Shares of Citigroup fell 5.9 percent to US$32 yesterday, the lowest in four years, after Goldman Sachs Group Inc downgraded the stock to "sell" from "neutral" on Monday, predicting the bank could write off up to US$15 billion in soured investments, including mortgage losses, in coming months.

The US' second-largest bank by market worth, Citigroup is already reeling from its exposure to the US housing downturn and tighter credit markets.

The banking behemoth is searching for a new chief executive officer after former CEO Charles Prince stepped down on Nov. 5 as Citigroup revealed it was facing likely investment writeoffs of between US$8 billion and US$11 billion.

Analysts at Goldman Sachs believed the company could be forced to absorb bigger writeoffs.

"We currently assume Citigroup will take an US$11 billion writeoff in the fourth quarter of 2007, at the high end of the firm's guidance, and we also assume an additional US$4 billion writeoff in the first quarter of 2008," the Goldman analysts said in a report.

They said the bank "will likely face an increasingly challenging operating environment which is likely to pressure results in many of their businesses."

Citigroup made US$2.4 billion in net profit during the third quarter, but its profits slowed dramatically amid pre-tax losses of US$1.56 billion and other losses and writedowns totaling almost US$2 billion.

New York-based Citigroup said earlier this month that further writeoffs would likely act as a drag on its fourth-quarter earnings.

The Goldman analysts have trimmed their earnings forecast for Citigroup next year to US$3.80 per share compared with a prior assumption of US$4.65.

The Goldman analysts said they "do not expect a `quick fix' to some of Citi's issues," adding that "the lack of leadership at this point in Citi's storied history could not have come at a worse time."

Deutsche Bank AG on Monday also cut its price target for Citigroup by 15 percent to US$29. Deutsche Bank has a "sell" recommendation on the shares.

Taiwan is projected to lose a working-age population of about 6.67 million people in two waves of retirement in the coming years, as the nation confronts accelerating demographic decline and a shortage of younger workers to take their place, the Ministry of the Interior said. Taiwan experienced its largest baby boom between 1958 and 1966, when the population grew by 3.78 million, followed by a second surge of 2.89 million between 1976 and 1982, ministry data showed. In 2023, the first of those baby boom generations — those born in the late 1950s and early 1960s — began to enter retirement, triggering

ECONOMIC BOOST: Should the more than 23 million people eligible for the NT$10,000 handouts spend them the same way as in 2023, GDP could rise 0.5 percent, an official said Universal cash handouts of NT$10,000 (US$330) are to be disbursed late next month at the earliest — including to permanent residents and foreign residents married to Taiwanese — pending legislative approval, the Ministry of Finance said yesterday. The Executive Yuan yesterday approved the Special Act for Strengthening Economic, Social and National Security Resilience in Response to International Circumstances (因應國際情勢強化經濟社會及民生國安韌性特別條例). The NT$550 billion special budget includes NT$236 billion for the cash handouts, plus an additional NT$20 billion set aside as reserve funds, expected to be used to support industries. Handouts might begin one month after the bill is promulgated and would be completed within

NO CHANGE: The TRA makes clear that the US does not consider the status of Taiwan to have been determined by WWII-era documents, a former AIT deputy director said The American Institute in Taiwan’s (AIT) comments that World War-II era documents do not determine Taiwan’s political status accurately conveyed the US’ stance, the US Department of State said. An AIT spokesperson on Saturday said that a Chinese official mischaracterized World War II-era documents as stating that Taiwan was ceded to the China. The remarks from the US’ de facto embassy in Taiwan drew criticism from the Ma Ying-jeou Foundation, whose director said the comments put Taiwan in danger. The Chinese-language United Daily News yesterday reported that a US State Department spokesperson confirmed the AIT’s position. They added that the US would continue to

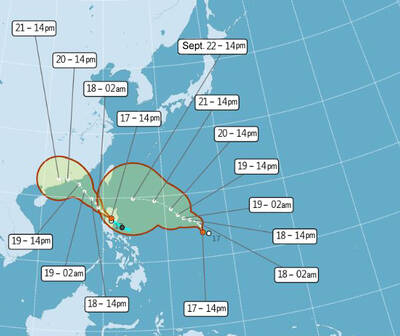

One of two tropical depressions that formed off Taiwan yesterday morning could turn into a moderate typhoon by the weekend, the Central Weather Administration (CWA) said yesterday. Tropical Depression No. 21 formed at 8am about 1,850km off the southeast coast, CWA forecaster Lee Meng-hsuan (李孟軒) said. The weather system is expected to move northwest as it builds momentum, possibly intensifying this weekend into a typhoon, which would be called Mitag, Lee said. The radius of the storm is expected to reach almost 200km, she said. It is forecast to approach the southeast of Taiwan on Monday next week and pass through the Bashi Channel