Wall Street and European stocks finished mostly higher on Tuesday after billionaire investor Warren Buffett offered to help out troubled bond insurers, easing some of the markets' concerns about further deterioration in the credit markets. The Dow Jones industrials rose more than 130 points.

In an interview on CNBC, Buffett said his Berkshire Hathaway Inc holding company has offered a second level of insurance on up to US$800 billion in municipal bonds. The reinsurance offer is for bond insurers Ambac Financial Group Inc, MBIA Inc and Financial Guaranty Insurance Co known as FGIC.

Word of the offer gave some investors relief although Buffett said a deal would only back municipal bonds, and not the risky and complicated financial instruments that many see as more likely to have problems. Still, further assurances on the soundness of municipal bonds could help shore up Wall Street's confidence and reinforce the differences in quality among various levels of debt.

Russell Croft, portfolio manager at Croft Leominster Investment Management in Baltimore, said Buffett's move gives the market a bit of needed confidence.

"It's a good thing to see," he said.

He also agreed with Buffett's assessment that stocks are mostly fairly valued.

"We could definitely test some more lows going forward but there was a pretty good drop-off there again and I think people are trying to take advantage of it to get some quality stocks at cheaper prices," Croft said.

"The offer by Warren Buffett is a signal that bond insurers haven't been as badly hit as originally thought, particularly considering that one insurer rejected the offer," said Christian Tegllund Blaabjerg, market strategist at Saxo Bank in Copenhagen. "The move is sure to be a trigger for a short-term rally in equity markets."

The Dow Jones STOXX 600 gained 3.3 percent, to 323.0. In terms of national markets, the UK's FTSE-100 rose 3.5 percent to 5910.0, while France's CAC-40 advanced 3.4 percent to 4840.7. Germany's DAX rose 3.3 percent to 6967.8.

But some analysts remained cautious.

Investors should be careful not to read too much into the market's advance, said Len Blum, managing director of Westwood Capital. He noted that recent readings on US retail spending show that Americans are hurting financially.

"Stock markets will have good days in bear markets," he said, adding that he believes more problems will be uncovered in the financial sector. "We haven't seen all the losses. Even if you have some investors willing to bottom fish, or very sophisticated investors like Warren Buffet willing to invest at this point, the financial sector is still really sick."

European financial stocks bounced back, with Dutch Bank Fortis making the most gains on the EuroSTOXX 50 index with a 7.1 percent increase to close at 14.05 euros (US$20.43).

Unicredito Italia also posted strong gains, rising 6.4 percent to 4.85 euros, while French bank BNP Paribas rose 3.7 percent to 60.67 euros and Credit Agricole 3.8 percent to 18.66 euros in France. Barclays was the best-performing bank on the FTSE-100, up 6.2 percent, while Credit Suisse ended the session 2.5 percent higher, having spent the morning in the red after posting its fourth-quarter results.

Insurance companies also advanced, with Legal & General rising 5.8 percent, Prudential gaining 5.5 percent and Royal & Sun Alliance rising 4.4 percent in London. Elsewhere, Sampo shares rose 6.1 percent to 17.50 euros in Helsinki and Cattolica Assicurazioni gained 4.8 percent to 29.92 euros in Italy.

The Dow rose 133.40, or 1.09 percent, to 12,373.41. The blue chip index was up more than 200 points earlier in the session.

Broader stock indicators were mixed. The Standard & Poor's 500 index advanced 9.73, or 0.73 percent, to 1,348.86, and the NASDAQ composite index edged down 0.02, or less than 0.01 percent, to 2,320.04.

Stocks' gains come a day after Wall Street finished moderately higher. Monday's session followed sharp losses last week.

Bond prices fell on Tuesday after Buffett's announcement. The yield on the benchmark 10-year Treasury note, which moves opposite its price, rose to 3.67 percent from 3.63 percent late on Monday.

The US dollar was mixed against other major currencies, while gold prices fell.

Advancing issues outnumbered decliners by 3 to 2 on the New York Stock Exchange, where volume came to 1.36 billion shares.

The Russell 2000 index of smaller companies rose 5.73, or 0.82 percent, to 705.48.

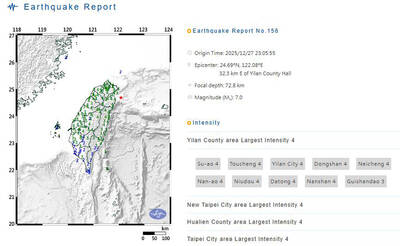

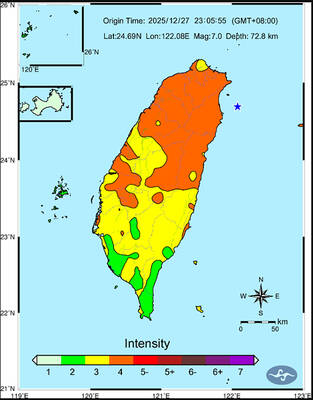

A magnitude 7.0 earthquake struck off Yilan at 11:05pm yesterday, the Central Weather Administration (CWA) said. The epicenter was located at sea, about 32.3km east of Yilan County Hall, at a depth of 72.8km, CWA data showed There were no immediate reports of damage. The intensity of the quake, which gauges the actual effect of a seismic event, measured 4 in Yilan County area on Taiwan’s seven-tier intensity scale, the data showed. It measured 4 in other parts of eastern, northern and central Taiwan as well as Tainan, and 3 in Kaohsiung and Pingtung County, and 2 in Lienchiang and Penghu counties and 1

FOREIGN INTERFERENCE: Beijing would likely intensify public opinion warfare in next year’s local elections to prevent Lai from getting re-elected, the ‘Yomiuri Shimbun’ said Internal documents from a Chinese artificial intelligence (AI) company indicated that China has been using the technology to intervene in foreign elections, including propaganda targeting Taiwan’s local elections next year and presidential elections in 2028, a Japanese newspaper reported yesterday. The Institute of National Security of Vanderbilt University obtained nearly 400 pages of documents from GoLaxy, a company with ties to the Chinese government, and found evidence that it had apparently deployed sophisticated, AI-driven propaganda campaigns in Hong Kong and Taiwan to shape public opinion, the Yomiuri Shimbun reported. GoLaxy provides insights, situation analysis and public opinion-shaping technology by conducting network surveillance

‘POLITICAL GAME’: DPP lawmakers said the motion would not meet the legislative threshold needed, and accused the KMT and the TPP of trivializing the Constitution The Legislative Yuan yesterday approved a motion to initiate impeachment proceedings against President William Lai (賴清德), saying he had undermined Taiwan’s constitutional order and democracy. The motion was approved 61-50 by lawmakers from the main opposition Chinese Nationalist Party (KMT) and the smaller Taiwan People’s Party (TPP), who together hold a legislative majority. Under the motion, a roll call vote for impeachment would be held on May 19 next year, after various hearings are held and Lai is given the chance to defend himself. The move came after Lai on Monday last week did not promulgate an amendment passed by the legislature that

AFTERMATH: The Taipei City Government said it received 39 minor incident reports including gas leaks, water leaks and outages, and a damaged traffic signal A magnitude 7.0 earthquake struck off Taiwan’s northeastern coast late on Saturday, producing only two major aftershocks as of yesterday noon, the Central Weather Administration (CWA) said. The limited aftershocks contrast with last year’s major earthquake in Hualien County, as Saturday’s earthquake occurred at a greater depth in a subduction zone. Saturday’s earthquake struck at 11:05pm, with its hypocenter about 32.3km east of Yilan County Hall, at a depth of 72.8km. Shaking was felt in 17 administrative regions north of Tainan and in eastern Taiwan, reaching intensity level 4 on Taiwan’s seven-tier seismic scale, the CWA said. In Hualien, the