and if the UK would continue to carry out similar operations. Lammy replied “yes” to both questions. The

‘OF COURSE A COUNTRY’: The president outlined that Taiwan has all the necessary features of a nation, including citizens, land, government and sovereignty President William Lai (賴清德) discussed the meaning of “nation” during a speech in New Taipei City last night, emphasizing that Taiwan is a country as he condemned China’s misinterpretation of UN Resolution 2758. The speech was the first in a series of 10 that Lai is scheduled to give across Taiwan. It is the responsibility of Taiwanese citizens to stand united to defend their national sovereignty, democracy, liberty, way of life and the future of the next generation, Lai said. This is the most important legacy the people of this era could pass on to future generations, he said. Lai went on to discuss

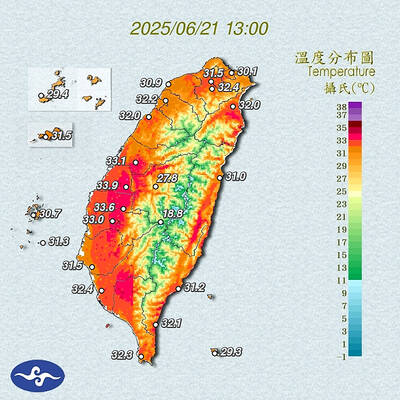

AMENDMENT: Climate change is expected to increase the frequency of high-temperature days, affecting economic productivity and public health, experts said The Central Weather Administration (CWA) is considering amending the Meteorological Act (氣象法) to classify “high temperatures” as “hazardous weather,” providing a legal basis for work or school closures due to extreme heat. CWA Administrator Lu Kuo-chen (呂國臣) yesterday said the agency plans to submit the proposed amendments to the Executive Yuan for review in the fourth quarter this year. The CWA has been monitoring high-temperature trends for an extended period, and the agency contributes scientific data to the recently established High Temperature Response Alliance led by the Ministry of Environment, Lu said. The data include temperature, humidity, radiation intensity and ambient wind,

SECOND SPEECH: All political parties should work together to defend democracy, protect Taiwan and resist the CCP, despite their differences, the president said President William Lai (賴清德) yesterday discussed how pro-Taiwan and pro-Republic of China (ROC) groups can agree to maintain solidarity on the issue of protecting Taiwan and resisting the Chinese Communist Party (CCP). The talk, delivered last night at Taoyuan’s Hakka Youth Association, was the second in a series of 10 that Lai is scheduled to give across Taiwan. Citing Taiwanese democracy pioneer Chiang Wei-shui’s (蔣渭水) slogan that solidarity brings strength, Lai said it was a call for political parties to find consensus amid disagreements on behalf of bettering the nation. All political parties should work together to defend democracy, protect Taiwan and resist